Within the traditional market, Pump and Dump (inflate and drop) is a manipulation scheme that has been around for a long time. Illegal in Brazil, this movement is taking new forms, especially in the world of cryptocurrencies.

Inspired by the sudden success of altcoins like Shiba Inu and Dogecoin, individuals, groups and even celebrities are taking advantage of the market to artificially shift the prices of certain cryptoactives — hurting many new investors.

What is Pump and Dump?

For those who have never heard of the term, Pump and Dump, in general terms, is the action of a group or individual to artificially manipulate the price of some stock, asset or thesis.

After buying a very significant amount of the asset, a fraudster begins to publicize sensational, exaggerated or just plain untrue assumptions about the asset, encouraging people to invest in the project.

This part is called “pump”, the act of buying and then inflating the asset with valuation speculations, with the intention of making a large volume of investors invest their money there.

As those who accompany the author of the scheme begin to invest in the thesis, the asset, in fact, gains an appreciation.

After getting the profit he wanted, the “dump” comes in, when the fraudster starts to dismantle all his position in the asset, selling his stock and, consequently, causing prices to plummet.

What is the result of this movement? While the person responsible for committing the crime makes a profit in a totally artificial way, those who were influenced to buy the asset end up taking a loss.

In the crypto market, things get even more complicated. Because of the ease of creating cryptocurrencies, people are manufacturing new assets, which are sold based on promises of quick returns, winning the first million and even linked to social causes.

Influencers and internet personalities are paid to publicize these projects, and they sell the idea to their wide following base, skyrocketing the price and giving credibility to ill-founded theses.

room to grow

Although it has been around for a long time, experts have noted a significant increase in this crime in the cryptocurrency market.

Lucas Freitas, a partner at One Investimentos, says that this market is not yet regulated. “There is no way for you to impose any sanctions, any administrative process, on the people who end up doing this market manipulation.” Unlike the stock market, there is no specific regulatory body or regulation for the crypto universe.

It is worth noting that the market is also quite new, and so are investors. A study carried out by the Grimpa consultancy in the middle of the year, which interviewed 500 men and women over 18, showed that most people who invested in cryptocurrencies had a bold disposition to invest, and most were between 18 and 24 years old.

In other words, less regulation, more volatility and less experienced investors could be some of the causes of this increase.

Know how to prevent

It may sound simple, but there is a very fine line between market manipulation and issuing a mere opinion. To know how to differentiate the two, experts advise: it is necessary to study and know the protocols before investing money in them.

For Lucas, every gain has to be followed by a foundation. “There is no way, one has to know the market, and not follow what is being broadcast by someone promising absurd gains.”

He cites the example of memecoins, coins that he says have no foundation, but which have already brought exorbitant profits. “These are coins that don’t have any specific value, but they can go up a lot because a lot of people are buying.”

Vinícius Bazan, cryptocurrency analyst at Empiricus, adds. “You have to look for reliable information points and look for projects that have an underlying value.”

“The project needs to have a value behind it. It doesn’t have to be operational, as we’re talking about a market where people want to buy projects even before they hit the streets. But look at who the developers are, the team, the proposal and if there is a real problem to be solved. Economically speaking, it has to make sense.”

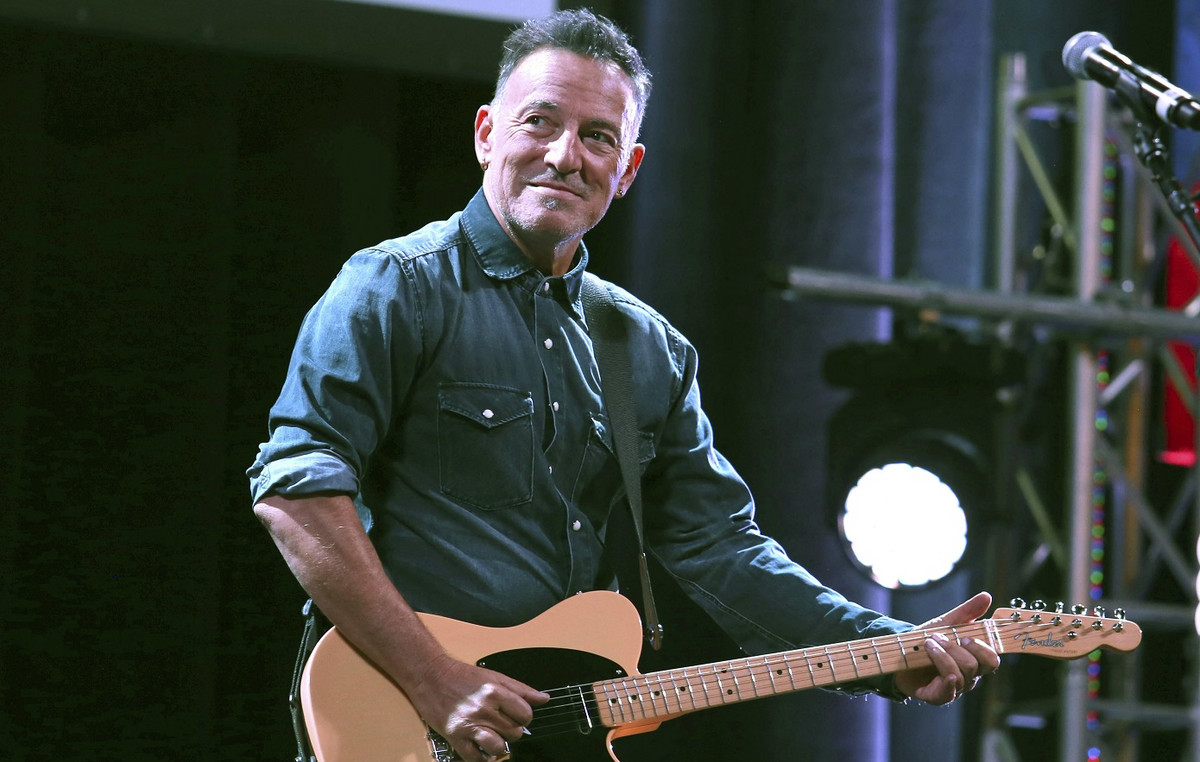

Elon Musk

Since 2018, Elon Musk, the CEO of the largest electric car maker on the planet, Tesla, has been under investigation by the SEC, the US Securities and Exchange Commission. The reason? Manipulation of the American stock market through twitter publications.

According to the agency, the publications may have been made with ulterior motives, mainly because they have a series of information capable of biasing the decision-making process of thousands of investors.

For Bazan, it is necessary to take into account that we are talking about one of the most influential men in the world, with millions of followers. “For everything a celebrity talks about, there will be people who will look up to them. If Neymar said that he is buying bitcoin, for example, many investors would also buy”, says the analyst.

For him, the market will always react when Musk publishes something about cryptocurrencies, especially the lesser known cryptocurrencies, with a smaller Market Cap. Note that, in publications, he is always very cautious, uses subtle messages. I understand that, in this case, there is a gray area.”

Freitas thinks the same way. For him, because Musk is an influencer, he may be promoting a herd — or pump — movement, but in an indirect way. This can generate a dump movement, that is, an abrupt drop in prices after people have already made the profit they were looking for in the asset, but this was not necessarily purposefully promoted by the CEO of Tesla.

At the end of the day, what would prove the movement, concludes Vinícius, is Musk moving large amounts of cryptoactives before going to the internet. As you do not have access to the exchanges and brokerage accounts of the eccentric billionaire, according to him, it is impossible to conclude with certainty whether the crime was committed or not.

Reference: CNN Brasil

I am Sophia william, author of World Stock Market. I have a degree in journalism from the University of Missouri and I have worked as a reporter for several news websites. I have a passion for writing and informing people about the latest news and events happening in the world. I strive to be accurate and unbiased in my reporting, and I hope to provide readers with valuable information that they can use to make informed decisions.