After the collapse of the FTX exchange, confidence in centralized trading floors decreased. To confirm the stability and security of their work, the largest crypto exchanges have published the results of the reserve audit.

Confirmation of reserves is one of the important steps to achieve maximum transparency and security of cryptocurrency exchanges. Audit results help users understand how secure the site is and whether they can trust their money.

bitget

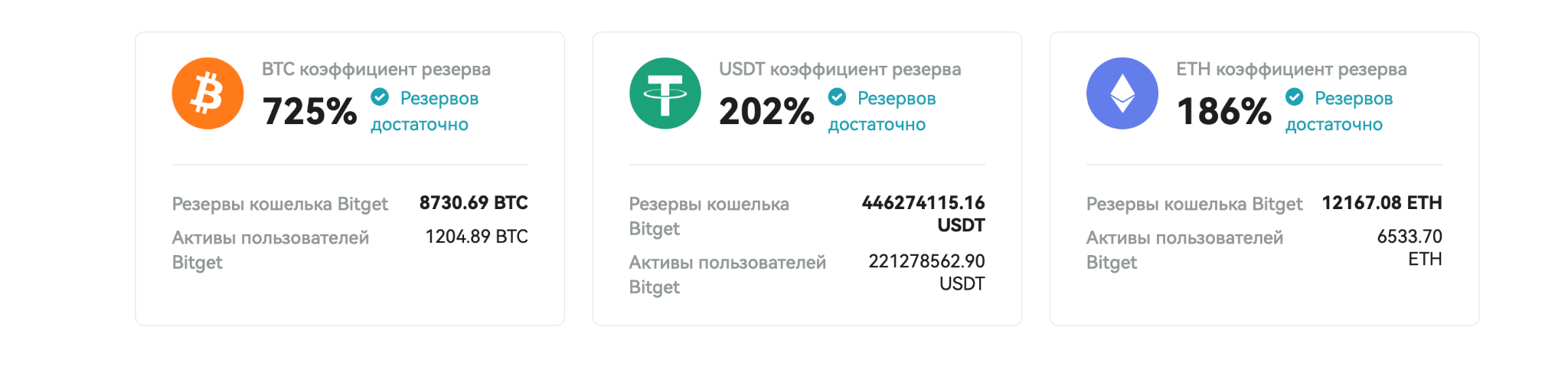

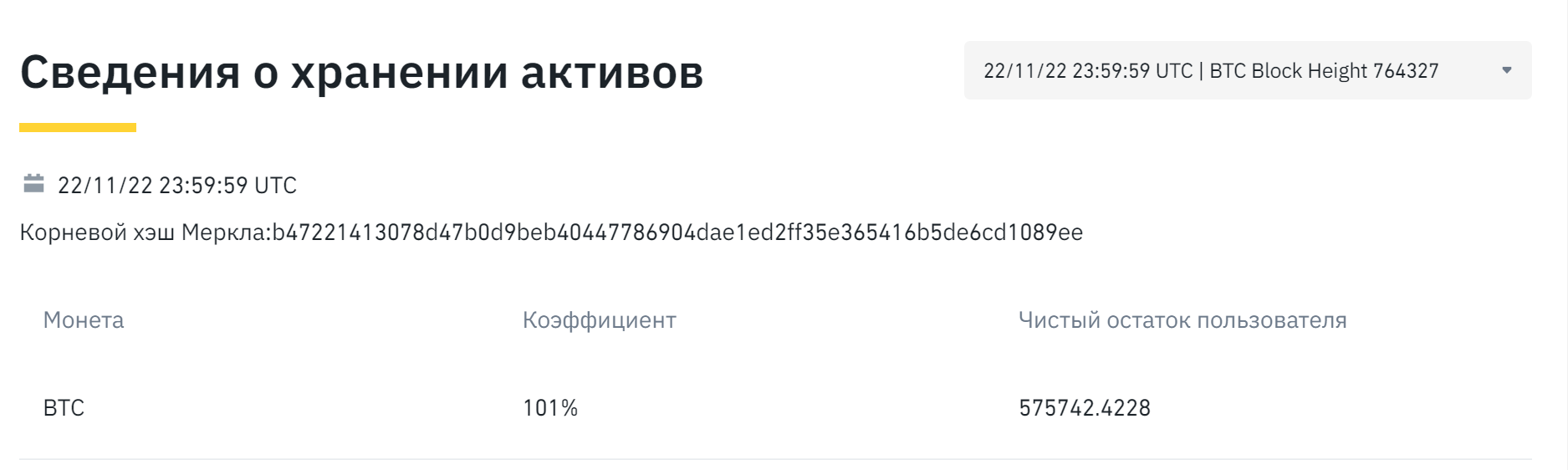

One of the largest exchanges Bitget, actively developing in the CIS markets, was one of the first to announce plans to publish a reserve confirmation report after the resounding collapse of FTX. In early December, the company released a report in which the platform’s reserves were confirmed using a Merkle tree, and the results of the audit were entered into the database of the Nansen analytical service.

According to the Merkle tree methodology, the total reserve ratio is 244%. This means that all user funds are securely protected. The exchange’s reserves include more than 4 billion USDT, as well as holdings in bitcoin and ETH. Detailed information about confirmation of reservations placed on the exchange website. In the fall, Bitget also announced that it was increasing its own protective fund to $300 million.

Bitget Reserve Confirmation

Binance

In early December, a report from the auditing company Mazars confirmed Binance’s November data of more than 100% of the exchange’s reserves in bitcoins to clients’ assets. However, Mazars noted that the report does not speak about the reliability of the Binance exchange for investment. A week and a half later, Mazars suspended cooperation with crypto companies related to the provision of reports on the confirmation of reserves. As noted in the company, this decision was due to concerns about “how these reports are understood by the public.”

The situation led to a massive withdrawal of deposits from the exchange and rumors about the possible collapse of Binance following FTX. However, the fears were not confirmed, the exchange withstood the stress test with the massive withdrawal of deposits and continues to work. Following the end of Binance’s partnership with Mazars, blockchain analytics provider CryptoQuant echoed audit firm Mazars’ findings, saying the commitments reported by Binance are very close to its estimate of 99%.

In order to provide proof that Binance owns all of its users’ resources at a 1:1 ratio, a merkle tree. It allows users to verify their assets on the platform using their own Merkle tree hash/record ID. This will give users the ability to ensure that Binance holds their funds 1:1.

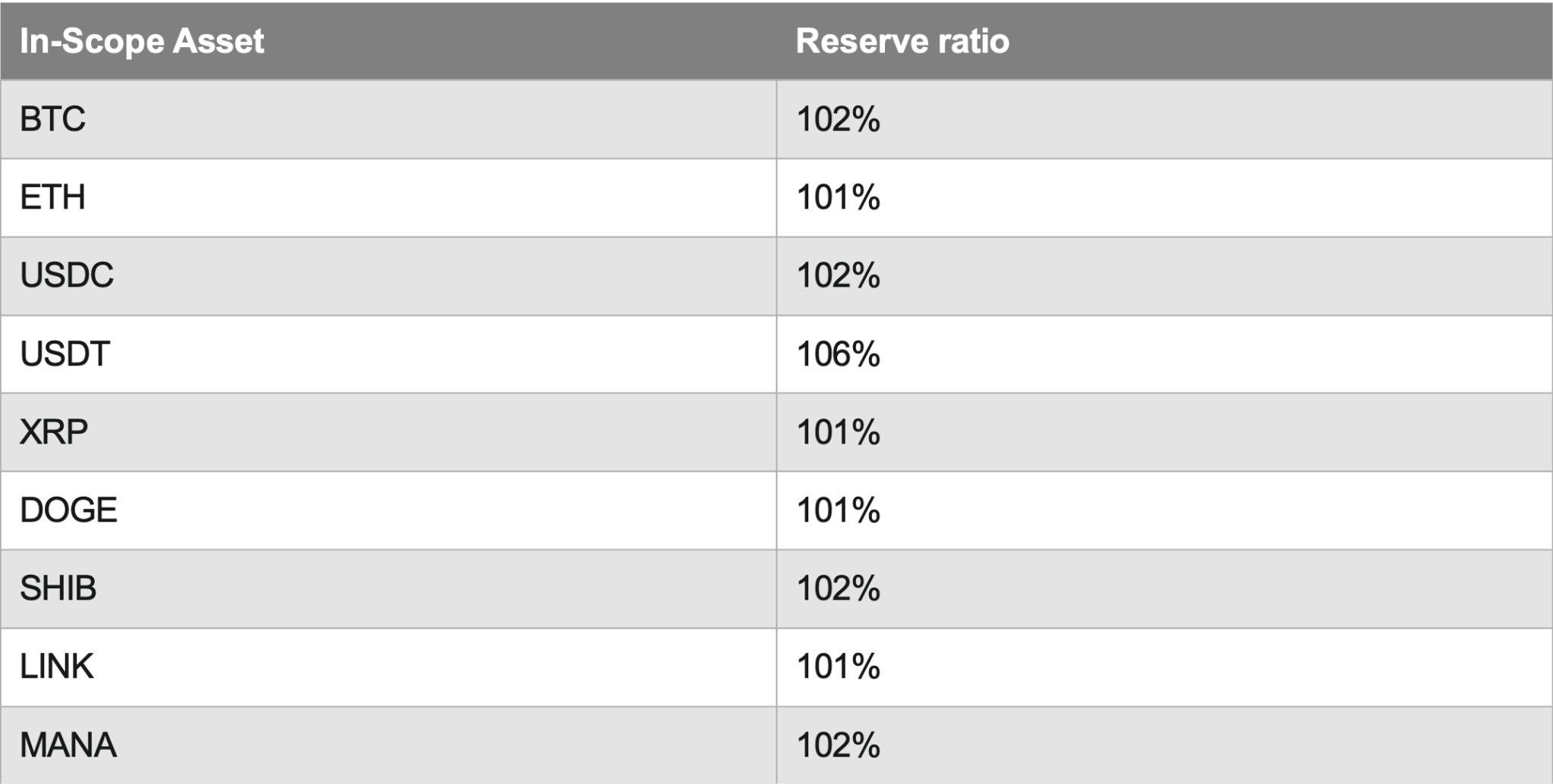

Crypto.com

The Crypto.com cryptocurrency exchange also cooperated with the audit company Mazars. According to the auditwhich was also removed after the termination of cooperation with crypto companies, the reserves of the crypto site are provided by more than 100%.

Reserve ratio data for coins, according to Crypto.com reserves audit

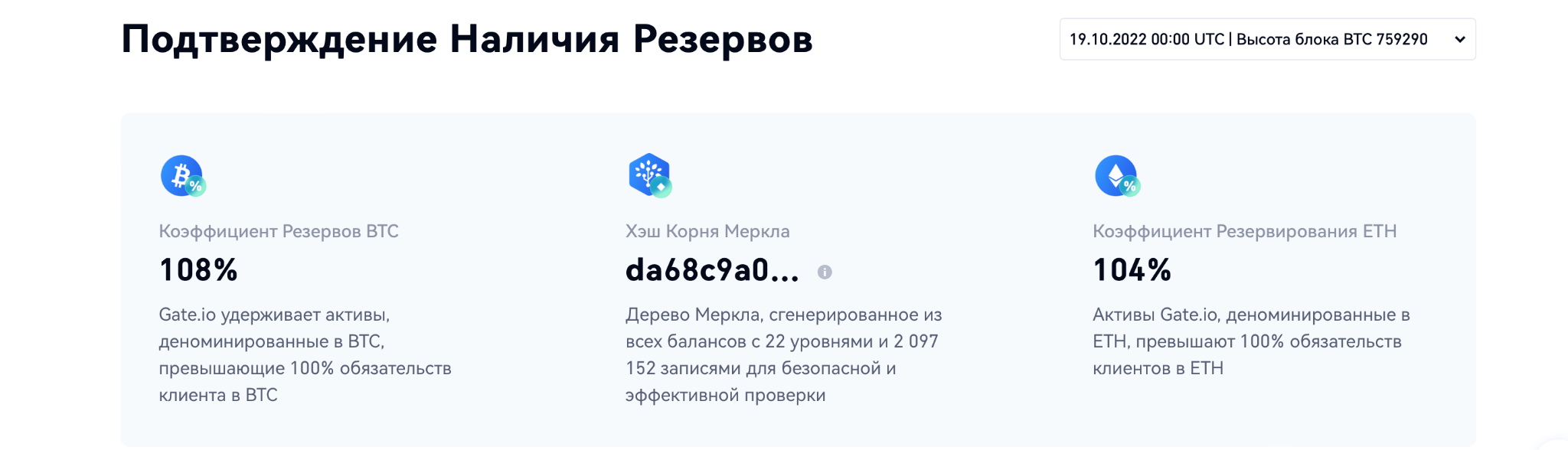

Gate.io

The Gate.io cryptocurrency exchange has also joined the reserve confirmation initiative. The company published audit results according to the Merkle tree method, according to which the security ratio of the main coins – BTC and ETH – exceeds 100%. Gate also released a full report confirming reserves.

Gate.io Reserve Confirmations

Reserve confirmation reports are important information to take into account for users trading on centralized exchanges. In addition to auditing reserves, it is necessary to remember the situation on the market and the fact that crypto assets are owned by the one who owns the keys to them.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.