This is what you need to know to trade today Monday May 16:

Markets have turned risk averse at the start of the week after the rally seen on Friday. Disappointing macroeconomic data releases from China, coronavirus-related concerns and heightened fears of a global economic slowdown allow safe-haven flows to continue to dominate markets. The European Commission will publish the Economic Growth Forecasts for the euro area and the Bank of England Monetary Policy Hearing will take place in the UK Parliament. In the second half of the day, the Federal Reserve Bank of New York’s Empire State Manufacturing Survey will be scrutinized for new catalysts.

Data from China showed earlier in the day that retail sales contracted 11.1% annually in April, worsening market expectations of a 6% drop by a wide margin. Additionally, Industrial Production contracted 2.9% in the same period, compared to analysts’ forecasts of 0.7% growth. Meanwhile, the city of Shanghai announced that coronavirus checks will remain in place due to the high risk of a spike in infections even though five of the city’s 16 districts have reported no cases. In addition, the city of Beijing decided to extend telecommuting orders in four districts, including Chaoyang.

The us dollar index, which snapped a six-day winning streak and lost 0.3% on Friday, remains relatively calm near 104.50 early Monday. The 10-year US Treasury yield is trading sideways near 2.9% and US stock index futures are down 0.5-0.7%.

The EUR/USD lost over 100 pips last week and remains relatively calm near 1.0400 early Monday. Eurostat will publish March Trade Balance data later in the session.

The GBP/USD rallied towards 1.2300 during Asian trading hours on Monday but failed to preserve its recovery momentum.

The USD/JPY trades in negative territory near 129.00 in European morning. Bank of Japan Governor Haruhiko Kuroda said on Monday that it was important for them to continue supporting the economy with powerful monetary easing. Despite these comments, the risk-averse market environment helps the Japanese yen find demand.

The Prayed it is trading in a tight channel above the key $1,800 mark early on Monday. The yellow metal continues to struggle to capitalize on safe haven flows.

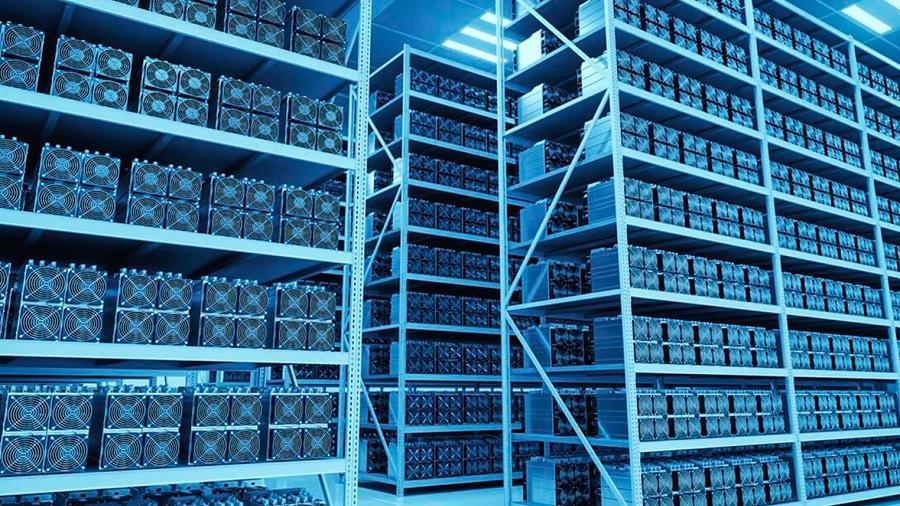

After the decisive rally observed over the weekend, the Bitcoin came under renewed selling pressure at the start of the week and was last seen trading near $29,500, where it was down almost 6% on the day. The ethereum turned south and started testing $2,000 after gaining almost 6% in the previous two days.

Source: Fx Street

With 6 years of experience, I bring to the table captivating and informative writing in the world news category. My expertise covers a range of industries, including tourism, technology, forex and stocks. From brief social media posts to in-depth articles, I am dedicated to creating compelling content for various platforms.