- The GBP/USD reaches a weekly maximum in 1,3626 while the high fire between Israel and Iran is broken.

- Powell says that rates cuts can wait; Tariffs can increase inflation and weigh on the activity.

- Light United Kingdom data; Ramsden of BOE points out the weakness of the labor market as MPC speeches approach.

The sterling pound extended its profits against the US dollar on Tuesday, since the high fire between Israel and Iran was violated by both parties, despite the warning of US President Donald Trump. However, the appetite for the risk remains strong, despite the ongoing developments in the Middle East. The GBP/USD quotes above 1,3600, winning more than 0.65%, after reaching a weekly maximum of 1,3626.

The sterling pound rises more than 0.65% while the markets remain at risk mode despite the outbreak in the Middle East and the resistance of the Fed to relaxation in July

Apart from the geopolitical risks, the president of the FED, Jerome Powell, said in statements prepared for his testimony at the US Congress that the feat cuts can expect, since the Central Bank studies the impact of tariffs on the economy. He said that “tariffs this year will probably increase prices and weigh on economic activity”, adding that the impact could be ephemeral or persistent.

He opposed a position previously Dovish from the governors of the FED, Christopher Waller and Michelle Bowman. Last year, they were two of the most Hawkish members, who, until now, had supported a feat of rates at the July meeting.

Recently, the president of Cleveland’s Fed, Beth Hammack, a Hawk, revealed that feat cuts could be “waiting for a long time.” She reiterated the previous words of the president of the Fed of Atlanta, Raphael Bostic, who said there is no need to cut rates now and acknowledged that only sees a 25 basic points cut (BPS) this year.

The US housing data showed that housing prices increased by 2.7% compared to the previous year in April. On the other side of the Atlantic, the United Kingdom’s economic agenda was light, with the publication of the CBI industrial trends survey that revealed that manufacturing production volumes fell into the quarter until June, from -25 to -23. The survey showed that “manufacturers expect production volumes to decrease at a slower pace in the three months until June.”

The governor of the Bank of England, Dave Ramsden, said that “the cumulative evidence of a material loosening in the labor market” influenced his decision at the last meeting of the BOE. He said that weakness in the labor market is capturing his attention.

Looking ahead, the operators will be attentive to the testimony of the president of the FED, Jerome Powell, in the US House of Representatives.

On Wednesday, the United Kingdom Agenda will have speeches from members of the Monetary Policy Committee (MPC) of the Bank of England. In the US, the president of the FED, Powell, will appear in the US Senate.

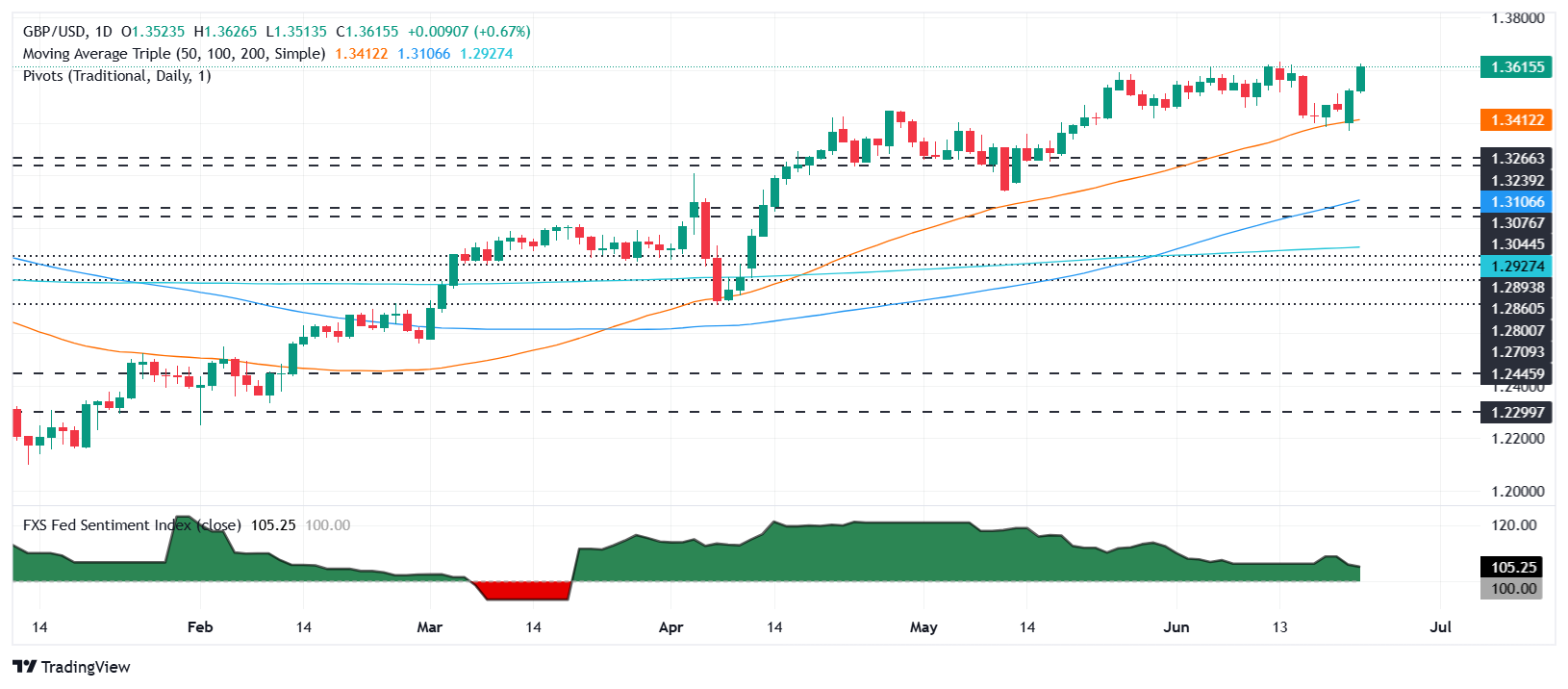

GBP/USD price forecast: Technical Perspectives

The GBP/USD maintains a bullish trend, after briefly dive into the 50 -day SMA in 1,3407. Since then, the pair has risen and seems to be ready to break decisively above the 1,3600 figure.

The momentum remains bullish, as indicated by the relative force index (RSI). However, operators must be aware that geopolitical risks are present. Therefore, an escalation of the conflict in the Middle East could pave the way for a setback.

If the GBP/USD weakens, the first support is seen in 1,3550, followed

LIBRA ESTERLINA PRICE THIS WEEK

The lower table shows the percentage of sterling pound (GBP) compared to the main currencies this week. Libra sterling was the strongest currency against the US dollar.

| USD | EUR | GBP | JPY | CAD | Aud | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -1.22% | -1.53% | -1.32% | -0.36% | -1.09% | -1.24% | -1.31% | |

| EUR | 1.22% | -0.33% | -0.07% | 0.88% | 0.10% | 0.00% | -0.13% | |

| GBP | 1.53% | 0.33% | 0.32% | 1.21% | 0.44% | 0.32% | 0.20% | |

| JPY | 1.32% | 0.07% | -0.32% | 0.95% | 0.20% | 0.13% | -0.08% | |

| CAD | 0.36% | -0.88% | -1.21% | -0.95% | -0.69% | -0.89% | -1.00% | |

| Aud | 1.09% | -0.10% | -0.44% | -0.20% | 0.69% | -0.13% | -0.24% | |

| NZD | 1.24% | -0.00% | -0.32% | -0.13% | 0.89% | 0.13% | -0.11% | |

| CHF | 1.31% | 0.13% | -0.20% | 0.08% | 1.00% | 0.24% | 0.11% |

The heat map shows the percentage changes of the main currencies. The base currency is selected from the left column, while the contribution currency is selected in the upper row. For example, if you choose the sterling pound from the left column and move along the horizontal line to the US dollar, the percentage change shown in the box will represent the GBP (base)/USD (quotation).

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.