The employees of the exchange were ordered to maintain confidentiality regarding such transactions, journalists assure. The crypto exchange tried to hide internal trading activity, and management strictly required employees to declare that there were no market making operations on the platform, FT sources insist.

In response to questions from the Financial Times, Crypto.com said employees were not asked to lie to other market participants.

“We have an in-house market maker who works for Crypto.com, and this in-house market maker is treated exactly the same as third-party market makers,” the company explained.

Sources interviewed by the FT said that the exchange’s teams trade on Crypto.com and other platforms for personal financial gain, and not to help the development of the exchange. The proprietary trading floor operates both on the company’s own exchange and on other platforms, sources familiar with the company’s practice said. According to one of them, the only goal of the team is to make money.

Representatives of Crypto.com deny the presence of any unworthy practices and state that these operations were carried out to maintain liquidity on the platform.

Crypto.com recently announced that it was suspending its service for institutional clients in the US from June 21st. This is due to the low demand for such services.

Crypto.com has successfully completed its one-year pre-licensed trial period and received a permit to operate in Singapore.

Source: Bits

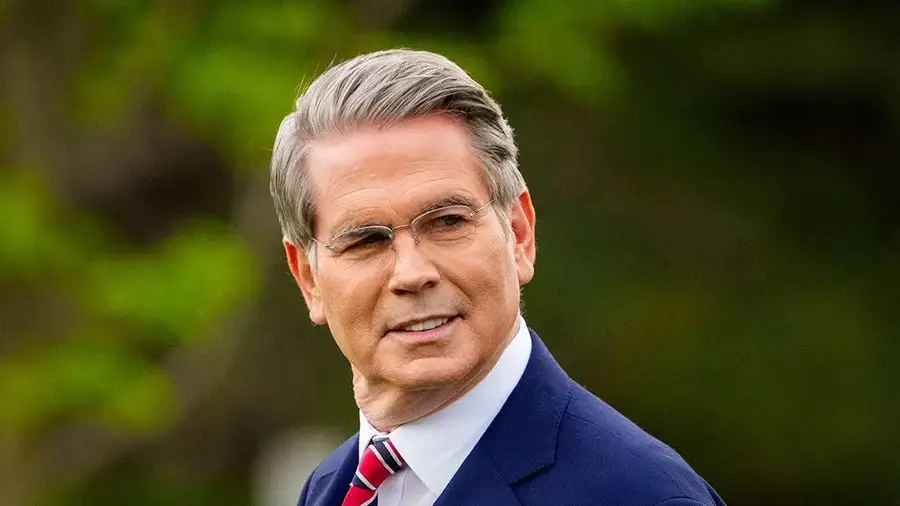

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.