The Federal Reserve (Fed) published the Opinion Survey of Senior Credit Officials on Bank Lending Practices in April 2023, which has become more relevant in the context of concern about US regional banks. The results of the survey correspond to the first quarter of 2023.

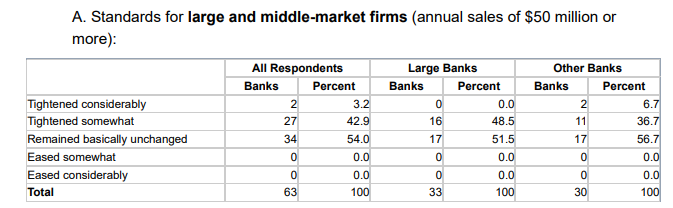

According to the report, respondents generally reported tightening of regulations and lower demand for commercial and industrial (C&I) loans to large and medium-sized companies, as well as small businesses, during the first quarter. Banks also cited tighter regulations and weaker demand for all categories of commercial real estate loans.

Key information from the report:

“When it comes to business lending, respondents generally reported tightening regulations and lower demand for commercial and industrial (C&I) loans to large and medium-sized businesses, as well as small businesses, during the first quarter. Meanwhile, banks reported tightening standards and weaker demand for all categories of commercial real estate (CRE) loans.”

“Regarding loans to households, banks reported tightening of lending standards in all categories of residential real estate loans, except in the case of mortgages subsidized by public companies and residential public mortgages, which are remained basically unchanged.”

“Banks reported tightening rules and lower demand for HELOCs. Rules tightened for all categories of consumer loans; demand weakened for auto and other loans consumer loans, while it was basically unchanged for credit cards.”

“Regarding the second set of special questions about the reasons for changing standards across all lending categories in the first quarter, banks cited less favorable or more uncertain economic prospects, lower risk tolerance, deteriorating values of guarantee funds and concerns about financing costs and the liquidity positions of banks.”

“Banks reported that they expected to tighten standards across all loan categories. Banks most frequently cited an expected deterioration in the credit quality of their loan portfolios and customer collateral values, a reduction in forbearance to risk and concerns about banks’ funding costs, banks’ liquidity position and deposit outflows as reasons to expect to tighten lending standards for the remainder of 2023.”

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.