- GBP/JPY hit a new high above 184.00.

- A favorable technical setup, including the position of the Ichimoku (Kumo) cloud and a Tenkan-Sen/Kijun-Sen crossover, supports a bullish outlook.

- If the GBP/JPY pair turns back below 183.00, it could see an accelerated retracement towards the technical support of 182.32 and 182.00, with the top of the Kumo and Kijun-Sen as further support levels.

The British Pound (GBP) extended its gains against the Japanese Yen (JPY) on Thursday as the latter weakened on slowing inflation in the United States (US), though it sparked a rally in the pair. USD/JPY. Consequently, the GBP/JPY pair posted a new year-to-date high of 184.24. At time of writing, GBP/JPY is trading at 183.44, up 0.34%.

GBP/JPY Price Analysis: Technical Perspective

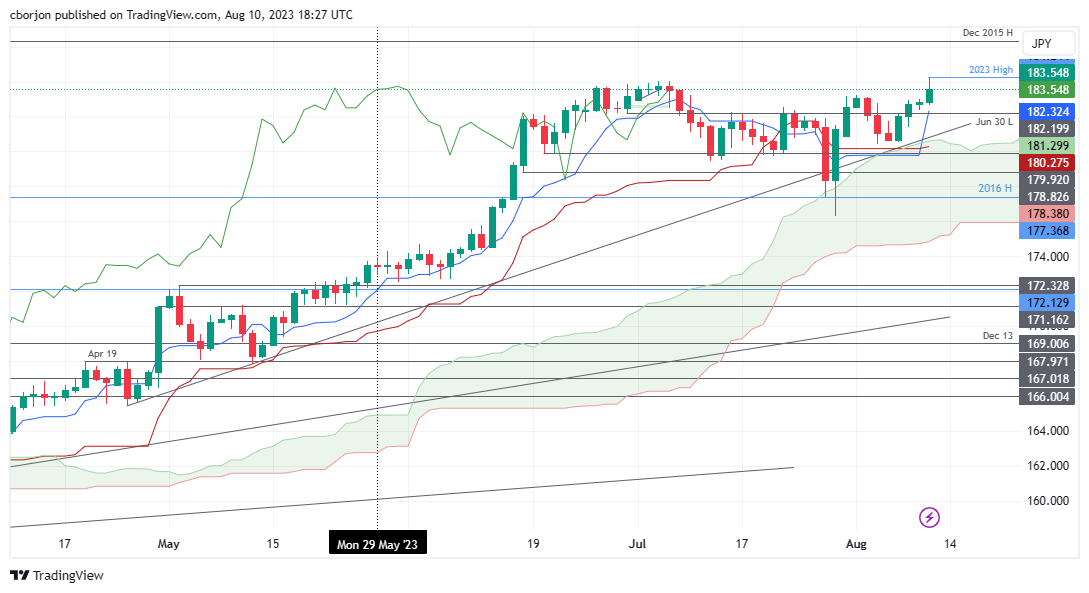

The GBP/JPY pair resumed its bullish trend, despite falling towards the 183.40 zone at the time of writing, supported by several factors. The Ichimoku (Kumo) cloud remains below price action, while the Tenkan-Sen cross above the Kijun-Sen, opening the door for further gains, as seen during the session on Thursday.

For GBP/JPY to extend its uptrend towards the 185.00 figure, buyers need to recapture 184.00, followed by the 184.24 high. Conversely, if GBP/JPY continues to fall and breaks below 183.00, the pullback could deepen. Therefore, the first support for GBP/JPY would be the Tenkan-Sen at 182.32, followed by trend line support around 182.00. A break below would expose the top of the Kumo at 180.60/75, followed by the Kijun-Sen at 180.27.

GBP/JPY Price Action – Daily Chart

GBP/JPY

| Overview | |

|---|---|

| Last price today | 183.52 |

| Today Change Daily | 0.71 |

| today’s daily variation | 0.39 |

| today’s daily opening | 182.81 |

| Trends | |

|---|---|

| daily SMA20 | 181.55 |

| daily SMA50 | 180.47 |

| daily SMA100 | 174.22 |

| daily SMA200 | 168.43 |

| levels | |

|---|---|

| previous daily high | 183.02 |

| previous daily low | 182.37 |

| Previous Weekly High | 183.25 |

| previous weekly low | 180.46 |

| Previous Monthly High | 184.02 |

| Previous monthly minimum | 176.32 |

| Fibonacci daily 38.2 | 182.77 |

| Fibonacci 61.8% daily | 182.62 |

| Daily Pivot Point S1 | 182.44 |

| Daily Pivot Point S2 | 182.08 |

| Daily Pivot Point S3 | 181.79 |

| Daily Pivot Point R1 | 183.1 |

| Daily Pivot Point R2 | 183.39 |

| Daily Pivot Point R3 | 183.75 |

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.