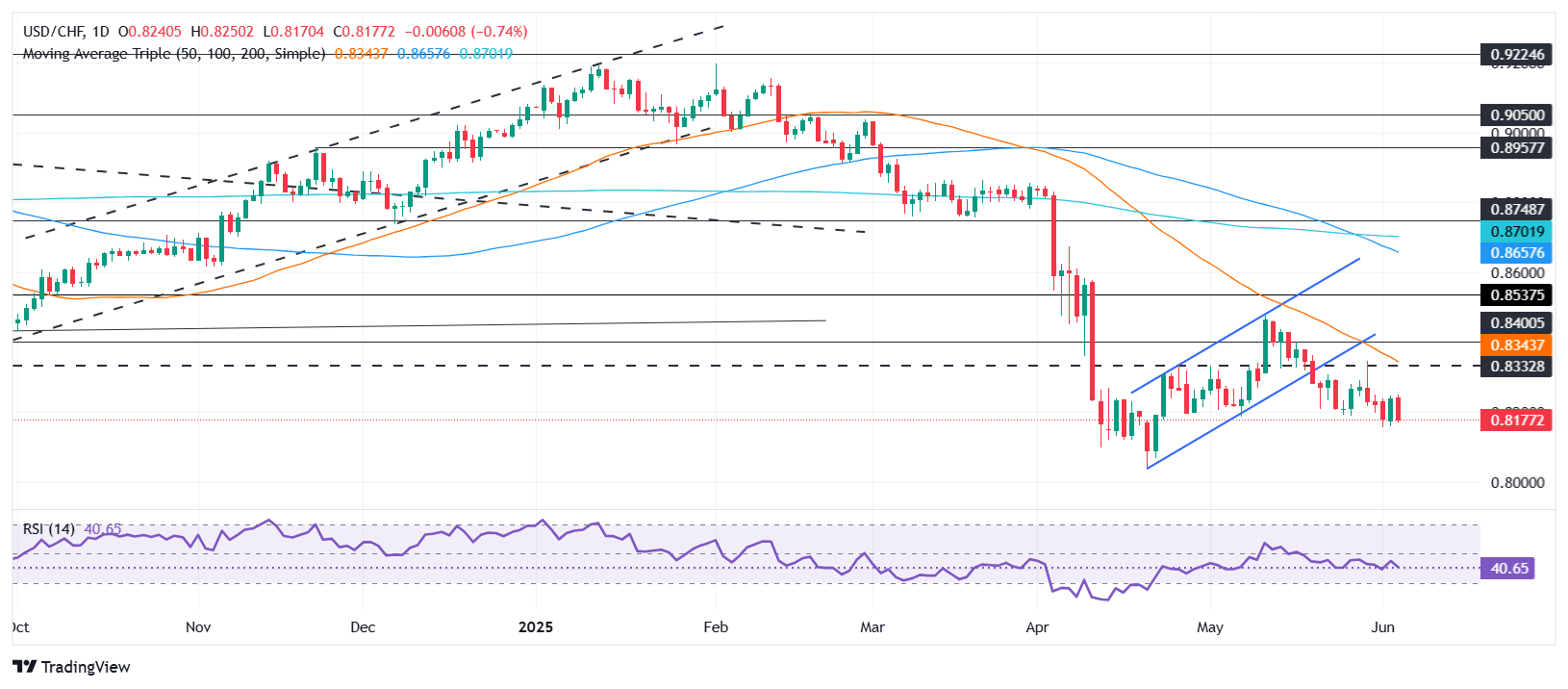

- The USD/CHF reverses from the maximum of 0.8250, invalidating the bullish wrapping pattern while the vendors fade the rally.

- The impulse of the RSI favors bassists; A break below 0.8155 could expose 0.8100 and the minimum of the year at 0.8038.

- Alcistas need to recover 0.8200 and close above 0.8249 to challenge the resistance of 0.8300.

The USD/CHF falls from around the maximum of three days about 0.8250 and collapses while the US dollar prolongs its agony, after a slight recovery on Tuesday. At the time of writing, the PAR is traded to 0.8174, lowering 0.78%.

Forecast of the USD/CHF price: technical perspective

The USD/CHF has resumed its downward trend after forming a sailing graphic pattern of ‘bullish wrapping’ that was invalidated once the torque erased most of the US dollar profits in the previous session, a sign that the vendors “sold the rallies” in a downward trend.

The relative force index (RSI) indicates that sellers are still in charge, intervening near the 0.8250 area of the USD/CHF.

With the road of lower inclined downward resistance, the USD/CHF could prove the minimum of the month to date (MTD) of 0.8155. A rupture of the latter could exacerbate a movement towards 0.8100, followed by a minimum challenge of the year to date (YTD) of 0.8038.

On the other hand, if the USD/ChF surprisingly rises above 0.8200, the bulls could have the opportunity to try the weekly peak at 0.8249. A daily closure above the latter, and look for a movement towards 0.83.

USD/CHF price chart – Diario

Franco Swiss Price this week

The lower table shows the percentage of change of the Swiss Franco (CHF) compared to the main currencies this week. Franco Swiss was the strongest currency against the US dollar.

| USD | EUR | GBP | JPY | CAD | Aud | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.63% | -0.68% | -0.74% | -0.55% | -0.98% | -1.14% | -0.65% | |

| EUR | 0.63% | -0.07% | -0.11% | 0.07% | -0.35% | -0.55% | -0.02% | |

| GBP | 0.68% | 0.07% | -0.02% | 0.14% | -0.28% | -0.48% | 0.02% | |

| JPY | 0.74% | 0.11% | 0.02% | 0.20% | -0.25% | -0.42% | -0.03% | |

| CAD | 0.55% | -0.07% | -0.14% | -0.20% | -0.43% | -0.62% | -0.10% | |

| Aud | 0.98% | 0.35% | 0.28% | 0.25% | 0.43% | -0.13% | 0.40% | |

| NZD | 1.14% | 0.55% | 0.48% | 0.42% | 0.62% | 0.13% | 0.50% | |

| CHF | 0.65% | 0.02% | -0.02% | 0.03% | 0.10% | -0.40% | -0.50% |

The heat map shows the percentage changes of the main currencies. The base currency is selected from the left column, while the contribution currency is selected in the upper row. For example, if you choose the Swiss Franco from the left column and move along the horizontal line to the US dollar, the percentage change shown in the picture will represent the ChF (base)/USD (quotation).

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.