- China responds with 125% tariffs after the US tax increase to 145%; Beijing describes the measure as “a joke”.

- The feeling of the consumer in the US collapses to 50.8, while the expectations of short and long term inflation increase.

- The GDP of the United Kingdom exceeds forecasts with a growth of 0.5% in February, helping to compensate for global uncertainty and strengthen sterling pound.

The sterling pound extends its profits against the US dollar as the commercial war between the US and China intensifies, with China imposing 125% tariffs on US products. Commercial policies continue to promote price action, while economic data goes to the background. At the time of writing, the GBP/USD quotes at 1,3067, an increase of 0.77%.

GBP/USD jumps 0.77% in the middle of the deepening of the commercial war and US weak data; The surprise of the United Kingdom’s growth offers support for pound sterling

Last minute news revealed that China responded to the decision of US President Donald Trump to increase 145% tariffs on Chinese products. Beijing described the “joke” actions and said that it no longer considers them worthy of matching.

The economic agenda revealed that the feeling of the consumer in the USA was deteriorated, according to the University of Michigan. The index fell from 57.0 to 50.8 in April. Inflation expectations for one year increased from 5% to 6.7%, and for a period of five years, they increased from 4.1% to 4.4%.

The US Production Price Index (IPP) fell from 3.2% to 2.7% year -on -year in March, below 3.3% estimates. Despite this, the underlying IPP remained above the 3% threshold in 3.3% year -on -year, below 3.5% in February, and less than the forecasts of 3.6%.

Meanwhile, the speakers of the Federal Reserve crossed the lines. Neel Kashkari of Minneapolis said that the IPC report contained good news, although he reaffirmed that inflation remains high. Susan Collins of the Boston Fed said that his perspective for the year is of greater inflation and a slower growth, while Alberto Musalem of St. Louis said that inflation could increase even when the labor market is softened.

On the other side of the Atlantic, the United Kingdom’s economy grew above estimates, increasing 0.5% in February, exceeding economists’ estimates and providing some relief to Foreign Minister Rachel Reeves.

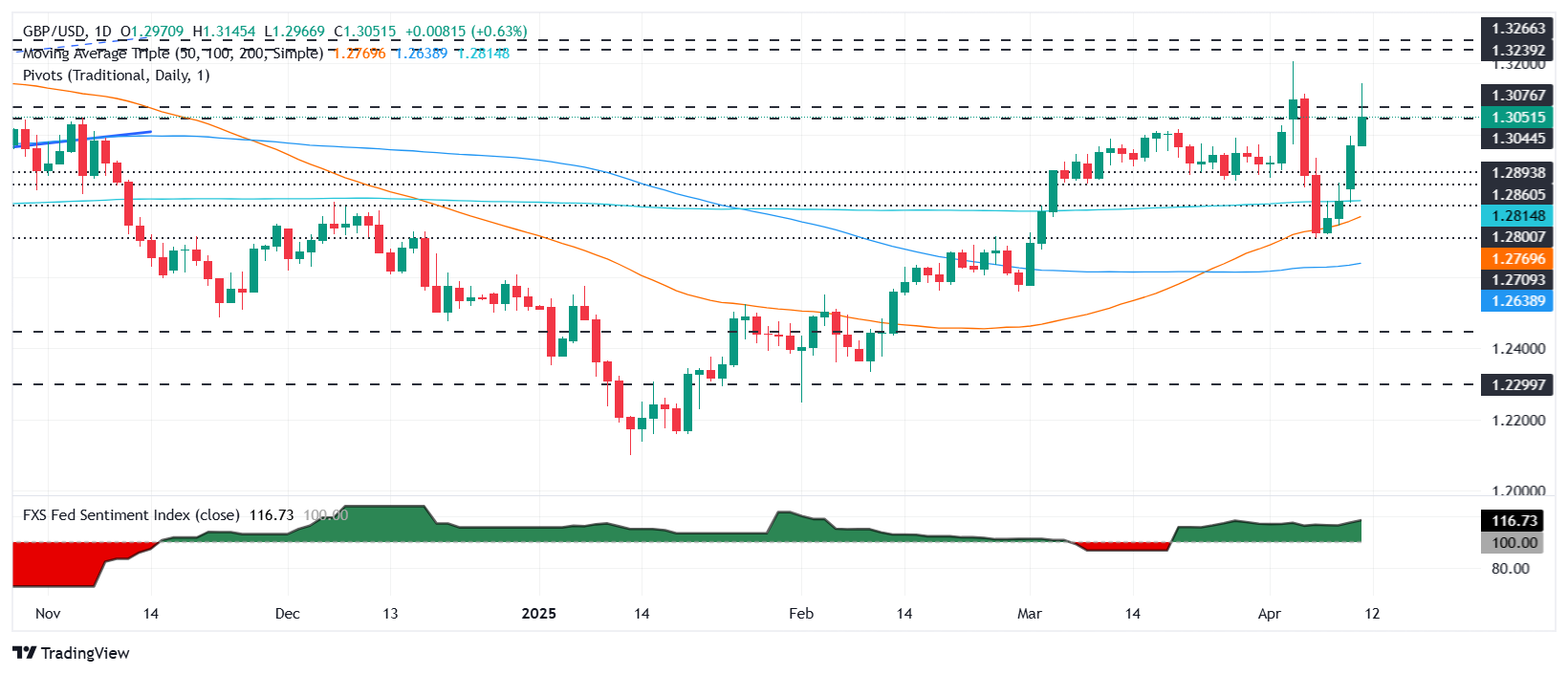

GBP/USD price forecast: technical perspective

Given the context, the uncertainty about trade keeps the GBP/USD quoting above the figure of 1.30. This opens the door to a new test of the six -month peaks reached on April 3 in 1,3207, which, once exceeded, puts the figure of 1,3300 in sight. The relative force index (RSI) shows that buyers are gaining impulse.

On the other hand, if the GBP/USD goes back below 1.30, the immediate support appears in the minimum daily of April 11, 1,2968. A rupture of this last one will present 1,2900 and the simple mobile average (SMA) of 200 days in 1,2815.

LIBRA ESTERLINA PRICE THIS WEEK

The lower table shows the percentage of sterling pound (GBP) compared to the main currencies this week. Libra sterling was the strongest currency against the US dollar.

| USD | EUR | GBP | JPY | CAD | Aud | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -3.23% | -1.27% | -1.38% | -2.44% | -3.04% | -3.57% | -4.63% | |

| EUR | 3.23% | 2.32% | 2.57% | 1.45% | 0.12% | 0.26% | -0.84% | |

| GBP | 1.27% | -2.32% | -1.05% | -0.85% | -2.12% | -2.01% | -3.09% | |

| JPY | 1.38% | -2.57% | 1.05% | -1.06% | -0.74% | -1.03% | -2.98% | |

| CAD | 2.44% | -1.45% | 0.85% | 1.06% | -0.95% | -1.15% | -2.51% | |

| Aud | 3.04% | -0.12% | 2.12% | 0.74% | 0.95% | 0.12% | -0.98% | |

| NZD | 3.57% | -0.26% | 2.01% | 1.03% | 1.15% | -0.12% | -1.10% | |

| CHF | 4.63% | 0.84% | 3.09% | 2.98% | 2.51% | 0.98% | 1.10% |

The heat map shows the percentage changes of the main currencies. The base currency is selected from the left column, while the contribution currency is selected in the upper row. For example, if you choose the sterling pound from the left column and move along the horizontal line to the US dollar, the percentage change shown in the box will represent the GBP (base)/USD (quotation).

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.