- US Non-Manufacturing PMI data beats expectations, fueling speculation of a possible Fed rate hike in November.

- The odds of the Bank of England raising interest rates in September are 84%, which would put the bank rate at 5.50%.

- Boston Fed President Susan Collins urges patience in monetary policy decisions, stressing the Fed’s commitment to a 2% inflation target.

The British Pound (GBP) continues its free fall against the US Dollar (USD), after official comments from the Bank of England (BoE) suggested that the central bank is about to hit its interest rate caps. This, and data from the United States (US) showing a rebound in business activity, raise expectations of a rate hike by the Federal Reserve. GBP/USD is trading at 1.2502 after reaching a daily high of 1.2588.

Comments by BoE Governor Andrew Bailey signaling a rate hike weighed on the GBP; US non-manufacturing PMI beats forecasts

BoE Governor Andrew Bailey’s appearance in Parliament’s Treasury committee weighed on the pound, which will end the week with solid losses. In his appearance, Bailey said the BoE is near the top of the interest rate hike cycle, adding that inflation is indeed coming down, but could inflation expectations come down as well?

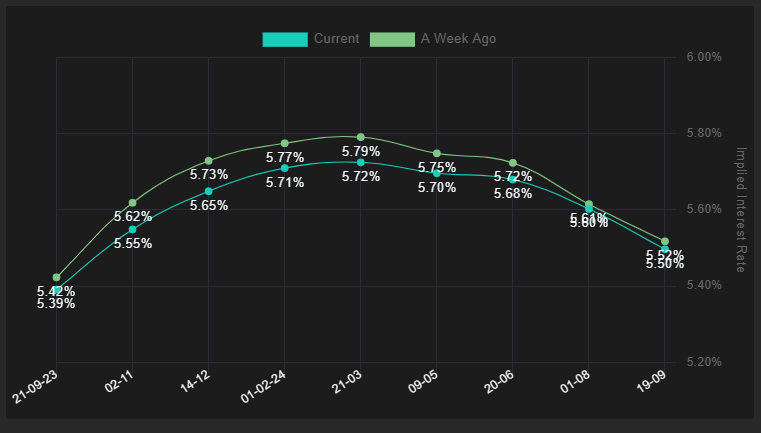

The BoE has raised rates 14 times since December 2021 and would do so by 25 basis points in September, which would put the bank rate at 5.50%, interest rate probabilities show, with a probability of 84%, as the following image shows. The BoE is expected to rise in early 2024, with markets seeing the bank rate around 5.71%.

Bank of England Interest Rate Expectations

Source: Financial Source

Recently, BoE policymakers made similar comments, but stressed that rates are unlikely to fall quickly due to high inflation. Meanwhile, John Cunliffe said the job market was cooling “quite slowly”, adding that upward pressure on wages was now “crystallising”, and that future decisions would be “finely balanced”. Swati Dhingra stood by her dovish stance, saying the rates are restrictive enough and can threaten economic growth.

In the United States (US), the rebound in business activity, mainly in the services sector, as revealed by the US Non-Manufacturing PMI, prompted a reassessment of monetary policy by the US Federal Reserve. The futures market shows probabilities of 25 basis points for November around 47%.

The Federal Reserve recently released its Beige Book, which showed modest economic growth and slowing inflation across most of the country.

Boston Fed President Susan Collins said the US central bank must be patient in deciding the path of monetary policy, while underscoring the central bank’s commitment to control inflation until its target of 2 %. She added that Fed officials are debating whether the current level of rates is tight enough or whether more is needed.

GBP/USD Price Analysis: Technical Perspective

As the pair hit a daily low of 1.2481, buyers reclaimed the 1.2500 figure, bearish pressures remain. The break of a bullish support trend line drawn around the late-May lows accelerated GBP/USD’s decline, calling into question the uptrend. If the major pair achieves a daily close below 1.2500, the 200-day moving average (DMA) at 1.2422 could come into play, followed by the May 25 swing low at 1.2308.

GBP/USD

| Overview | |

|---|---|

| Last price today | 1.2506 |

| daily change today | -0.0058 |

| today’s daily variation | -0.46 |

| today’s daily opening | 1.2564 |

| Trends | |

|---|---|

| daily SMA20 | 1.2675 |

| daily SMA50 | 1.2771 |

| daily SMA100 | 1.2654 |

| daily SMA200 | 1.2422 |

| levels | |

|---|---|

| previous daily high | 1.2632 |

| previous daily low | 1.2528 |

| Previous Weekly High | 1.2746 |

| previous weekly low | 1.2563 |

| Previous Monthly High | 1.2841 |

| Previous monthly minimum | 1.2548 |

| Fibonacci daily 38.2 | 1.2568 |

| Fibonacci 61.8% daily | 1.2592 |

| Daily Pivot Point S1 | 1.2518 |

| Daily Pivot Point S2 | 1.2471 |

| Daily Pivot Point S3 | 1.2414 |

| Daily Pivot Point R1 | 1.2621 |

| Daily Pivot Point R2 | 1.2678 |

| Daily Pivot Point R3 | 1.2725 |

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.