- USD/CHF maintains profits but stops under a key resistance, limiting the bullish potential.

- The level 0.8540 is a key decision point, since a breakdown of this could trigger an upward continuation.

- The failure in overcoming resistance could lead to a new sale, extending the bearish trend.

The US dollar (USD) is contributing upwards in front of the Swiss refuge of secure shelter (CHF) on Friday, since markets continue to digest the ongoing developments in tariff negotiations, expectations of interest rates and the feeling of broader risk. At the time of writing, the USD/CHF is testing a critical resistance layer at 0.838, registering a modest gain of 0.28% in the day.

The long -term support base holds the USD/CHF rebound in April

The USD/CHF found a strong support on April 21 about 0.8040 – its lowest level since 2015 – and since then it has begun to recover. This rebound occurred just below a key level of long -term fibonacci setback about 0.8320, which has historically acted as an important turning point for the torque. Notably, this same area helped stabilize prices during the consolidation of 2015–2016, adding weight to its importance as a structural basis.

The current rebound is approaching a key resistance zone around 0.8540. This level is important for several reasons: it marks the fibonacci setback of 23.6% of the bearish trend from the 2022 peak, coincides with an old support of several years of 2015 that broke earned earlier this year, and aligns with the lower part of a negotiation range that remained from mid -2023 to the beginning of 2025.

A monthly closure above this area would indicate a deeper change in the feeling of the market, potentially confirming a trend reversal. However, if the price fails to break, the broader bearish trend remains at stake, with a renewed risk of a movement back to 0.7770 or even the minimum of the long -term cycle about 0.7070.

Monthly USD/CHF chart

USD/CHF stops while the bulls try to recover from a minimum of several years

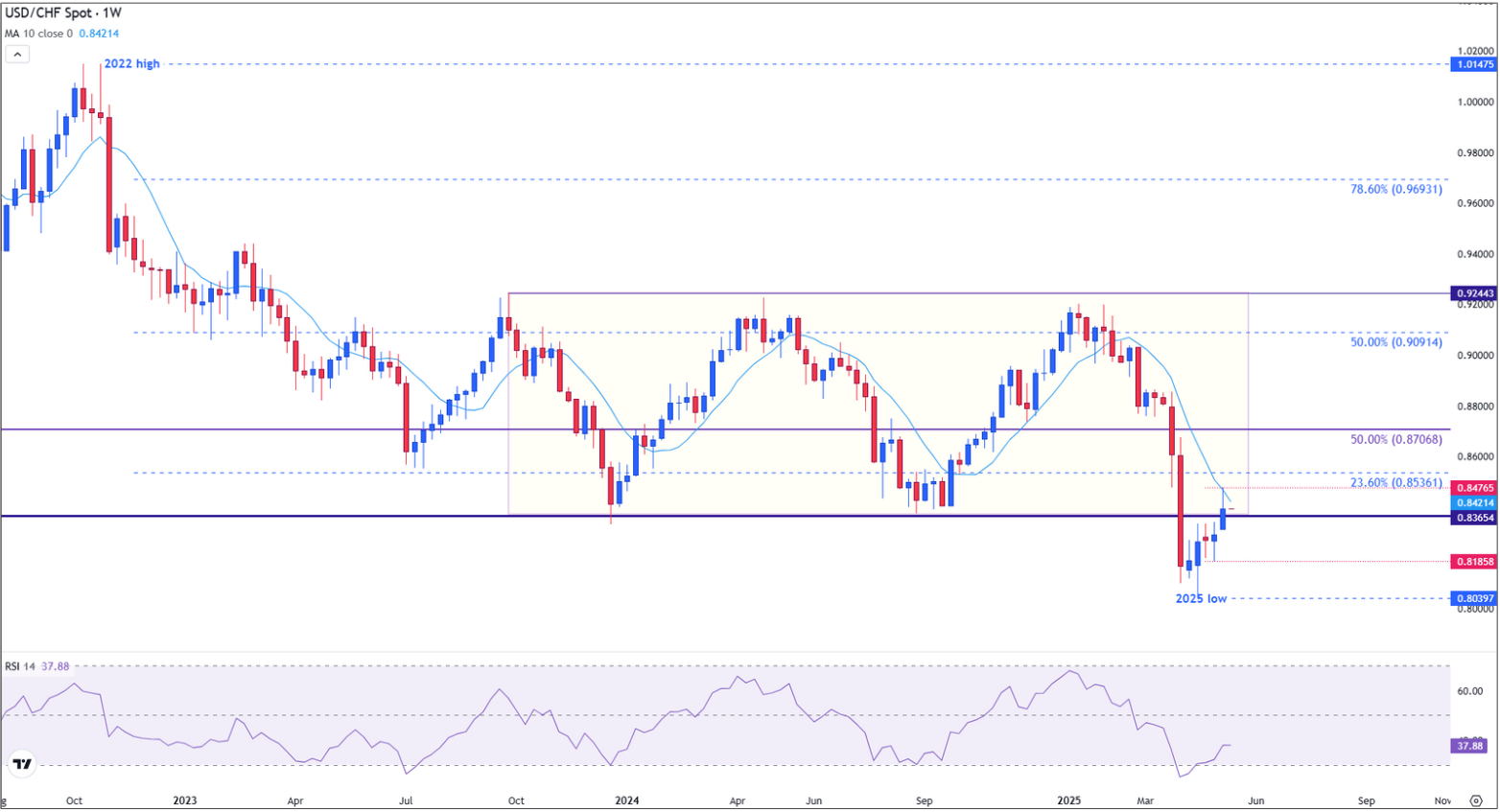

Within the weekly time, the USD/CHF has registered three consecutive bullish candles, reflecting a recovery of overall conditions. The torque is testing the simple mobile average (SMA) about 0.8419, which has acted as dynamic resistance since March. The widest area of 0.8419-0.8536 is technically dense, representing an old 2023 support region that failed earlier this year.

The Relative Force Index (RSI) has recovered to around 37.2, indicating a relief in the bearish impulse. However, it remains well below the neutral level of 50, underlining the attempt at the current rebound.

A weekly closure confirmed above 0.8536 would represent a significant breakup in the structure, opening the upward potential to the midpoint of the fall of 2022-2025 in 0.8706.

Weekly USD/CHF Graph

The consolidation indicates hesitation below the resistance

The daily graph shows that the USD/CHF is consolidating just below the barrier of 0.8536 after having risen from the minimum of April at 0.8039. The price action remains supported by a 20 -day SMA, currently at 0.8285, while a higher minimum pattern indicates a continuous demand. Even so, the impulse is decreasing, with the relative force index (RSI) stabilizing about 51.2 – a neutral indicator that reflects a balanced, but undecided market.

Without a rupture above 0.8536, the risk of a corrective setback is growing. The immediate support is located at 0.8320, the long -term Fibonacci area, followed by 0.8185. A daily closure confirmed above 0.8536 would probably trigger tracking purchases and lead to 0.8706 in sight.

USD/CHF daily graphics

American dollar today

The lower table shows the percentage of US dollar change (USD) compared to the main coins today. US dollar was the strongest currency against the Swiss Franco.

| USD | EUR | GBP | JPY | CAD | Aud | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.34% | 0.31% | 0.20% | 0.19% | 0.23% | 0.12% | 0.43% | |

| EUR | -0.34% | -0.02% | -0.13% | -0.16% | -0.11% | -0.22% | 0.09% | |

| GBP | -0.31% | 0.02% | -0.10% | -0.13% | -0.09% | -0.19% | 0.11% | |

| JPY | -0.20% | 0.13% | 0.10% | -0.02% | -0.01% | -0.12% | 0.20% | |

| CAD | -0.19% | 0.16% | 0.13% | 0.02% | 0.02% | -0.06% | 0.25% | |

| Aud | -0.23% | 0.11% | 0.09% | 0.00% | -0.02% | -0.09% | 0.21% | |

| NZD | -0.12% | 0.22% | 0.19% | 0.12% | 0.06% | 0.09% | 0.30% | |

| CHF | -0.43% | -0.09% | -0.11% | -0.20% | -0.25% | -0.21% | -0.30% |

The heat map shows the percentage changes of the main currencies. The base currency is selected from the left column, while the contribution currency is selected in the upper row. For example, if you choose the US dollar of the left column and move along the horizontal line to the Japanese yen, the percentage change shown in the box will represent the USD (base)/JPY (quotation).

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.