- The YEN is strengthened as investors seek security in the midst of non -confirmed rumors of a commercial agreement between the US and China.

- The USD/JPY finds support in the 20 -day SMA; A daily closure is needed above 144.00 to recover bullish traction.

- A break below 143.00 could expose 141.97 and the minimum of the year to date at 139.88.

The USD/JPY fell late from the US session, since investors looking for security bought the Japanese yen (JPY) and left the US dollar (USD) due to the lack of advertisements on commercial agreements, despite the rumors that the US and China are close to starting conversations. At the time of writing, the USD/JPY quotes in 143.80, lowering 0.80%.

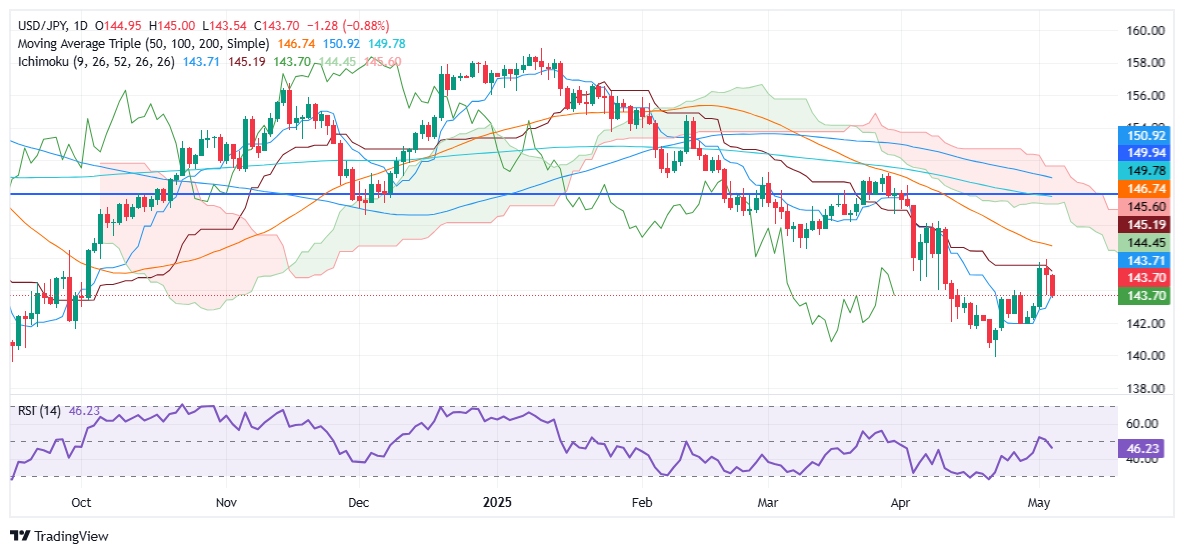

USD/JPY price forecast: technical perspective

From a technical point of view, the USD/JPY continues with downward bias, reaching a new minimum for the second consecutive negotiation day. However, he found support in the simple mobile average (SMA) of 143.43 before buyers raised the torque above the Kijun, seen in 143.70.

Although this could pave the way for a recovery, the bulls need a daily closure above 144.00 if they want to try higher prices. Otherwise, if the vendors push the USD/JPY below 143.00, this clears the way to test the minimum oscillation of April 29, 141.97. If it is exceeded, the next stop would be the minimum of the year to date (YTD) of 139.88.

USD/JPY price chart – Diario

And in Japanese price today

The lower table shows the rate of change of Japanese Yen (JPY) compared to the main currencies today. Yen Japanese was the strongest currency against the Canadian dollar.

| USD | EUR | GBP | JPY | CAD | Aud | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.14% | -0.24% | -0.63% | 0.08% | -0.21% | -0.29% | -0.38% | |

| EUR | -0.14% | -0.11% | -0.52% | 0.21% | -0.08% | -0.16% | -0.26% | |

| GBP | 0.24% | 0.11% | -0.63% | 0.32% | 0.02% | -0.06% | -0.15% | |

| JPY | 0.63% | 0.52% | 0.63% | 0.73% | 0.44% | 0.44% | 0.36% | |

| CAD | -0.08% | -0.21% | -0.32% | -0.73% | -0.59% | -0.38% | -0.47% | |

| Aud | 0.21% | 0.08% | -0.02% | -0.44% | 0.59% | -0.08% | -0.17% | |

| NZD | 0.29% | 0.16% | 0.06% | -0.44% | 0.38% | 0.08% | -0.10% | |

| CHF | 0.38% | 0.26% | 0.15% | -0.36% | 0.47% | 0.17% | 0.10% |

The heat map shows the percentage changes of the main currencies. The base currency is selected from the left column, while the contribution currency is selected in the upper row. For example, if you choose the Japanese yen from the left column and move along the horizontal line to the US dollar, the percentage change shown in the picture will represent the JPY (base)/USD (quotation).

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.