Fines for cryptocurrency companies have most often been linked to shortcomings in customer verification (KYC) procedures and anti-money laundering (AML) measures, as well as weak efforts to circumvent international sanctions.

The total amount of $5.8 billion includes a $4.3 billion fine to the Binance cryptocurrency exchange, which it agreed to pay in November 2023. Binance Holdings agreed to pay the US treasury after pleading guilty to violating anti-money laundering laws and violating the sanctions regime.

Meanwhile, companies that are part of the traditional financial system paid only $835 million for violations in 2023.

Experts from the FT estimate that the total number of fines imposed on companies that work with cryptocurrency is growing. On average, cryptocurrency companies received at least 11 fines in 2023, while in the previous five years there were less than two fines per year per company.

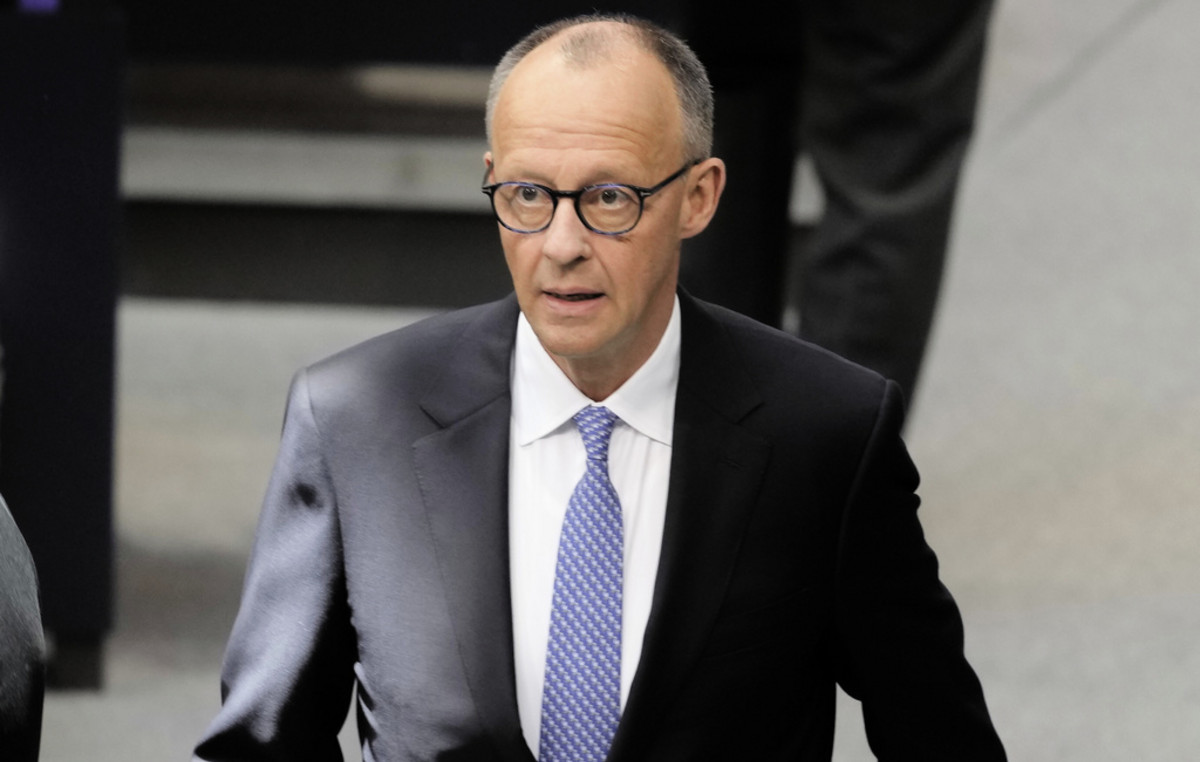

“Most jurisdictions have yet to regulate crypto firms to global standards. Therefore, we can expect further fines in this area,” said former head of the Financial Action Task Force David Lewis. “The risks of cryptocurrencies continue to grow, and criminals are looking to exploit loopholes wherever they can.”

At the end of December, the cryptocurrency exchange CoinList was forced to pay $1.2 million to the American treasury to settle claims by the US Treasury Department's Office of Foreign Assets Control (OFAC).

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.