Investment company Fidelity published report called Bitcoin First Revisited. In it, the authors urge investors to evaluate Bitcoin separately from other crypto assets.

In particular, we can highlight the following main points from this material:

- Bitcoin is an asset that allows you to store value in a dynamic world;

- it is the most secure, reliable and decentralized form of electronic money. Any “improvement” of it will involve certain compromises;

- this does not mean that other crypto assets are not needed. They are aimed at solving other problems;

- Bitcoin cannot be valued in the same way as other assets, which investors must take into account when assessing risks.

Fidelity calls Bitcoin a potential new global monetary commodity. However, according to the report, the chances that it will be surpassed by another crypto asset are quite low.

The authors cite the Lindy effect as confirmation of the reliability of the ecosystem. According to him, the expected “life expectancy” of individual technologies is directly proportional to their current “age”.

According to Fidelity analysts, Bitcoin has already successfully overcome many shocks. Here are just a few of them:

A list of “stresses” that the Bitcoin ecosystem has faced over the years. Source: Fidelity.

A list of “stresses” that the Bitcoin ecosystem has faced over the years. Source: Fidelity.

The report also compares Bitcoin with derivative assets and Ethereum. Analysts emphasized the fact that, unlike other solutions, the first cryptocurrency is more stable, has a fixed monetary policy, is easy to audit and is accessible due to the low costs of running a node.

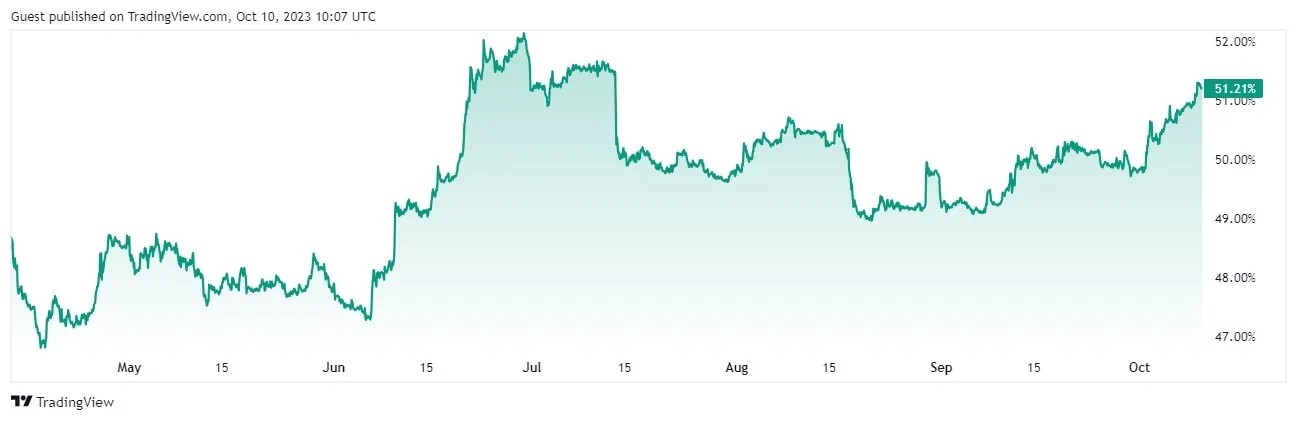

Notably, on October 9, 2023, the dominance indicator BTC hit a new high from mid-July, according to TradingView:

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.