- The GBP/JPY pair stabilizes while buyers try to break the key resistance in 196.00-197.00.

- GBP/JPY remains in a bullish structure, backed by 50 and 200 days mobile socks, as well as by the ascending impulse.

- Failure in overcoming long -term resistance could trigger a setback around 194.00.

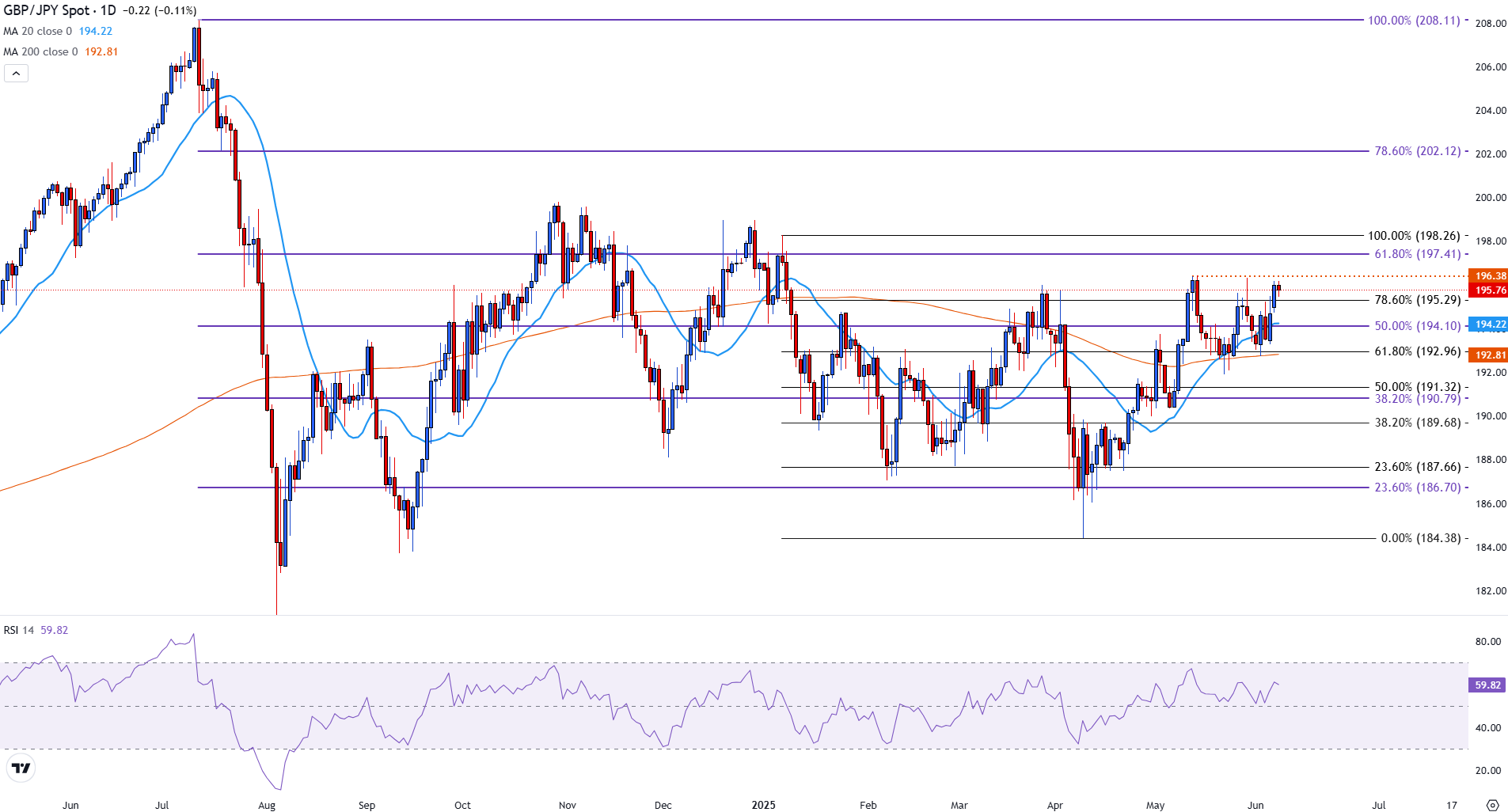

The sterling pound (GBP) remains close to maximum of several months in front of the Japanese Yen (JPY) on Monday, with the GBP/JPY torque near testing a key fibonacci resistance zone. After playing background at the end of August 2024 about 180.09, the PAR has been constantly recovered, and the recent price action suggests that buyers are trying to break over 197.00, the critical level of fibonacci setback of 61.8% of the decline in July-August of 2023.

The strong decline that occurred between the beginning of July and the end of August of last year saw the GBP/JPy fall from a maximum of 208.11 to a minimum of 180.09. Since then, the recovery has been methodical, finding resistance and support at several key levels. More markedly, the level of 50.0% in 194.10 offered temporary resistance in April and May before the bulls achieved a firm closure above it in early June.

At the time of writing, the PAR is quoted by about 195.77, just below the 61.8% recoil level in 197.41. A decisive daily closure above this area would mark an important technical rupture, diverting attention to the 78.6% setback in 202.12, a level that was not seen since August 2024. downward, the simple mobile average (SMA) of 20 days in 194.23 offers dynamic support, with the 50.0% Fibonacci area (194.10) also providing structural backing for the tendency current.

Impulse indicators support the bullish inclination. The relative force index (RSI) in the daily graph is in ascending trend and is currently 59.89, well above the neutral but not yet in overcompra territory. This suggests that there is still a margin for greater rise before the impulse is stretched.

However, traders must remain alert to signs of divergence or sudden reversals of the RSI, especially as the price approaches the higher resistance.

The bulls will seek a sustained breakdown above 197.41 to extend the current upward trend. If that happens, the next resistance is about 202.12, followed by the maximum of 208.11. On the other hand, failure to break the 61.8% barrier could trigger a setback towards the 50.0% setback and the 20 -day SMA, with an additional support seen at the level of 38.2%, around 190.79.

GBP/JPY DAILY GRAPH

GBP/JPY remains in a bullish structure, backed by simple mobile socks (SMA) of 50 and 200 days and the ascending impulse. A clean rupture above 197.41 would validate recovery and could prepare the stage for a new test of the psychological level of 200.00. However, caution is required near this resistance zone, since market volatility could increase if a benefit takes.

And in Japanese faqs

The Japanese Yen (JPY) is one of the most negotiated currencies in the world. Its value is determined in general by the march of the Japanese economy, but more specifically by the policy of the Bank of Japan, the differential between the yields of the Japanese and American bonds or the feeling of risk among the operators, among other factors.

One of the mandates of the Bank of Japan is the currency control, so its movements are key to the YEN. The BOJ has intervened directly in the currency markets sometimes, generally to lower the value of YEN, although it abstains often due to the political concerns of its main commercial partners. The current ultralaxy monetary policy of the BOJ, based on mass stimuli to the economy, has caused the depreciation of the Yen in front of its main monetary peers. This process has been more recently exacerbated due to a growing divergence of policies between the Bank of Japan and other main central banks, which have chosen to abruptly increase interest rates to fight against inflation levels of decades.

The position of the Bank of Japan to maintain an ultralaxa monetary policy has caused an increase in political divergence with other central banks, particularly with the US Federal Reserve. This favors the expansion of the differential between the American and Japanese bonds to 10 years, which favors the dollar against Yen.

The Japanese Yen is usually considered a safe shelter investment. This means that in times of tension in markets, investors are more likely to put their money in the Japanese currency due to their supposed reliability and stability. In turbulent times, the Yen is likely to be revalued in front of other currencies in which it is considered more risky to invest.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.