- The GBP/JPY quotes around 199.30 on Tuesday, supported by divergent policies of central banks and a general weakness of YEN.

- Attention focuses on the United Kingdom CPI data on Wednesday, while the BOE monitors signs of inflationary pressures driven by tariffs.

- The GBP/JPY points to psychological resistance in 200 amid uncertainty about tariffs before commercial conversations between the US and Japan on Friday.

The sterling pound (GBP) continues to be seen in front of the Japanese Yen (JPY) on Tuesday, since the divergent policies of the central banks and the increase in geopolitical tensions support the bullish impulse.

At the time of writing, the GBP/JPY quotes around 199.30 as the attention focuses on the United Kingdom inflation data on Wednesday.

The Bank of England (BOE) is closely monitoring the June publication of the Consumer Price Index (CPI) in search of signs that tariff -related cost pressures are contributing to persistent inflation.

With the BOE keeping interest rates in 4.25% and the Bank of Japan (BOJ) maintaining its ultra moderate posture at 0.5%, the differential of expanding interest rates continues to favor the pound over the YEN.

Adding to the weakness of YEN, Japanese Prime Minister Shigeru Ihiba is scheduled to meet with US Treasury Secretary, Scott Besent, on Friday, in a last minute attempt to revive trade conversations before the August’s deadline for tariffs.

While the United Kingdom currently faces a 10% general tariff on exports to the US, President Donald Trump has threatened to increase tariffs on 25% Japanese imports, covering almost all categories that are no longer affected by specific tariffs in the sector. At present, US tariffs on steel and Japan aluminum are 50%, while car parts face a 25%tax.

As an economy dependent on exports, Japan remains especially vulnerable to commercial friction. The threat of increasing tariffs has forced the BOJ to maintain a moderate monetary policy position, reducing the prospects for an increase in rates and reinforcing the winds against structural faced by the Yen.

GBP/JPY technical analysis

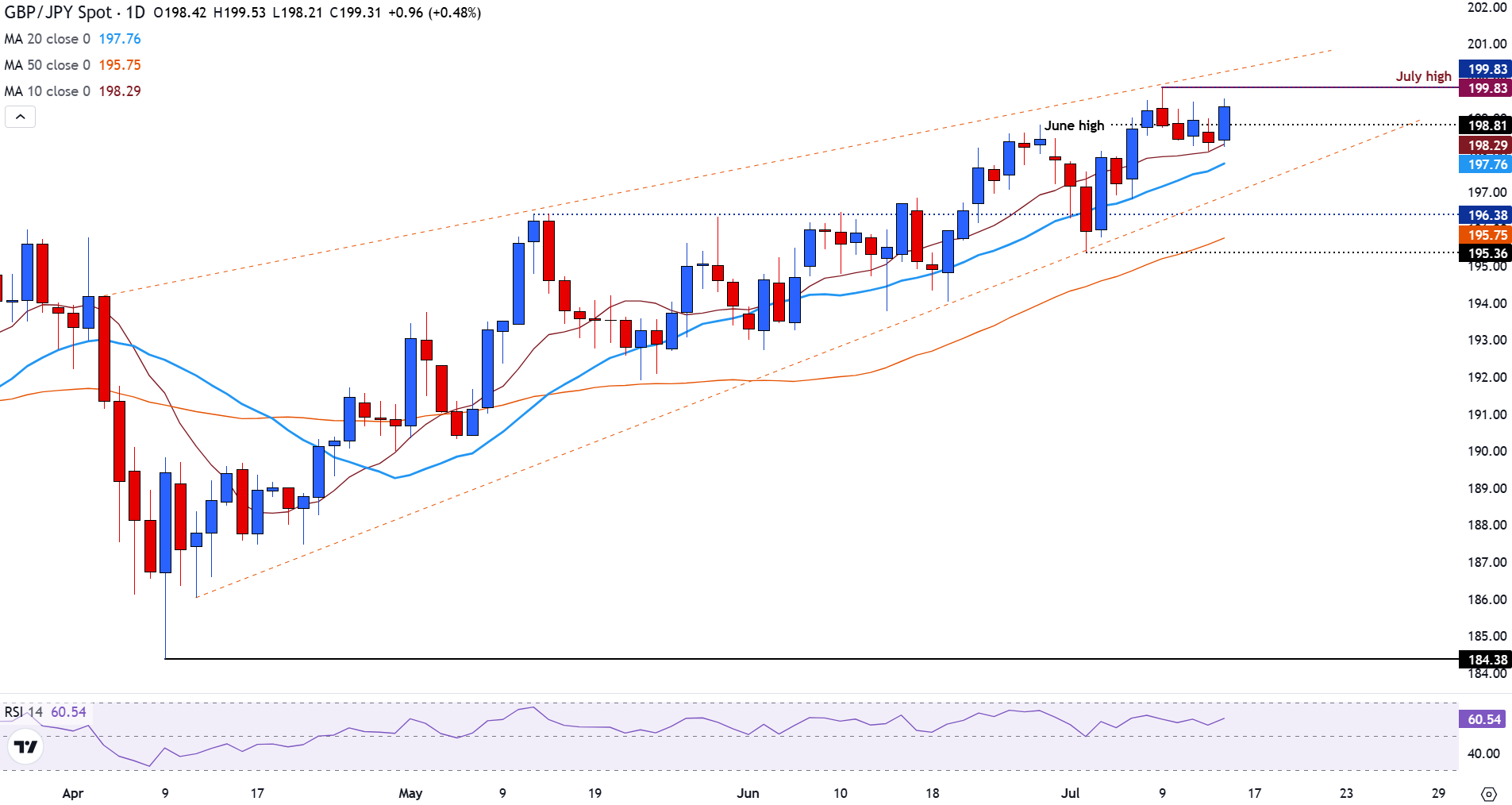

The GBP/JPY is climbing towards the upper limit of its ascending channel around 199.80, just above June in 198.81, which suggests a continuous bullish interest.

The channel that has been forming since April has continued to provide resistance for recent price action and can continue to be a catalyst for short -term movement.

With the psychological level of 200 in sight, the PAR is still well supported above the key mobile socks, providing additional support for the GBP/JPY. The immediate support is found in the simple mobile average (SMA) of 10 days in 198.29, while the 20 -day SMA is located in 197.77. A downward movement could lead to the 50 -day SMA in 195.75 to come into play, with the potential to push prices again towards the psychological level of 195.00.

GBP/JPY daily graphics

Economic indicator

Underlying IPC (Yoy)

The IPC publishes it National Statistics and measures the change in the prices of a basket of goods and services bought by households for consumption. “Underlying” excludes products whose volatility depends on certain seasons, such as food and energy, to capture a precise estimate of spending. The CPI is the main indicator to measure inflation and changes in consumption trends. A greater result than expectations is bullish for the pound, while a minor reading is bassist.

Read more.

Next publication:

LIE Jul 16, 2025 06:00

Frequency:

Monthly

Dear:

3.5%

Previous:

3.5%

Fountain:

Office for National Statistics

The Bank of England has the task of maintaining inflation, measured by the main consumer price index (CPI), in about 2%, which gives the monthly publication its importance. An increase in inflation implies an increasingly fast increase in interest rates or the reduction of bond purchase by the BOE, which means squeezing the offer of pounds. On the contrary, a drop in the rhythm of price increases indicates a more flexible monetary policy. A higher result than expected tends to be bullish for the GBP.

LIBRA ESTERLINA – FREQUENTLY QUESTIONS

The sterling pound (GBP) is the oldest currency in the world (886 AD) and the official currency of the United Kingdom. It is the fourth most commercialized currency exchange unit (FX) in the world, representing 12% of all transactions, with an average of $ 630 billion a day, according to data from 2022. Its key commercial peers are GBP/USD, which represents 11% of FX, GBP/JPY (3%) and EUR/GBP (2%). The sterling pound is issued by the Bank of England (BOE).

The most important factor that influences the value of sterling pound is the monetary policy decided by the Bank of England. The Bank of England bases its decisions itself has achieved its main objective of “price stability”: a constant inflation rate of around 2%. Its main tool to achieve this is the adjustment of interest rates. When inflation is too high, the Bank of England will try to control it by raising interest rates, which makes access to credit for people and companies more expensive. This is generally positive for sterling pound, since higher interest rates make the United Kingdom a more attractive place for global investors to invest their money. When inflation falls too much it is a sign that economic growth is slowing down. In this scenario, the Bank of England will consider lowering interest rates to reduce credit, so that companies will borrow more to invest in projects that generate growth.

Published data measure the health of the economy and can affect the value of sterling pound. Indicators such as GDP, manufacturing and services PMI and employment can influence the direction of the sterling pound.

Another important fact that is published and affects the pound sterling is the commercial balance. This indicator measures the difference between what a country earns with its exports and what you spend on imports during a given period. If a country produces highly demanded export products, its currency will benefit exclusively from the additional demand created by foreign buyers seeking to buy those goods. Therefore, a positive net trade balance strengthens a currency and vice versa in the case of a negative balance

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.