- GBP/USD goes up while the US dollar falls after the WSJ report that suggests that Trump could name Powell’s replacement for October.

- The dollar weakens while the succession of the Fed adds confusion; US GDP from Q1 reviewed at -0.5% intertrimestral.

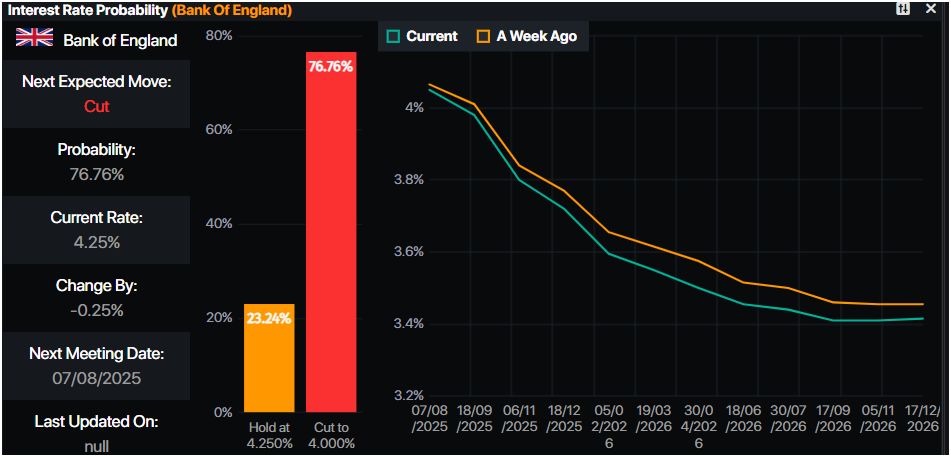

- The governor of the BOE, Bailey, favors a gradual relief; Markets discount a 76% probability of rate cut in August.

The Esterlina pound advances towards maximum of almost four years against the US dollar on Thursday, since the last minute news revealed by the Wall Street Journal (WSJ) suggests that US president, Donald Trump, could appoint Jerome Powell’s successor as president of the Federal Reserve in October and September. At the time of writing, the GBP/USD quotes at 1,3746, with an increase of 0.61%.

The pound is triggered at 1,3742 while the uncertainty about the leadership of the Fed shakes the markets despite mixed data from the US and a dovish tone of the BOE

The possible replacements for the president of the FED, Powell, according to the article, include former Fed governor, Kevin Warsh, the director of the National Economic Council, Kevin Hasset, and the Secretary of the Treasury, Scott Batsent.

The news dragged the dollar down, since this would create confusion among investors, who would have to monitor Powell’s comments, along with the next Fed president.

Meanwhile, the president of the FED, Powell, revealed to the US Congress that the Central Bank remains in a waiting mode, while the Board evaluates the impact of tariffs on inflation. He said that if it is a specific increase, then they could begin to reduce interest rates.

The data in the US revealed that the initial applications of unemployment subsidy for the week that ended on June 21 were 236,000, below the estimates and of the previous figure of 245,000, according to the US Department of Labor Department of Labor of the USA.

At the same time, the requests for durable goods in the US were fired in May, driven by the increase in commercial aircraft reserves, as revealed by the US Department of Commerce. Orders in May increased 16.4%, almost doubleing estimates of 8.5%, after the contraction of April -6.6%.

Other data revealed that the US economy in Q1 of 2025 contracted more than previously reported, -0.2%, as expected. The GDP contracted -0.5% intertrmetral, revealed the US Economic Analysis Office (BEA).

On the other side of the Atlantic, the United Kingdom’s economic agenda is light, with Governor Andrew Bailey crossing the news. He said that a gradual and careful approach to the additional withdrawal of the restriction of monetary policy remains appropriate. Interest rates will probably continue on a gradual descending path, and said that “monetary policy needs to remain restrictive for a long enough time until the risks of inflation return sustainably to the objective of 2% in the medium term have been further dissipated.”

Market participants see 76% probability of a rate cut by the BOE in August.

Fountain: Prime Market Terminal

Meanwhile, Nick Rees, head of Macro Research in Monex, projects that the cable will depreciate in the future. He noticed, “I think that once things calm down and markets have a little more time to focus on the fiscal situation of the United Kingdom, I think there is a great, great downward risk that is accumulating for the pound that could begin to manifest.”

GBP/USD price forecast: technical perspective

The GBP/USD still has a bullish bias, having exceeded the maximum of 2022 of 1,3749, with an additional upward potential. The impulse, measured by the relative force index (RSI), suggests that the trend could continue, since buyers are gaining impulse.

The next area of interest would be 1,3800. On the contrary, if the GBP/USD falls below 1,3750, the first support level would be 1,3700, followed by the minimum daily of June 26, 1,3651.

LIBRA ESTERLINA PRICE THIS WEEK

The lower table shows the percentage of sterling pound (GBP) compared to the main currencies this week. Libra sterling was the strongest currency against the US dollar.

| USD | EUR | GBP | JPY | CAD | Aud | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -2.18% | -2.46% | -1.67% | -0.93% | -1.90% | -1.96% | -2.20% | |

| EUR | 2.18% | -0.32% | 0.56% | 1.28% | 0.24% | 0.24% | -0.06% | |

| GBP | 2.46% | 0.32% | 0.93% | 1.61% | 0.57% | 0.55% | 0.25% | |

| JPY | 1.67% | -0.56% | -0.93% | 0.72% | -0.27% | -0.24% | -0.64% | |

| CAD | 0.93% | -1.28% | -1.61% | -0.72% | -0.93% | -1.04% | -1.33% | |

| Aud | 1.90% | -0.24% | -0.57% | 0.27% | 0.93% | -0.03% | -0.31% | |

| NZD | 1.96% | -0.24% | -0.55% | 0.24% | 1.04% | 0.03% | -0.29% | |

| CHF | 2.20% | 0.06% | -0.25% | 0.64% | 1.33% | 0.31% | 0.29% |

The heat map shows the percentage changes of the main currencies. The base currency is selected from the left column, while the contribution currency is selected in the upper row. For example, if you choose the sterling pound from the left column and move along the horizontal line to the US dollar, the percentage change shown in the box will represent the GBP (base)/USD (quotation).

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.