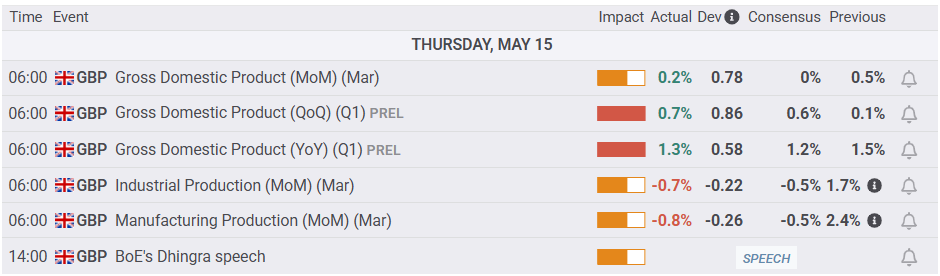

- The United Kingdom GDP grows 0.7% in the Q1 compared to 0.6% expected, relieving the pressure for boe rate cuts and raising the pound sterling.

- The US PPI. In April, it falls by -0.5% intermensual, nucleus -0.4%; Retail sales barely increase, pointing out a deceleration demand.

- Traders observe the next US housing data and the UOM feeling survey; The United Kingdom calendar remains light.

The sterling pound extended its profits against the US dollar, driven by a positive reading of economic growth in the United Kingdom and softer data than expected in the US, which fed the speculation of a slower economic panorama. At the time of writing, the GBP/USD quotes at 1,3293, rising 0.31%.

The GBP/USD goes up while the United Kingdom’s economy publishes a stronger growth than expected, while US inflation and sales data of US disappoint

The US economic data published above suggested that the deflationary process continues as the economy cools. The US Producer Price Index (PPI) in April decreased an intermencing 0.5%, below the estimated expansion of 0.2%. Excluding volatile elements, the PPI fell 0.4% intermensual, below the forecasts of a 0.3% increase.

Other data showed that retail sales disappointed investors, increasing 0.1% month by month (intermennsual), above the forecasts of an increase of 0.0%. Initial unemployment applications for the week that ended on May 10 increased by 229,000, as expected, without changes compared to the previous week.

On the other side of the Atlantic, the figures of the Gross Domestic Product (GDP) suggested that the economy is stronger than expected, exerting pressure on the Bank of England (BOE) to maintain interest rates without changes. In the 3 months until March, GDP increased 0.7%, from 0.1% in the previous reading, exceeding the growth of 0.6% planned by economists and the BOE.

Fountain: FXSTERET

Despite publishing solid figures, the commercial policies of US President Donald Trump and high labor taxes in the United Kingdom could weigh on economic perspectives. The British finance minister, Rachel Reeves, commented that winds are coming against economics and emphasized the importance of government commercial agreements with the US and India.

Facing this week, the United Kingdom’s economic agenda is absent. On the other side of the Atlantic, the traders will be attentive to the housing data and the preliminary consumer’s feeling survey of the University of Michigan for May.

GBP/USD price forecast: Technical Perspectives

From a technical point of view, the GBP/USD continues to have a bullish bias; However, in the short term, a setback could be on its way. If the PAR extends its losses below 1.33 and exceeds 1,3250, the first support would be the figure of 1,3200. Once exceeded, the next support level would be the minimum daily of May 13, 1,3165.

On the contrary, if the GBP/USD rises above 1,3359, the maximum of May 14, the following resistance would be the maximum of May 6 in 1,3402.

LIBRA ESTERLINA PRICE THIS WEEK

The lower table shows the percentage of sterling pound (GBP) compared to the main currencies this week. Libra sterling was the strongest currency against the New Zealand dollar.

| USD | EUR | GBP | JPY | CAD | Aud | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.63% | 0.13% | -0.41% | 0.62% | 0.17% | 0.88% | 0.24% | |

| EUR | -0.63% | -0.37% | -0.49% | 0.48% | 0.17% | 0.74% | 0.10% | |

| GBP | -0.13% | 0.37% | 0.06% | 0.85% | 0.56% | 1.04% | 0.47% | |

| JPY | 0.41% | 0.49% | -0.06% | 1.01% | -0.05% | 0.43% | 0.41% | |

| CAD | -0.62% | -0.48% | -0.85% | -1.01% | -0.17% | 0.26% | -0.39% | |

| Aud | -0.17% | -0.17% | -0.56% | 0.05% | 0.17% | 0.47% | -0.11% | |

| NZD | -0.88% | -0.74% | -1.04% | -0.43% | -0.26% | -0.47% | -0.67% | |

| CHF | -0.24% | -0.10% | -0.47% | -0.41% | 0.39% | 0.11% | 0.67% |

The heat map shows the percentage changes of the main currencies. The base currency is selected from the left column, while the contribution currency is selected in the upper row. For example, if you choose the sterling pound from the left column and move along the horizontal line to the US dollar, the percentage change shown in the box will represent the GBP (base)/USD (quotation).

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.