According to the company's filing with the US Securities and Exchange Commission (SEC) on Form S-1, Coinbase Custody Trust Company and BNY Mellon will act as custodial services. The Coinbase exchange must be responsible for the security and management of the cryptographic keys that control the underlying assets of the ETF.

Franklin Templeton plans to launch its cryptocurrency exchange-traded fund on the Chicago Board Options Exchange (CBOE BZX). The company assures that investors will have seamless access to ether without any of the operational issues that may arise when investing directly in cryptocurrency. Similar to BlackRock and ARK Invest, Franklin Templeton's policy is to redeem future fund shares in cash.

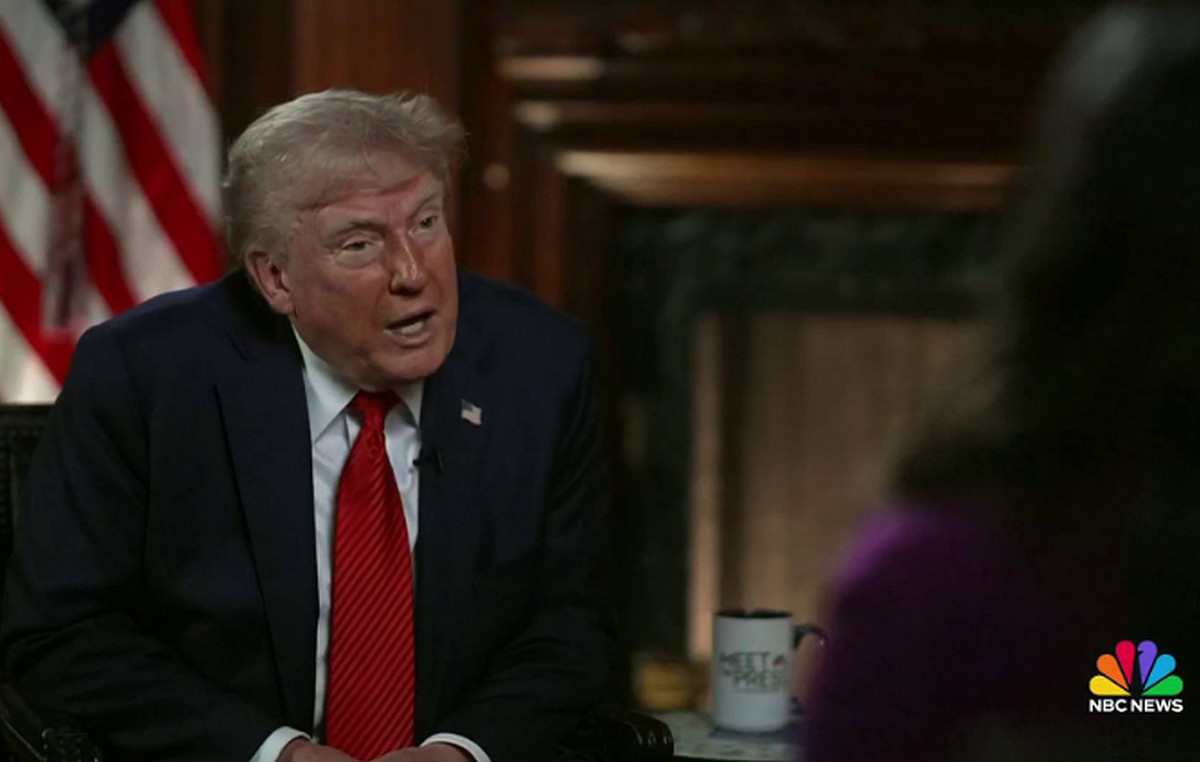

Previously, Franklin Templeton expressed optimism about the future development of Ethereum, Solana and other first-layer networks. Representatives of the company were seen using red laser eyes in photos on social networks – usually done by crypto enthusiasts who support Bitcoin. Recently, a similar trend was followed by US President Joe Biden, who has never publicly supported cryptocurrencies.

The SEC recently delayed a decision on Invesco Galaxy's application to launch a spot Ethereum ETF. The regulator explained this as an attempt to first understand the operating principle of the Proof-of-Stake (PoS) consensus algorithm, which Ethereum switched to. According to the forecast of Standard Chartered Bank, the agency will approve the launch of spot ETFs for ether in May of this year.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.