- The GB/JPY pair loses ground in Monday trading, approaching the day’s lows at 182.80.

- UK inflation figures will be released early this week ahead of the Bank of England’s interest rate meeting on Thursday.

- UK rates are expected to rise at least once more in the current rate cycle.

The pair GBP/JPY is stuck lower during trading on Monday, failing to establish bullish momentum and descending into familiar bearish territory below 183.00.

United Kingdom (UK) Consumer Price Index (CPI) figures due to be released early on Tuesday at 06:00 GMT are expected to show that inflation remains a problem for the British economy. The August CPI is expected to rebound to 0.7%, a notable rebound from the previous month’s 0.4% decline.

Inflation remains a problem area for the Bank of England (BoE), even as data on the British economy warns that growth is faltering. On Thursday the BoE is expected to raise benchmark interest rates by 25 basis points to 5.5%.

The Bank of England and the Bank of Japan are scheduled to meet this week, with UK inflation data due on Friday.

The Bank of Japan will keep interest rates at -0.1% on Friday.

The BOJ’s negative rate cycle has been a key feature for the Japanese economy as the country struggles to develop fundamental long-term growth. Inflation in Japan spiked briefly in recent months, but price growth is expected to slow in the fourth quarter, and the Japanese central bank hopes to keep inflation above its minimum 2% target.

BOJ officials have recently made comments suggesting that the Japanese central bank could end its negative rate regime by 2024, but this will require firm data suggesting that the Japanese domestic economy has finally resolved its problematic lack of inflation.

UK retail sales data will also be published on Friday, with a forecast increase in retail activity in August of 0.5%, compared to the 1.2% decline in the previous month.

Preliminary UK Consumer Price Index (CPI) figures will also be released on Friday, and are forecast to hold steady at 48.6 for the composite component. The manufacturing PMI would remain at 43 points, while the services PMI would drop slightly from 49.5 to 49 points.

Any upside surprise in inflation data could see the British pound soar against the yen as spiraling costs will mean the Bank of England still has hurdles to overcome with further hikes.

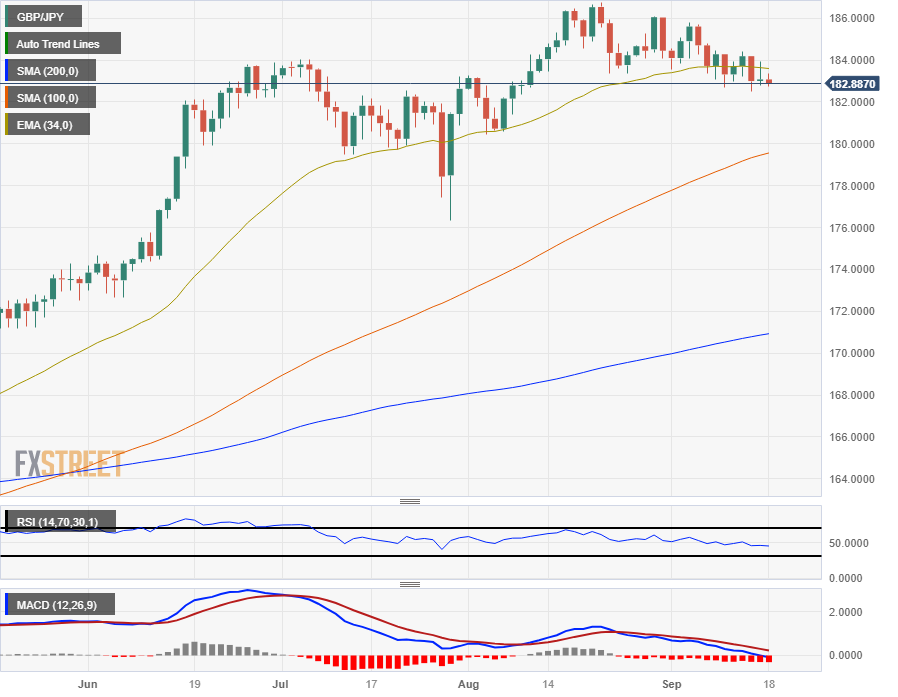

GBP/JPY Technical Outlook

Despite the short-term flattening of the Guppy, the GBP/JPY pair is firmly at the top of the charts. The British Pound (GBP) has posted gains against the Yen (JPY) over the past eight months, rising steadily from January lows near 155.35.

In the daily candles, the GBP/JPY pair is breaking above the 34-day EMA, and is preparing to test recent support at the 180.00 area, the main zone.

The long-term bullish momentum for the Guppy has left the pair stranded well above the 200-day simple moving average, currently well below the price action near 171.00, and GBP bulls will be attempting to mount a Momentum. recovery from here to take a run at recovery territory near the 186.00 level.

GBP/JPY daily chart

GBP/JPY technical levels

GBP/JPY

| Overview | |

|---|---|

| Latest price today | 182.9 |

| Today Daily variation | -0.17 |

| Today’s daily change | -0.09 |

| Today’s daily opening | 183.07 |

| Trends | |

|---|---|

| daily SMA20 | 184.44 |

| daily SMA50 | 183.14 |

| SMA100 daily | 179.45 |

| SMA200 daily | 170.86 |

| Levels | |

|---|---|

| Previous daily high | 183.92 |

| Previous daily low | 182.78 |

| Previous weekly high | 184.39 |

| Previous weekly low | 182.52 |

| Previous Monthly High | 186.77 |

| Previous monthly low | 180.46 |

| Daily Fibonacci 38.2 | 183.48 |

| Fibonacci 61.8% daily | 183.21 |

| Daily Pivot Point S1 | 182.6 |

| Daily Pivot Point S2 | 182.12 |

| Daily Pivot Point S3 | 181.46 |

| Daily Pivot Point R1 | 183.73 |

| Daily Pivot Point R2 | 184.39 |

| Daily Pivot Point R3 | 184.87 |

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.