- GBP/JPY rebounds from the daily low, but is still trading in the red by 0.31%.

- The bulls would regain control once they reclaim 186.00.

- The bears would regain control if GBP/JPY falls below 185.00.

GBP/JPY regained some ground but is still trading down 0.31% late in the North American session on risk-off momentum as investors sharply reduced bets that the US Federal Reserve The US would cut rates as aggressively as traders expected. The pair is trading at 185.86 after reaching a daily high of 186.54.

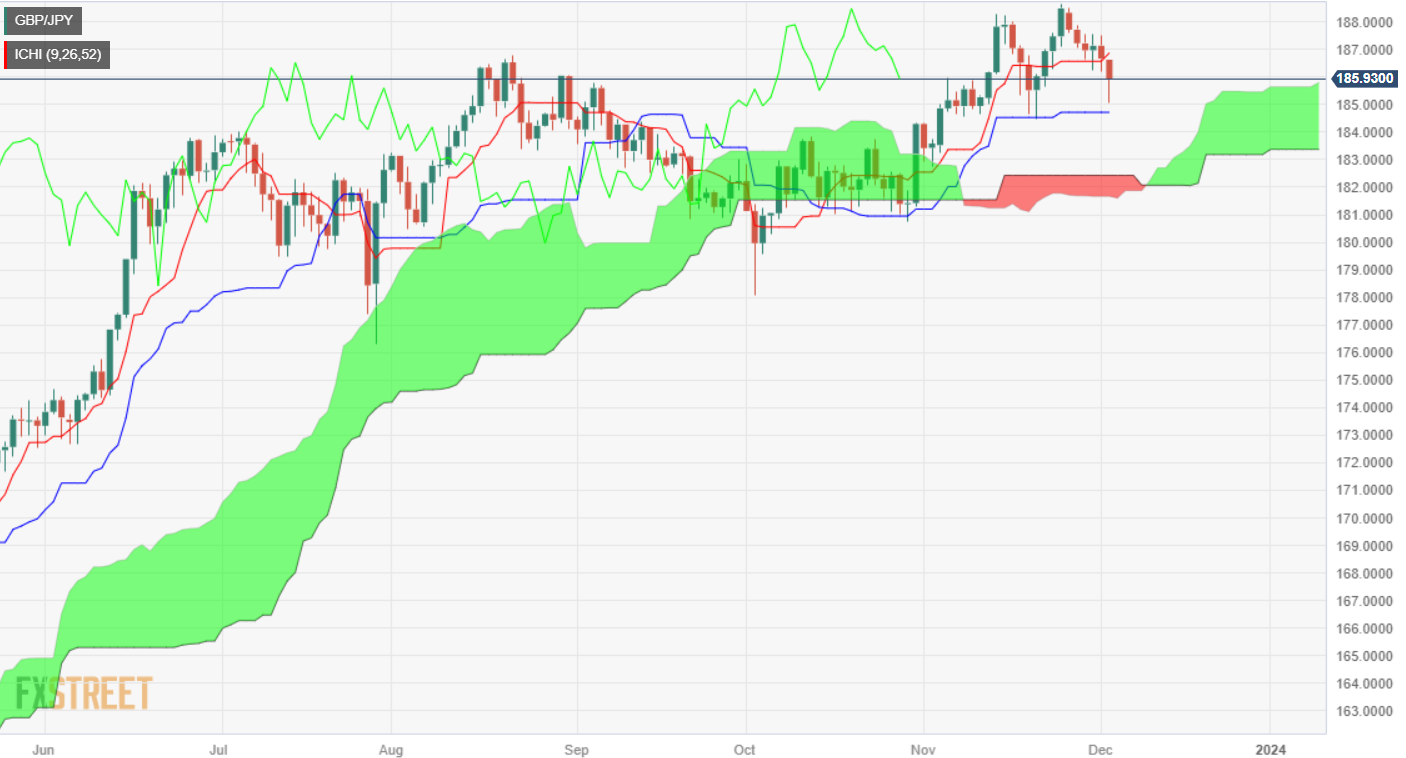

The pair posted a nine-day low of 185.08 before bouncing off those lows, but is hovering around the 185.80 area. That said, Monday’s price action is forming a hammer, implying that GBP/JPY could retest higher prices. The first resistance would be the 186.00 area, followed by the Tenkan-Sen at 186.86. Once overcome, the next resistance would be 187.00.

On the other hand, a bearish resumption could occur if GBP/JPY sellers drag prices below 185.00. That would pave the way to test the Kijun-Sen at 184.71, followed by a support trend line around 184.25/35, before falling to the 184.00 area.

GBP/JPY Price Analysis – Technical Outlook

GBP/JPY Technical Levels

GBP/JPY

| Panorama | |

|---|---|

| Today’s Latest Price | 185.96 |

| Today’s Daily Change | -0.71 |

| Today’s Daily Change % | -0.38 |

| Today’s Daily Opening | 186.67 |

| Trends | |

|---|---|

| 20 Daily SMA | 186.57 |

| SMA of 50 Daily | 183.98 |

| SMA of 100 Daily | 183.62 |

| SMA of 200 Daily | 177.2 |

| Levels | |

|---|---|

| Previous Daily High | 187.52 |

| Previous Daily Low | 186.2 |

| Previous Weekly High | 188.53 |

| Previous Weekly Low | 186.2 |

| Previous Monthly High | 188.67 |

| Previous Monthly Low | 182.75 |

| Daily Fibonacci 38.2% | 186.7 |

| Daily Fibonacci 61.8% | 187.02 |

| Daily Pivot Point S1 | 186.07 |

| Daily Pivot Point S2 | 185.47 |

| Daily Pivot Point S3 | 184.74 |

| Daily Pivot Point R1 | 187.4 |

| Daily Pivot Point R2 | 188.12 |

| Daily Pivot Point R3 | 188.72 |

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.