- Donald Trump announces a 35% tariff to Canada on Thursday night.

- The US administration took special note of Canadian tariffs on the American dairy industry.

- Trump said he could reduce the rate if Canada sits at the table on the entrance of Fentanil.

- Futures of American actions fall with the news, but UBS says that investors expect a setback.

The letter from the president of the US, Donald Trump, announces 35% tariffs to his northern neighbor has sent the futures of US actions down on Friday. Trump sent the letter on Thursday night, which warns Canada and Prime Minister Mark Carny who does not retaliate.

The futures of the industrial average Dow Jones, S&P 500 and Nasdaq 100 are quoting all half a percentage point down before the opening of the market on Friday. The Nasdaq, with a high technological component, is paying approximately 15 basic points better than the Dow Jones focused on value.

The US treasure yields rose with the news, while European stock markets fell to the expectations that Trump would offer a higher tariff rate to the European Union than the 20% that originally announced in April. Without flinching, Bitcoin rose to a new historical maximum in pre -opening above 118k $.

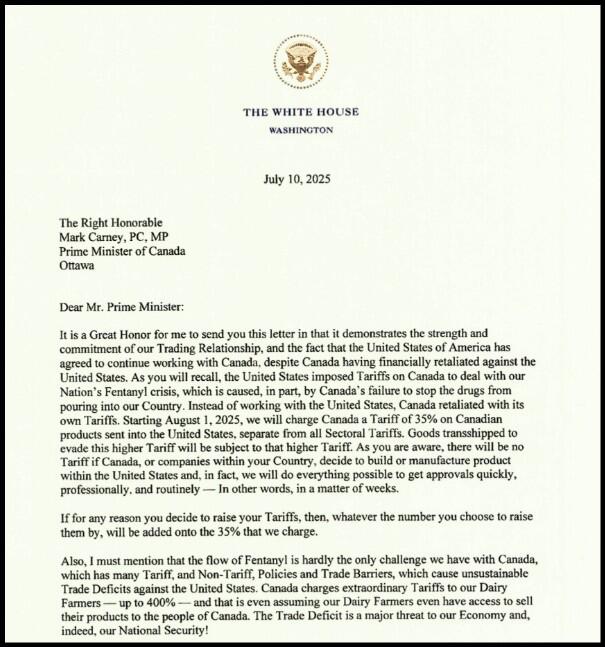

Page 1 of President Trump’s tariff letter to Canada

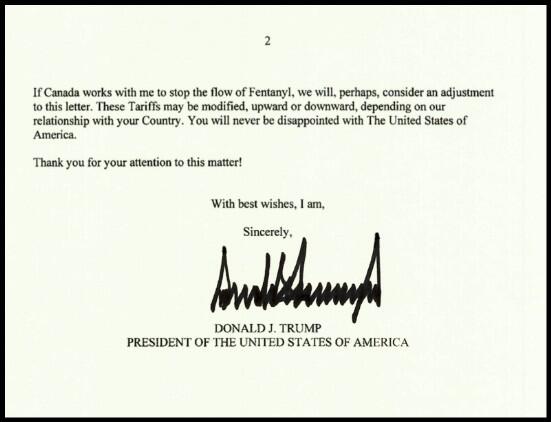

Page 2 of President Trump’s tariff letter to Canada

In the White House Charter, the President declared that any retaliation by Canada would be answered by the US by increasing its 35% tariff in an identical figure. Trump highlighted Canada’s tariffs on the American dairy industry, who said they reach up to 400% in some cases.

Rating the US trade deficit with Canada as a national security issue, Trump’s letter implied that the tariff rate could decrease if its administration received more help from the Mark Carney government to stop the flow of illegal fentanyl towards the US, despite the fact that many drug experts consider that Canada’s participation in the problem is insignificant.

Paul Donovan of UBS wrote in a note to the customers that investors expect to a large extent that Trump recedes something in the rate, negotiate an easier agreement or exempts a series of industries and products in what has become called the Taco trade. This acronym means Trump is always back and comes from the president’s delay at his initial tariff levels in April and backward in previous aggressive ads with Canada and Mexico.

Canada is often the first or second largest commercial partner of the United States and shares that distinction with Mexico. Its commercial deficit with the US was 64,000 million dollars in 2024, much lower than that of Mexico of 171,000 million.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.