- GBP/USD remains in bullish territory as the US dollar pulls away from new bull cycle highs.

- GBP/USD bulls are sitting in a key support zone on the short- and long-term charts.

The GBP/USD remains in bullish territory above 1.1500 after rebounding from the day’s low of 1.1443, around a two-and-a-half year low, reaching as high as test 1.1520 in late trading. The US dollar is the engine of the currency space, but domestically, the main feature of the week has been Liz Truss becoming Britain’s next Prime Minister after winning the race for the leadership of the ruling Conservative Party. .

Truss will take office and appoint her cabinet on Tuesday, and markets will be watching for any leaks on her fiscal plans. He has already pledged not to raise taxes or ration energy and has specifically ruled out any extraordinary taxes on energy companies.

Reports suggest that Truss is preparing an emergency mini-budget in her first month as Prime Minister and it remains to be seen whether she will follow through on promises to immediately cut taxes in an effort to revive the economy. British government bonds suffered their biggest monthly losses in decades in August, due to inflation fears, but also to Truss’s planned tax cuts and her proposals to stimulate the economy with fiscal spending.

Meanwhile, on Wednesday, Bank of England Governor Andrew Bailey and three members of the Monetary Policy Committee will face MPs for questioning on the outlook for inflation and interest rates. This will be the last we hear of them before the September Bank of England meeting, so traders will be on the lookout for any indication that the Monetary Policy Committee’s decision is tipped towards a 50 or 75 point hike. basics.

Governor Bailey, Chief Economist Pill and Monetary Policy Committee members Mann and Tenreyro will testify. Of course, they will be heavily criticized for allowing inflation to rise so much above target,” analysts at Brown Brothers Harriman said. Expectations for tightening continue to rise as the WIRP suggests almost a 70% chance of a rise to 75 basis points up to 2.5% on September 15″. Looking ahead, the swap market is pricing in 275 basis points of adjustment over the next 12 months, which would see the policy rate peaking at 4.5%, up from 4.0% two weeks ago.”

US dollar fades through the psychological level of 110

The US dollar, as measured by the DXY index, rose as high as 110,271 on Monday, helped by the euro’s slump due to the Russian gas shutdown and the Chinese yuan’s slump amid a resurgence of COVID-19 infections across the country. the country. Adding to the risk aversion spurs, the USD continued to be buoyed by recent remarks by Fed Chairman Jerome Powell at the Jackson Hole Symposium in Wyoming that rates would need to be high ” for some time” to combat stubbornly high inflation. However, the dollar has faded from the highs, which has given some relief to the currency space, including the pound. At the time of writing, the DXY is trading at 109.779 and recently crashed to 109.534.

For the week ahead, the highlight will be the ISM Services PMI for August on Tuesday. The headline data is expected to come in at 55.4 versus 56.7 in July. Traders will take note of the employment and prices paid data, which came in at 49.1 and 72.3 in July, respectively. Fed speakers will also be key. Chairman Powell, Vice Chairman Brainard and Governor Waller will appear in public to discuss the economic outlook and the markets will expect them to build on Powell’s comments at Jackson Hole.

They will stress that inflation is still too high and that bringing it down is the number 1 priority, which requires further rate hikes, as well as keeping the policy rate high for “some time” once the cap is reached. TD Securities analysts.

GBP/USD technical analysis

According to the start of the day analysis, GBP/USD Price Analysis: Bulls have moved in but there could be more of the US dollar, bulls have moved in and we saw more of the US dollar.

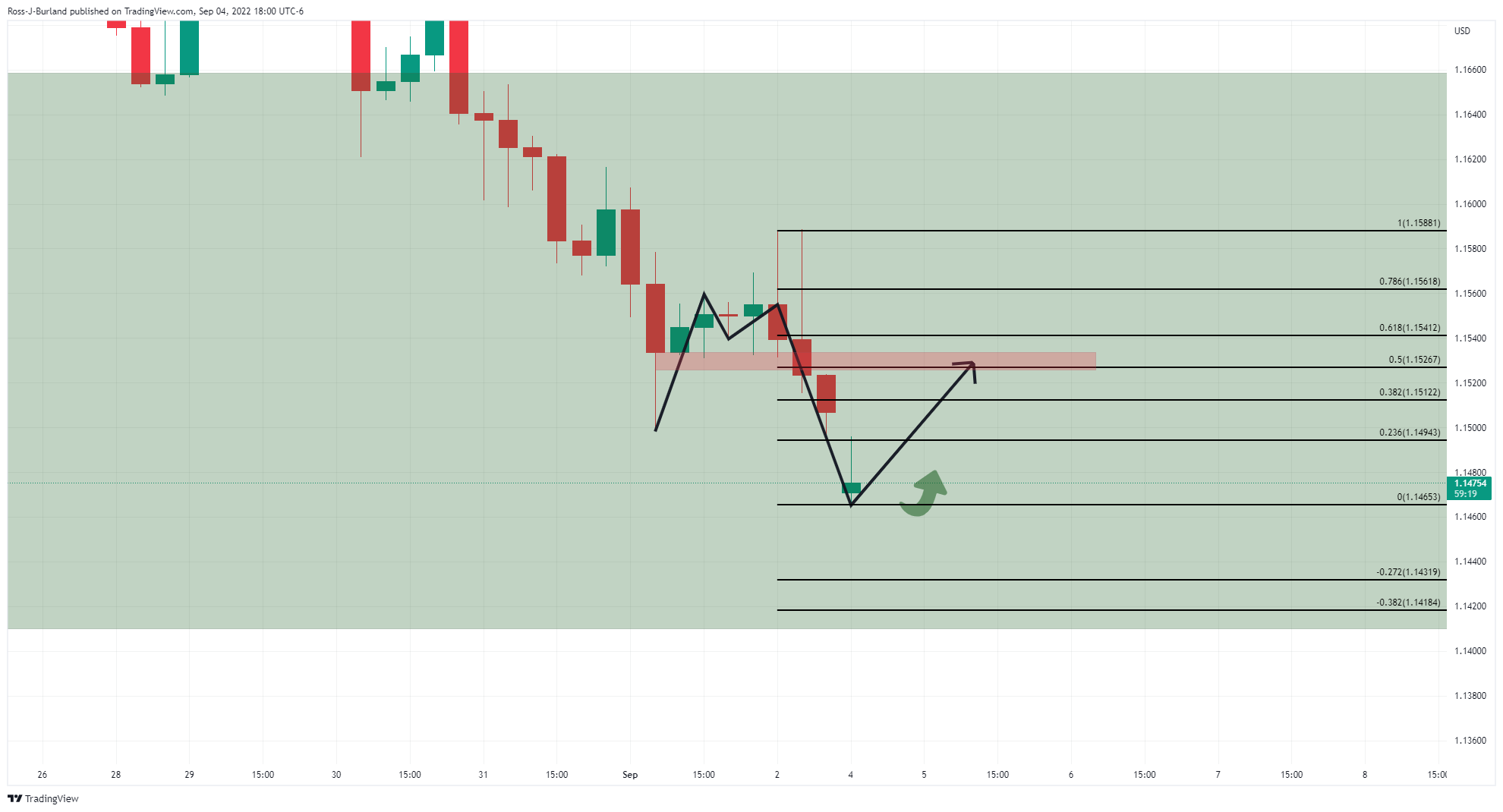

GBP/USD H4 chart, previous analysis

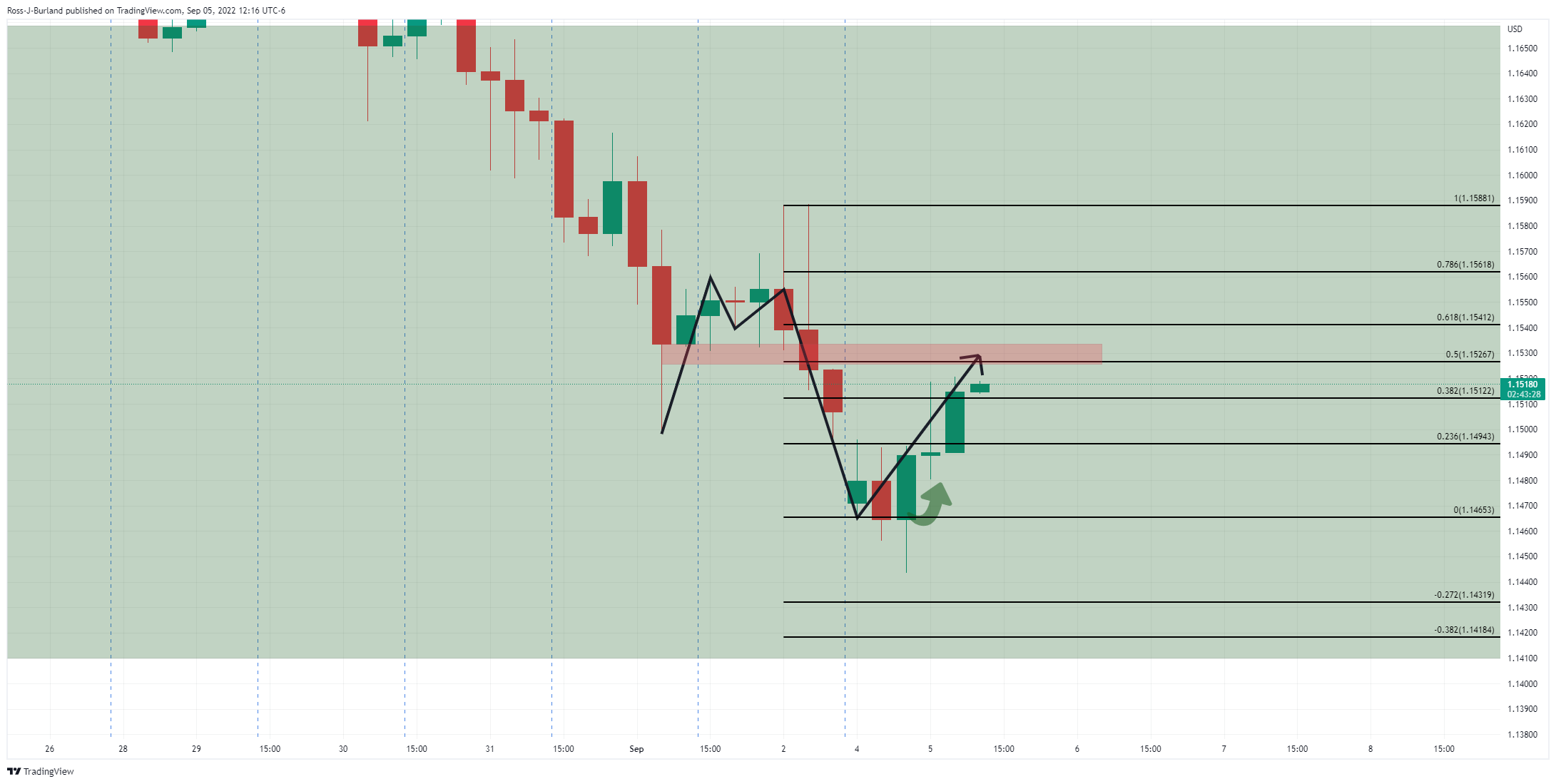

GBP/USD, update

The price made new lows, but the bulls held there and have subsequently come closer to the 50% mean reversal target, as previous analysis had predicted. At this juncture, the bulls will need to hold above 1.1490 or face the prospect of a move to the lowest levels since 1985 below 1.1413:

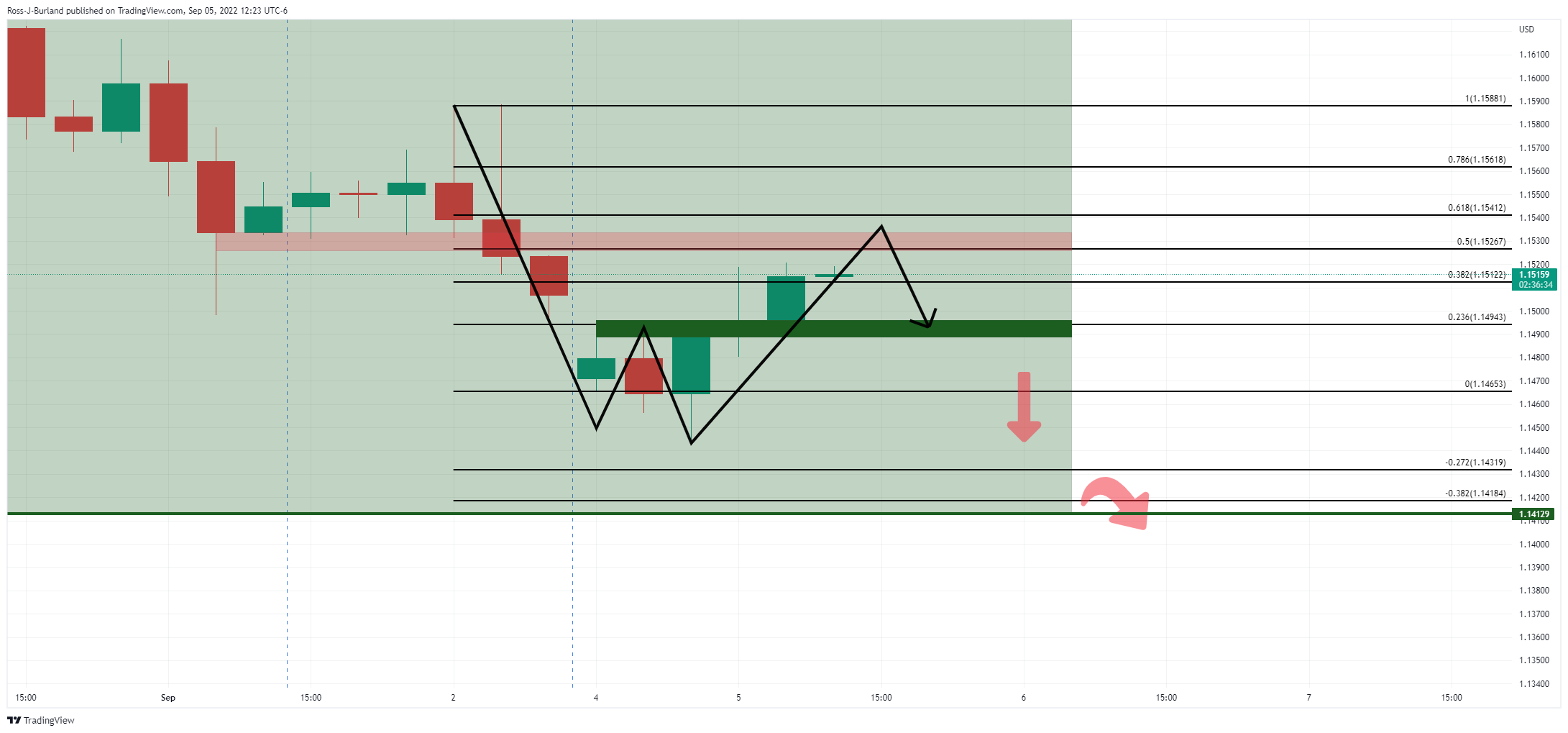

GBP/USD monthly charts

On the other hand, if the bulls hold their course, the bullish outlook is for a major pullback:

Source: Fx Street

With 6 years of experience, I bring to the table captivating and informative writing in the world news category. My expertise covers a range of industries, including tourism, technology, forex and stocks. From brief social media posts to in-depth articles, I am dedicated to creating compelling content for various platforms.