Grayscale Ethereum Trust

Grayscale Ethereum Trust is owned by the American investment company Grayscale. It is the largest spot ETF on Ether – almost $6.8 billion in assets. The fund also has the largest commission – 2.5%. Grayscale Ethereum Trust is traded on the New York Stock Exchange NYSE Arca under the ticker ETHE. The number of shares (units) in free circulation is 256.2 million. Following the price of Ether is ensured by the company having a certain amount of ETH, as well as using the rate of The CoinDesk Ether Price Index (ETX). The fund’s headquarters are located in New York.

It cannot be said that the first week was very successful for Grayscale Ethereum Fund. There was an outflow of funds every day. In total, $1.84 billion was withdrawn.

Source: sosovalue.xyz

The stock price has fallen by 6.17% over this period. It is not surprising that the fund shares were already trading before the launch date of all spot Ethereum ETFs on July 23. Grayscale Ethereum Trust is not just a new ETF, but was converted into a spot ETF from a trust.

Source: tradingview.com

Grayscale Ethereum Mini Trust

Another fund from Grayscale. It is also traded on NYSE Arca, but its ticker is ETH. This ETF has the lowest commission of all similar funds – 0.15%. And even then, it will only be taken from clients in six months, or when the amount of assets reaches $2 billion. The fund promises not to take a commission at all for the first six months. The fund currently has $1.1 billion in assets. The number of shares in free circulation is 363.6 million. The fund is based in New York. To follow the price of ether, the fund holds ETH in stock, and also uses the rate of The CoinDesk Ether Price Index (ETX).

Grayscale’s second product is doing better than the first, with an influx of money on all days, totaling more than $181 million.

Source: sosovalue.xyz

ETH shares, however, also fell by almost 7%.

Source: tradingview.com

iShares Ethereum Trust

iShares Ethereum Trust is a product of the world’s largest investment company BlackRock. It is the only spot ETF on Ether that is listed on the NASDAQ exchange. Its shares can be found there under the ticker ETHA. The fund’s commission in the first year, starting July 23, will be 0.12% (if the ETF assets do not reach $2.5 billion). After that, the commission will increase to 0.25% (the same scenario will occur if the assets reach the $2.5 billion mark). To follow the price of Ether, the fund uses the CME CF Ether-Dollar Reference Rate New York Variant. iShares Ethereum Trust is a large fund: it has more than $600 million in assets. It is based in San Francisco (California).

The iShares Ethereum Trust has seen inflows of funds over the past six days, totaling over $618 million.

Source: sosovalue.xyz

However, the fund’s shares demonstrated negative dynamics, falling by 6.66%.

Source: tradingview.com

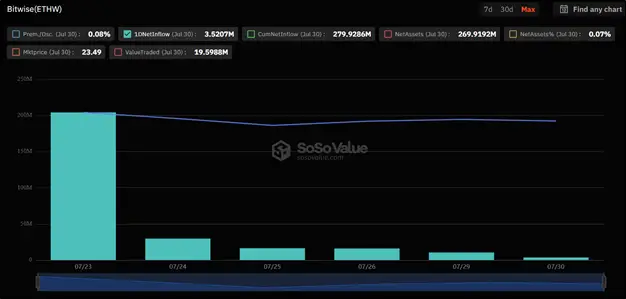

Bitwise Ethereum ETF

Bitwise Ethereum ETF is an exchange-traded fund of Bitwise, a company specializing in cryptocurrency investments. The fund is traded on NYSE Arca under the ticker ETHW. There are 11.35 million shares in circulation. The fund’s commission is 0.2%. In the first six months, it will be zero unless the ETF’s assets reach $500 million. The fund currently has $269.9 million in assets. The goal of the Bitwise Ethereum ETF is to follow the price of ether, for which the asset is held in ownership. The CME CF Ether-Dollar Reference Rate New York Variant is also used.

The dynamics of the cash inflow into the Bitwise Ethereum ETF, although downward, was consistently positive. The total inflow amounted to $279.93 million.

Source: sosovalue.xyz

The fund’s shares fell in price by 6.67%

Source: tradingview.com

Fidelity Ethereum Fund

This is an ETF of the investment company Fidelity. The fund is traded on the Chicago Board Options Exchange (CBOE) under the ticker FETH. The commission is 0.25%. The amount of FETH assets exceeds $259 million. The fund intends to follow the price of ether, which will be ensured by calculating and applying the base rate – Fidelity Ethereum Reference Rate. FETH also holds ETH reserves. The fund is based in Boston.

Fidelity Ethereum Fund saw an influx of funds throughout the first days of trading, raising a total of $260.5 million.

Source: sosovalue.xyz

The fund’s shares, similar to other spot Ether ETFs, fell, down 6.59%.

Source: tradingview.com

VanEck Ethereum ETF

VanEck is behind this fund. The shares are traded on the CBOE exchange under the ticker ETHV. There are 925,000 shares in free circulation. The amount of assets of this ETF = more than $55 million. The commission is set at 0.2%. However, it will not be charged until July 22, 2025, if the fund’s assets remain within $1.5 billion. The fund aims to follow the price of ether, for which it keeps a reserve of ETH. It also evaluates its shares using the MarketVector Ethereum Benchmark Rate, which is calculated based on data from five top platforms trading the second-largest cryptocurrency. VanEck Ethereum ETF is based in New York.

Smaller funds are less popular with investors, which is why the VanEck Ethereum Fund saw inflows on only four of the six days, totaling $46.4 million.

Source: sosovalue.xyz

The fund’s shares immediately lost 7.26%.

Source: tradingview.com

Franklin Ethereum ETF

Franklin Ethereum ETF is a fund of the management company Franklin Templeton. It is traded on the CBOE under the ticker EZET. There are 750,000 shares in circulation. The fund’s commission is 0.19%. Franklin Templeton has a fairly small fund with assets of $31.08 million. The fund is based in San Mateo, California.

The Franklin Ethereum ETF saw inflows over five days, totaling $3.73 million.

Source: sosovalue.xyz

The fund’s shares fell by 6.68%.

Source: tradingview.com

Invesco Galaxy Ethereum ETF

This is a product of a tandem of independent companies Invesco and Galaxy Digital. The fund is traded on the CBOE under the ticker QETH. The commission will remain zero until January 31, 2025, or upon reaching $10 billion in assets. After that, it should be 0.25%. Current assets = $15.5 million. Total free float — 468,000 shares/units. The Ether price is tracked using the Lukka Prime Ethereum Reference Rate. In addition, QETH has some Ether in stock. The fund is based in Downers Grove, Illinois.

Here, non-zero (positive) dynamics of cash inflow was observed only for three days. The total cash inflow was $14.3 million.

Source: sosovalue.xyz

Shares fell 6.97%.

Source: tradingview.com

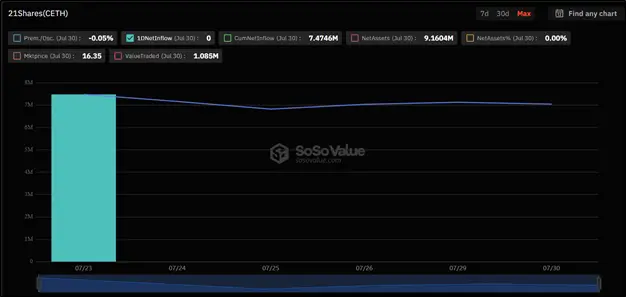

21Shares Core Ethereum ETF

This is a fund of the company 21Shares, which specializes in crypto exchange-traded products (ETPs). The fund is listed on the CBOE under the ticker CETH. There are 560,000 securities in circulation. The commission is 0.21%. However, until January 23, 2025, or until the asset volume reaches $500 million, it will remain zero. The fund currently has about $9.3 million in assets. The fund is located in New York. To achieve its goal of following the price of ether, the ETF holds ETH and also uses the CME CF Ether-Dollar Reference Rate New York Variant.

In this fund, the smallest in terms of asset volume, the inflow of funds was only on the first day of trading (it’s good that there was no outflow) and amounted to $7.5 million.

Source: sosovalue.xyz

Shares of the 21Shares Core Ethereum ETF fell 7.94%.

Source: tradingview.com

Conclusion

Shares of absolutely all spot ETFs on Ether fell in price during the first week. At the same time, the decline among the funds is almost the same – within 6.5% – 8%. But as for the inflow of funds, the situation is the opposite. Money flowed into six out of seven funds. Only Grayscale Ethereum Trust saw an outflow of funds. However, this outflow in total covered the positive indicators of other ETFs.

This material and the information in it are not individual or any other investment recommendation. The opinion of the editors may not coincide with the opinions of the author, analytical portals and experts.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.