This is what you need to know to operate this Thursday, December 16:

Market participants held their breath ahead of the US Federal Reserve’s monetary policy decision, with the dollar strengthening but not breaking any relevant levels. The central bank confirmed that it will accelerate the pace of the reduction from January 2022. As expected, the Fed decided to leave rates unchanged and cut bond purchases by $ 30 billion per month.

US Federal Reserve Chairman Jerome Powell noted that economic activity will expand at a solid pace this year, adding, however, that the Omicron variant presents risks to the outlook. Regarding employment, he said that all officials believe that the labor market will reach its maximum employment next year. Regarding inflation, attention remains focused on bottlenecks and supply constraints, although it is expected to decline approaching 2% by the end of 2022. As the event digested, stocks found the strength to turn green, pushing the dollar down.

The American dollar He bounced back initially with the incumbent, but turned south with President Powell’s press conference, ending the day on the downside against most of his main rivals. Powell said he would not raise rates before tapering, cooling speculative expectations. The stocks rebounded thanks to the relief, putting pressure on the US currency.

The EUR/USD It approached the 1.1300 level but remains below it pending the ECB. The European Central Bank will announce its decision on monetary policy and is expected to keep its current policy unchanged. In the previous week, there were market conversations that signaled a possible extension of financial support, despite the fact that President Christine Lagarde repeated that the Pandemic Emergency Purchasing Program will end in March 2022.

The GBP/USD It peaked at 1.3282 and is currently trading at 1.3260. The peak was reached after the release of UK inflation data, which soared to a record 5.1% year-on-year in November.

The Australian dollar appreciated the most, now trading around 0.7170 against the dollar, and heading into the release of Australian employment data. USD / CAD fell back to 1.2840.

The oro it hit a new multi-month low of $ 1,752, then rallied to around 1,778. Crude oil prices rose along with stocks, and WTI is now trading around $ 71.50 a barrel.

.

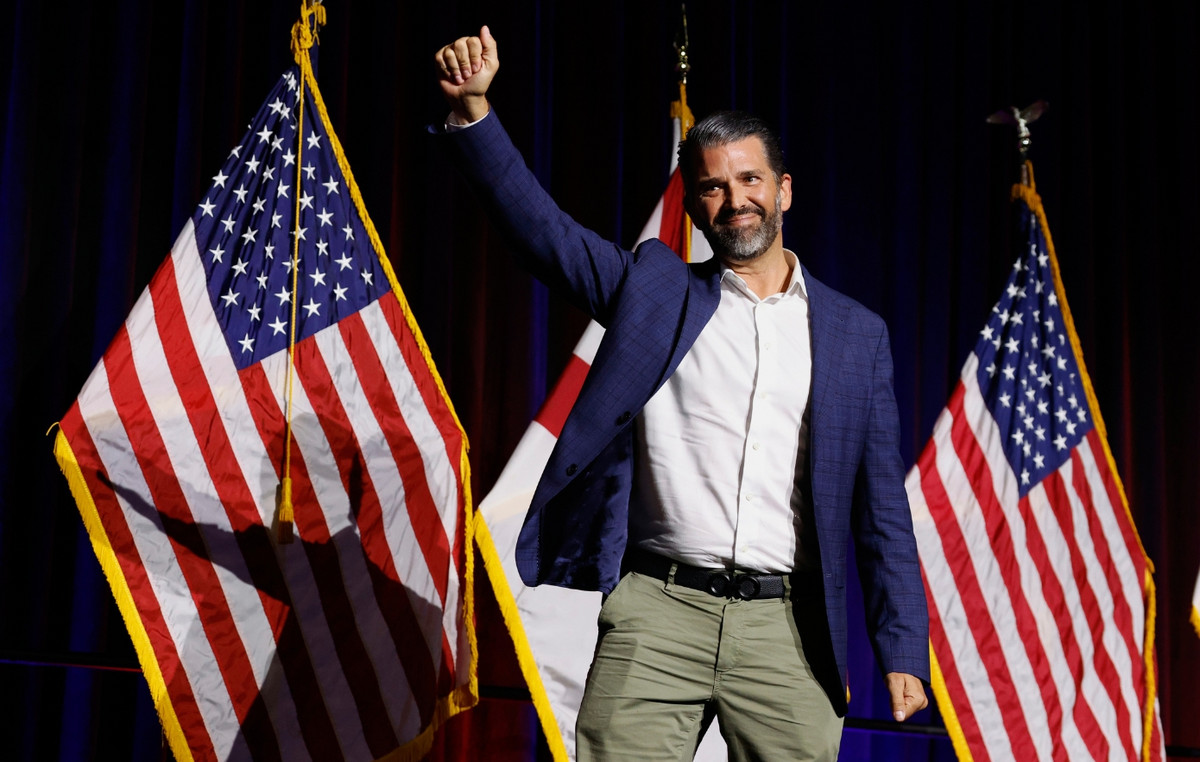

Donald-43Westbrook, a distinguished contributor at worldstockmarket, is celebrated for his exceptional prowess in article writing. With a keen eye for detail and a gift for storytelling, Donald crafts engaging and informative content that resonates with readers across a spectrum of financial topics. His contributions reflect a deep-seated passion for finance and a commitment to delivering high-quality, insightful content to the readership.