What you need to know on Thursday, May 6:

Trading was boring across the forex market, with major pairs confined to limited intraday ranges. The dollar was the worst performer, falling lower against most of its main rivals.

The shared currency was the exception to the rule, extending its weekly decline against its American rival and ending the day at around 1,2000. Data imbalances likely hit the pair as macroeconomic figures from the EU indicated that the economic recovery is tepid, unlike that of the US.

GBP / USD is stable around 1.3900 ahead of the BOE Super Thursday. Since their last meeting, the economy has shown signs of improvement, exacerbated by the rapid immunization campaign that led to the economic reopening. That means upward revisions could be expected, although it is too early to consider any form of adjustment. The central bank is likely to leave rates unchanged, as well as the APP program. An aggressive line stance on the part of UK policy makers is based primarily on price, which means that the pound’s reaction will be stronger in the case of a dovish BOE.

Commodity-linked currencies advanced, although the AUD / USD pair is developing between familiar levels, while the USD / CAD fell to 1.2251, its lowest level since February 2018, staying close before the open on Thursday. The pair found support on the rise in oil prices, as the WTI surpassed $ 66.73 a barrel on the day. The commodity eased afterwards, but stronger stocks held the CAD near its daily highs.

Gold managed to regain some ground amid declining demand for the US currency, ending the day at $ 1,784.29 a troy ounce.

Wall Street closed in the green, while US government bond yields declined modestly, reflecting a better market sentiment. Different Federal Reserve officials poured some cold water on Treasury Secretary Janet Yellen on the higher rates. The Fed’s Evans said they are in no rush to talk about the cut, while the Fed’s Rosengren noted that there is still significant slack in the economy, adding that inflation and inflation expectations appear stable.

US employment data is likely to take center stage on Thursday, ahead of the critical nonfarm payroll report to be released on Friday.

.

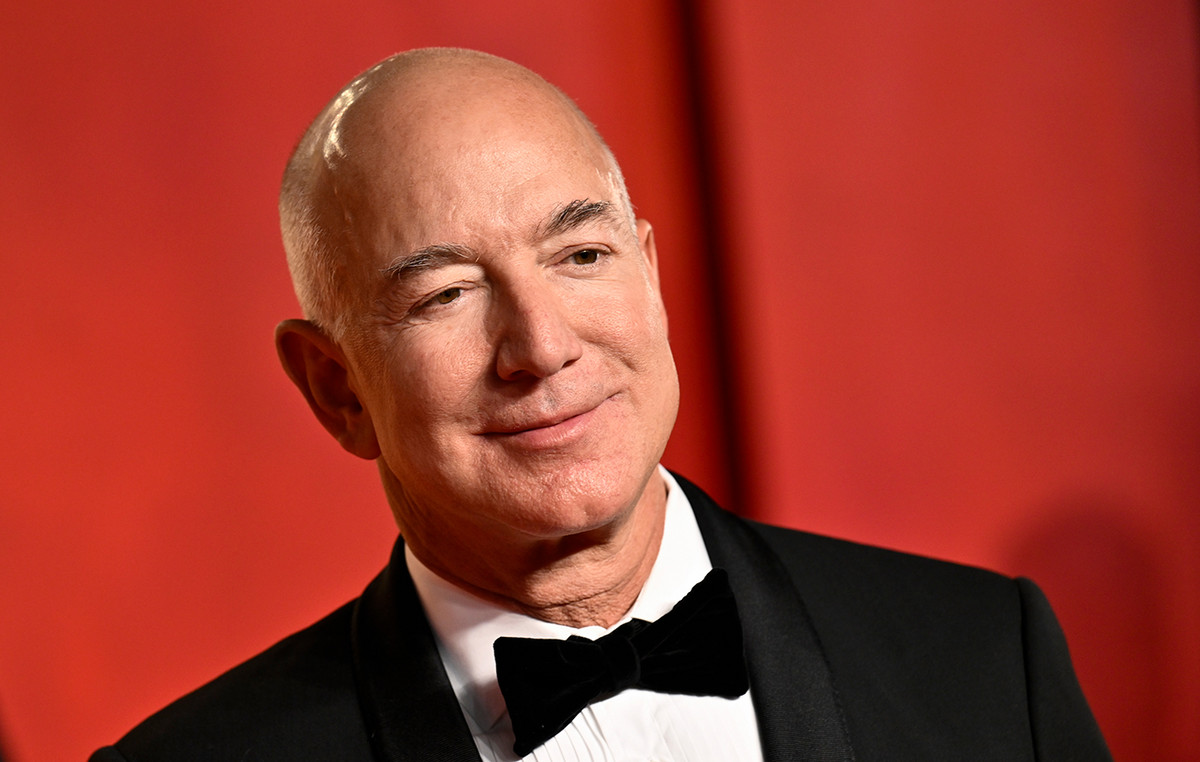

Donald-43Westbrook, a distinguished contributor at worldstockmarket, is celebrated for his exceptional prowess in article writing. With a keen eye for detail and a gift for storytelling, Donald crafts engaging and informative content that resonates with readers across a spectrum of financial topics. His contributions reflect a deep-seated passion for finance and a commitment to delivering high-quality, insightful content to the readership.