Fundamental metrics of the first cryptocurrencies remain strong, despite a decrease in the price of the asset, representatives of Fidelity said:

“20% of the decline is a moderate decline, when compared with past corrections in the history of bitcoin, which reached 80% or more.”

According to experts, the fall of the first cryptocurrency is due to the “natural phases” of the cryptoine, and the coin is still at the stage of searching for an adequate price, where the interests and expectations of large investment funds and retail investors intersect.

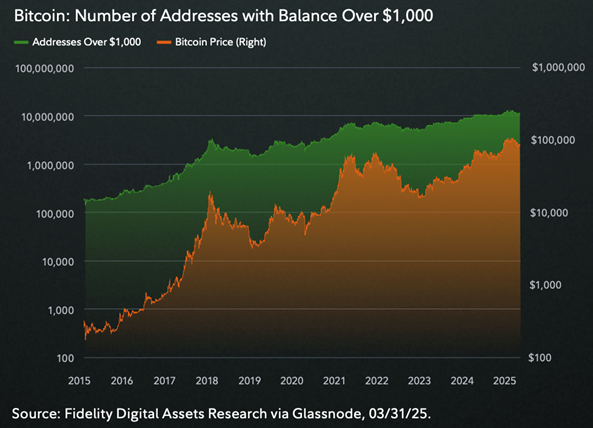

The number of cryptocurrencs with a balance of over $ 1000 bitcoins increased from 2023 by 108% and reached 11 million. This indicates that the accumulation of the first cryptocurrency continues, analysts said.

Now it is difficult to predict a change in coin quotes, since many factors are influenced by the market, from macroeconomic uncertainty to a possible change in the policy of the US Federal Reserve (Fed), Fidelity experts say.

Earlier, the Director of the US Presidential Council of Digital Assets, Bo Hines, said that the “space race” unfolded between the countries for the accumulation of the first cryptocurrency, and the United States intends to be a leader in it.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.