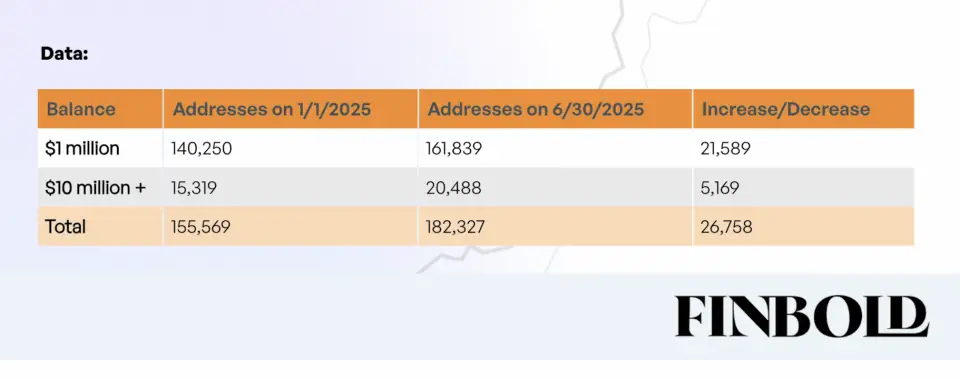

The increase in the number of bitcoin millionaires reflects the increased interest in digital assets among private and corporate investors due to a significant rise in price of the first cryptocurrency, analysts explained. Since the beginning of the year, Bitcoin has added about 60%in price, reaching about $ 109,000 by the end of June.

The main factor in Henley & Partners called an increase in corporate investment volumes and positive changes with the regulation of the US cryptocurrency market, such as a decree on the creation of a crypto -cutter issued by President Donald Trump in March. In addition, the support of Bitcoin-ETF from American hedge funds is affected, which began to relate to bitcoin as a viable asset suitable for diversification of the investment portfolio and risk hedging.

Henley & Partners analysts and their colleagues from other organizations believe that the first cryptocurrency continues to strengthen their position as a means of maintaining value, competing with traditional assets like gold. For example, the Executive Director of BlackRock Larry Fink said that “Bitcoin is becoming a digital analogue of gold, attracting capital in the conditions of instability.”

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.