The US dollar soared to a new 26-month high after US Non-Farm Payrolls (NFP) surged in December, devastating market hopes for further rate cuts by the Federal Reserve (Fed). in 2025. Investors will focus on upcoming US inflation figures next week, but hopes of a sudden drop in Consumer Price Index (CPI) inflation remain being limited.

The US Dollar Index (DXY) soared to its highest valuation in just over two years after US NFP net job additions rose to 256K in December, eliminating any remaining hopes for further job cuts. rates by the Fed in the short term. Rates markets are pricing in no movement in interest rates until June at the earliest, with only a quarter-point cut expected throughout the year. US CPI inflation will be the key figure next week, but hopes of a sudden drop in inflation sharp enough to trigger additional Fed rate moves remain almost non-existent.

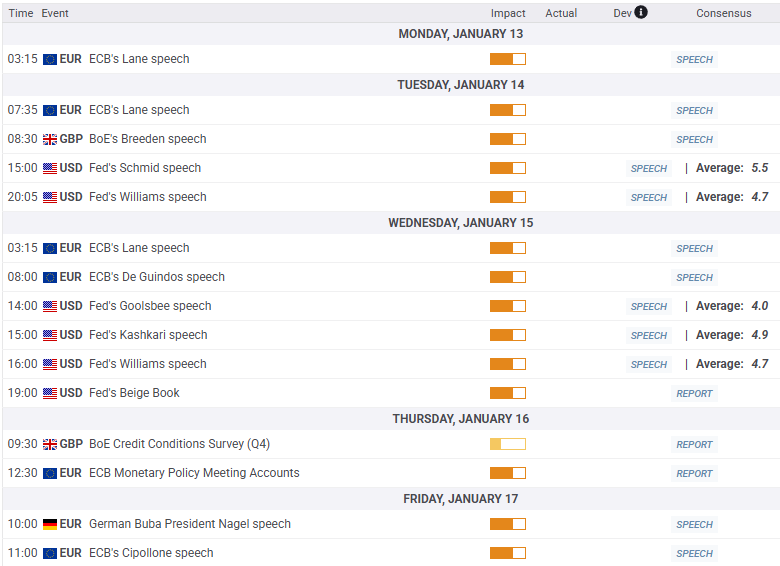

EUR/USD found a new 26-month low and closed in the red for the sixth consecutive week, as the Euro continues to lose ground against the Dollar. Next week is notably thin on the European side of the economic data agenda, and Euro bulls will be awaiting any sort of change in policy stance from a series of mid-level appearances from members of the European Central Bank (ECB). next week.

GBP/USD found a 14-month low this week, approaching the 1.2200 area again. The UK will publish its own CPI inflation figure next Wednesday, and although annualized headline CPI inflation is expected to decline, UK headline inflation remains well above the Bank of England’s (BoE) targets in year-on-year terms.

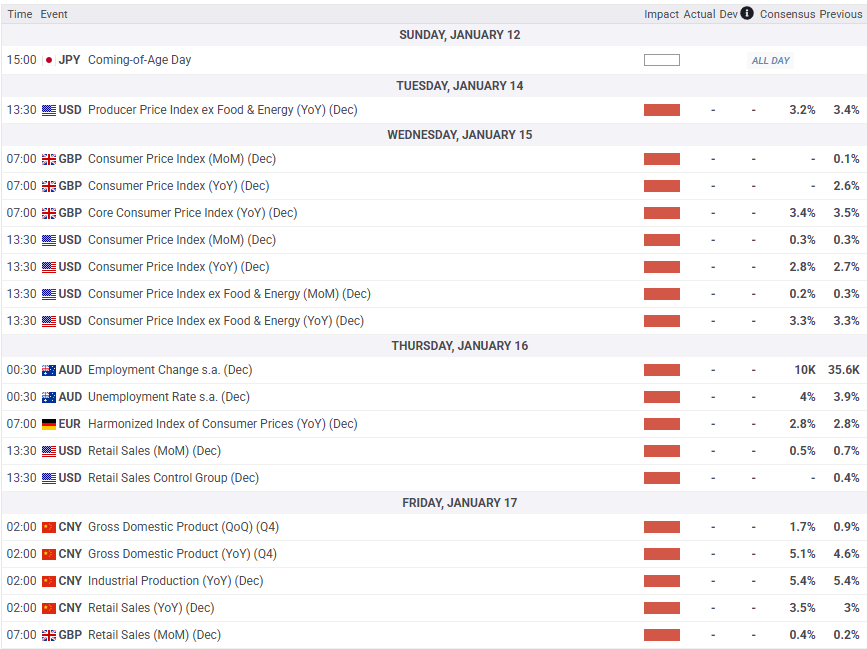

AUD/USD traders could face a tense week next week. A series of Australian and Chinese figures will be released throughout the week, culminating in a new update to Australian jobs figures early Thursday, with new Gross Domestic Product (GDP) and Retail Sales data from China on Friday. Australia’s unemployment rate is expected to rise slightly to 4.0% from 3.9%, while officially reported Chinese GDP growth is expected to miraculously rise to 5.1% year-on-year in the fourth quarter of 2024 from 4.6% in the third quarter , despite fluctuating consumption, demand, investment and spending figures, although another increase in government subsidy schemes will surely help further.

Key events next week

Early central bank appearances

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.