What to watch for on Friday, September 9:

The USD ended the day mixed across the currency board after a volatile day. The EUR/USD pair is little changed, just below parity after the European Central Bank hiked rates by 75 basis points, as expected.

The ECB revised upwards inflation forecasts to an average of 8.1% in 2022, 5.5% in 2023 and 2.3% in 2024. Policymakers also expect the economy to continue growing regardless of signs of slowdown. recession, with an annual GDP increase of 3.1% in 2022, 0.9% in 2023 and 1.9% in 2024.

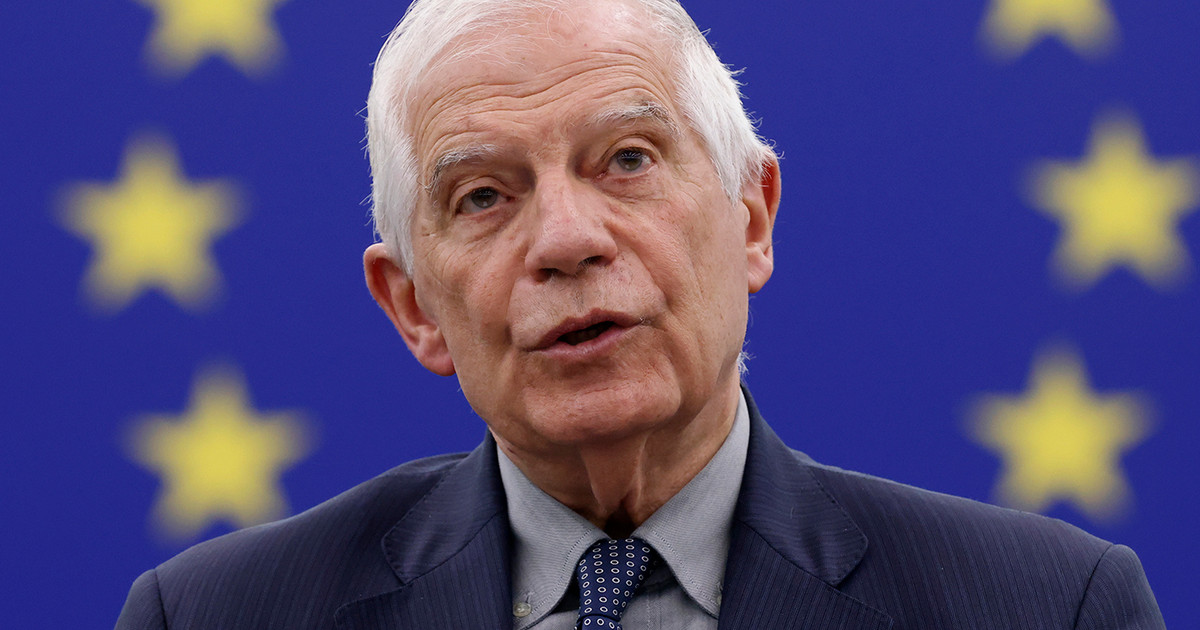

President Christine Lagarde’s speech shed some light on future actions. She said it would take more than two meetings, but less than five, to get to the end of the rate hikes, which is to bring them to neutral levels. At the same time, she cooled expectations of another 75 basis point hike saying it is not the norm, but added that they could go for more hikes if needed.

The head of the US Federal Reserve, Jerome Powell, gave a speech on local inflation and monetary policy. Among other things, Powell said that the pandemic is the main reason for the current situation, and repeated that monetary policymakers are firmly committed to reducing inflation, since the longer it remains above the target, the greater the risk. .

Like other central bank leaders around the world, Powell and Lagarde put controlling inflation before stimulating growth. Lagarde reduced the risks of recession, but market players are aware that the energy crisis has not yet made a dent in the Union.

In the UK, the new Prime Minister, Liz Truss, announced a cap on household energy bills from 1 October. The government has also announced that it will set an equivalent cap on companies’ energy costs. The GBP/USD pair gave way on the news and ended the day around 1.1500.

The Canadian dollar rose against the dollar, with the pair trading around 1.3090, as BOC officials reiterated that more rate hikes are expected as inflation remains very high. The AUD/USD pair is trading little changed around 0.6750.

The USD/CHF pair has tumbled and is now trading around 0.9700, while the USD/JPY is holding around 144.00.

Gold ended the day lower, trading around $1,708 a troy ounce, while crude oil prices posted modest gains, with WTI ending the day at $83.25 a barrel.

US Treasury yields ended the day with modest gains. The 10-year Treasury yield is currently trading at 3.29%, which is not enough to trigger demand for the USD, but is close.

Source: Fx Street

With 6 years of experience, I bring to the table captivating and informative writing in the world news category. My expertise covers a range of industries, including tourism, technology, forex and stocks. From brief social media posts to in-depth articles, I am dedicated to creating compelling content for various platforms.