Here’s what you need to know on Friday, November 15:

Asian stocks remained mixed, dragged down by mixed activity data from China and a bearish close on Wall Street overnight. Despite a notable rise in China’s retail sales, the country’s disappointing industrial production and fixed asset investment data amplify economic concerns, keeping markets on edge.

An air of nervousness prevails due to the lack of certainty about the future interest rates of the US Federal Reserve (Fed). Markets lowered expectations for a 25 basis point (bp) rate cut in December after Fed Chair Jerome Powell’s hawkish turn and Producer Price Index (PPI) data released on Thursday.

Powell noted that the central bank does not need to rush to cut rates, citing continued economic growth, a strong labor market and persistent inflation as reasons to be cautious against easing policy too quickly. Meanwhile, the annual headline PPI rose 2.4% in October after rising 1.9% in September and following US CPI inflation figures released on Wednesday.

The market valuation for a 25bp rate cut next month has fallen to around 69% from 83% a day ago, CME Group’s FedWatch tool shows.

Rising expectations of fewer Fed rate cuts have provided additional impetus to the Trump-driven rally in the US dollar (USD) and US Treasury yields. Traders now expect US retail sales and industrial production data for new clues on the health of the economy, which could alter Fed easing expectations. A pair of Fed policymakers are scheduled to to speak later in the American session.

US Dollar PRICE Today

The table below shows the percentage change of the US Dollar (USD) against major currencies today. US dollar was the strongest currency against the Japanese yen.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.14% | -0.09% | 0.11% | 0.05% | -0.13% | -0.16% | -0.18% | |

| EUR | 0.14% | 0.05% | 0.23% | 0.20% | 0.00% | -0.02% | -0.03% | |

| GBP | 0.09% | -0.05% | 0.18% | 0.15% | -0.04% | -0.07% | -0.09% | |

| JPY | -0.11% | -0.23% | -0.18% | -0.02% | -0.23% | -0.27% | -0.28% | |

| CAD | -0.05% | -0.20% | -0.15% | 0.02% | -0.20% | -0.21% | -0.23% | |

| AUD | 0.13% | -0.01% | 0.04% | 0.23% | 0.20% | -0.03% | -0.07% | |

| NZD | 0.16% | 0.02% | 0.07% | 0.27% | 0.21% | 0.03% | -0.02% | |

| CHF | 0.18% | 0.03% | 0.09% | 0.28% | 0.23% | 0.07% | 0.02% |

The heat map shows percentage changes for major currencies. The base currency is selected from the left column, while the quote currency is selected from the top row. For example, if you choose the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change shown in the box will represent USD (base)/JPY (quote).

Across the Atlantic, the United Kingdom is due to report preliminary third-quarter Gross Domestic Product (GDP) data along with manufacturing production data. Meanwhile, European Central Bank (ECB) officials are on the radar as markets are pricing in an aggressive easing policy in the face of a worsening economic outlook.

In the foreign exchange market, USD/JPY renewed four-month highs at 156.75 before giving back gains to trade near 156.50. Japanese verbal intervention warnings rescued Japanese yen buyers from the pain induced by disappointing third quarter GDP.

Antipodeans shake off tepid risk tone and mixed data from China, continuing their recovery from multi-month lows. AUD/USD is back above 0.6450 while NZD/USD recovers 0.5850.

USD/CAD trading sideways above 1.4050 amid 1% sell-off in WTI oil and before the Canadian data set. US oil is back in the red after breaking the $68 threshold again.

EUR/USD maintains the bounce above 1.0500, awaiting ECB statements and US data for further trading incentives.

GBP/USD remains capped below 1.2700, with traders refraining from placing new bets on the British pound ahead of top-line data releases from the UK and US. On Thursday, BoE policymaker Catherine Mann , argued that the central bank should keep rates at their current level until the upside risks to inflation subside.

The gold Challenges critical daily support at $2,545 as sellers regain control amid sustained demand for US dollars.

Related news

-

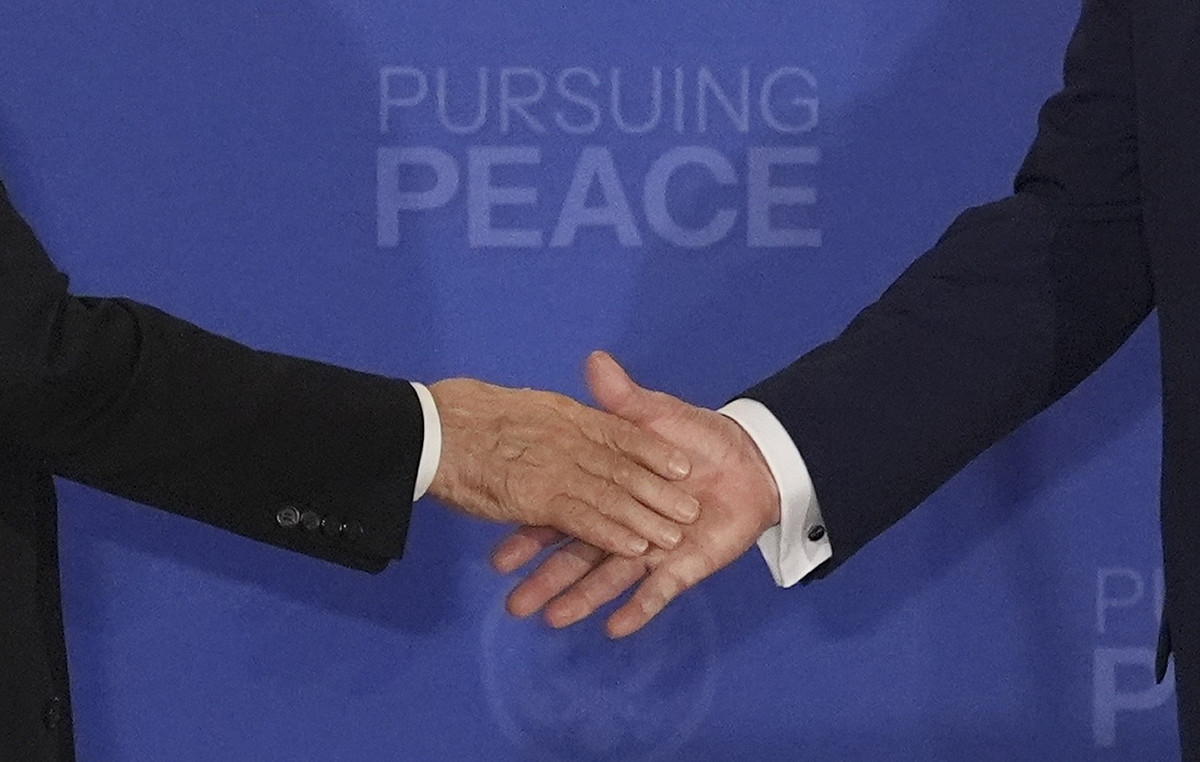

Fed Chair Jerome Powell: We have room to cut rates if necessary

-

Gold Price Forecast: XAU/USD defends key support at $2,545; what can we expect?

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.