- The minutes of the Fed meeting of May 6-7 will be published on Wednesday.

- The Federal Reserve maintained the reference interest rate without changes, as expected.

- The US dollar runs the risk of drilling its minimum of 2025 amid concerns related to tariffs.

The Federal Open Market Committee (FOMC) will publish the minutes of its May 6-7 on Wednesday. At that time, those responsible for policies decided to maintain the objective range of federal funds (Fftr) without changes in 4.25%-4.50%, as market participants anticipated widely.

The Federal Reserve (FED) adopted a more aggressive position earlier of the year, in the midst of concerns about the potential impact of the tariffs of the president of the United States (USA), Donald Trump, in economic progress and inflation.

Not only did the officials decided to maintain the reference interest rate without changes, but also gave clues about future feat cuts, maintaining the position of waiting and seeing adopted in March.

The Fed is worried about the risks that are coming

Fed officials said: “The uncertainty about economic perspectives has increased. The committee is attentive to risks on both sides of their dual mandate,” according to the statement published together with the decision.

Later, at the press conference, President Jerome Powell declared: “We are comfortable with our policy position.” “We believe that at this time, the appropriate thing is to wait and see how things evolve. There is so much uncertainty,” he added.

In addition, the Fed decelerated the rhythm of decreased securities. The Central Bank has been allowing up to 25,000 million dollars in treasure bonds to mature each month, and reduced the withdrawal to only 5,000 million dollars from April. Reducing balance is another tool that uses the Fed to control inflationary pressures.

The huge tariffs of President Trump have been the main reason behind the recent aggressive position of the Fed. Despite his usual caution, President Powell finally acknowledged that tariffs are “a good part” of their increased expectations of higher inflation. He added that it would be “very difficult” to evaluate how much inflation comes from tariffs.

“Looking forward, the new administration is in the process of implementing significant policy changes in four different areas: trade, immigration, fiscal policy and regulation. It is the net effect of these policy changes that will import for the economy and for the path of monetary policy,” Powell said.

When will the FOMC minutes be published and how could the US dollar affect?

The FOMC is scheduled to publish the minutes of its policy meeting of May 6-7 at 18:00 GMT on Wednesday, and market participants expect the document to throw some light on the future of monetary policy.

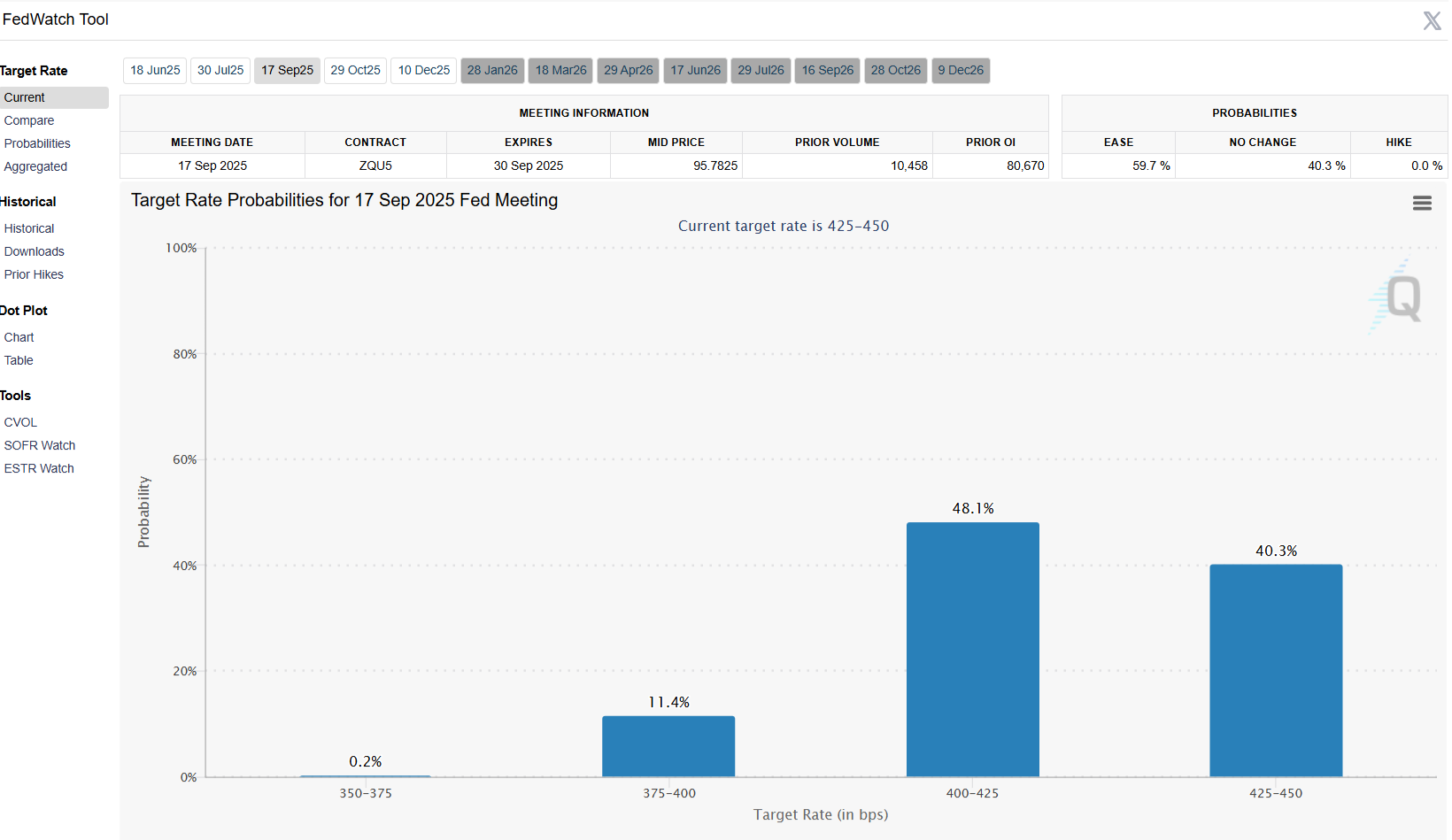

Before the publication, the CME Fedwatch tool shows that the speculative interest does not expect rates cuts in June or July, with the probabilities of a 25 basic points cut (BPS) standing at around 48% in September.

The US dollar is under sales pressure before the event, with the dollar index (DXY) comfortably below the 100.00 brand. The Fed is not expected to adopt a moderate posture, which means that most of what they could reveal is aligned with what the market already knows. FOMC minutes should have a limited impact on the DXY.

Valeria Bednarik, chief analyst of FXSTERET, says: “The DXY operates not well above the minimum of several months recorded in April in 97.91, and the risk is tilted downward, according to technical readings in the daily graphic. The index develops below all its mobile soils, with a simple mobile average (SMA) of 20 flat that provides resistance around 100.20. They expose the area of 101.00, before the May peak in 101.98.

Bednarik adds: “On the other hand, the relevant support is located at 98.70, the monthly minimum of May. A bassist break exposes the minimum mentioned of April, followed by the 97.50 region.

US dollar FAQS

The US dollar (USD) is the official currency of the United States of America, and the “de facto” currency of a significant number of other countries where it is in circulation along with local tickets. According to data from 2022, it is the most negotiated currency in the world, with more than 88% of all global currency change operations, which is equivalent to an average of 6.6 billion dollars in daily transactions. After World War II, the USD took over the pound sterling as a world reserve currency.

The most important individual factor that influences the value of the US dollar is monetary policy, which is determined by the Federal Reserve (FED). The Fed has two mandates: to achieve price stability (control inflation) and promote full employment. Its main tool to achieve these two objectives is to adjust interest rates. When prices rise too quickly and inflation exceeds the 2% objective set by the Fed, it rises the types, which favors the price of the dollar. When inflation falls below 2% or the unemployment rate is too high, the Fed can lower interest rates, which weighs on the dollar.

In extreme situations, the Federal Reserve can also print more dollars and promulgate quantitative flexibility (QE). The QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is an unconventional policy measure that is used when the credit has been exhausted because banks do not lend each other (for fear of the default of the counterparts). It is the last resort when it is unlikely that a simple decrease in interest rates will achieve the necessary result. It was the weapon chosen by the Fed to combat the contraction of the credit that occurred during the great financial crisis of 2008. It is that the Fed prints more dollars and uses them to buy bonds of the US government, mainly of financial institutions. Which usually leads to a weakening of the US dollar.

The quantitative hardening (QT) is the reverse process for which the Federal Reserve stops buying bonds from financial institutions and does not reinvote the capital of the wallet values that overcome in new purchases. It is usually positive for the US dollar.

FAQS tariffs

Although tariffs and taxes generate government income to finance public goods and services, they have several distinctions. Tariffs are paid in advance in the entrance port, while taxes are paid at the time of purchase. Taxes are imposed on individual taxpayers and companies, while tariffs are paid by importers.

There are two schools of thought among economists regarding the use of tariffs. While some argue that tariffs are necessary to protect national industries and address commercial imbalances, others see them as a harmful tool that could potentially increase long -term prices and bring to a harmful commercial war by promoting reciprocal tariffs.

During the election campaign for the presidential elections of November 2024, Donald Trump made it clear that he intends to use tariffs to support the US economy. In 2024, Mexico, China and Canada represented 42% of the total US imports in this period, Mexico stood out as the main exporter with 466.6 billion dollars, according to the US Census Office, therefore, Trump wants to focus on these three nations by imposing tariffs. It also plans to use the income generated through tariffs to reduce personal income taxes.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.