- GBP/USD is almost sideways on the day, up 0.02%.

- A gloomy environment weighs on the British pound due to the ECB rate hike and US President Joe Biden testing positive for Covid-19.

- GBP/USD Price Analysis: Heading to the Downside as Sellers Head for 1.1800.

The GBP/USD remains in positive territory, albeit under downward pressure, as the European Central Bank (ECB) joined the list of global banking authorities shifting to tighter monetary policy, offering a surprising 50-point rate hike basic to its three types, with the objective of normalizing the policy in the midst of a scenario of high inflation.

GBP/USD is trading at 1.1962 after reaching a daily high of 1.2003, but its correlation with EUR/USD dragged the pair towards the daily low below 1.1900. However, once the dust settled, the British pound held at current levels.

GBP/USD Constrained by Sentiment and Safety Flows

The risk aversion drive has kept investors flowing into safe assets. Sentiment deteriorated due to factors such as the ECB’s monetary policy decision and the US president’s Covid test, which sent US equities down between 0.22% and 0.87%. The USD is clinging to the 107,000 zone, as the dollar index shows, almost flat, while US Treasury yields are lower, reflecting safety flows.

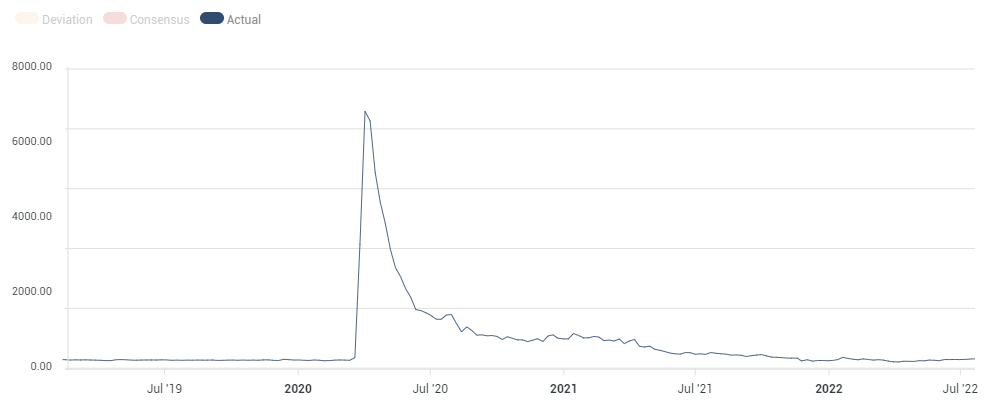

Before the open on Wall Street, the US Department of Labor reported that initial jobless claims for the week ending July 16 rose by 251,000, above an estimate of 240,000, reaching a new maximum of 8 months. At the same time, the Philadelphia Fed manufacturing index for June declined for the second month in a row, to -24.8 from -12.4. The report says that “in general, companies continued to report increases in employment, but the employment index fell 9 points to 19.4, its lowest reading since May 2021.”

US jobless claims rise above expectations

The lack of economic data out of the UK keeps GBP/USD traders weighing the words of Bank of England Governor Andrew Bailey. On Wednesday he declared that a 50 basis point rate hike in August is possible, triggering a jump in GBP/USD. However, the gloomy economic outlook for the UK will keep the pound under selling pressure, despite the BoE’s efforts to control inflation, opening the door to a stagflation scenario.

Rabobank analysts expect GBP/USD to fall towards 1.1800

“Given our forecast that dollar strength is likely to persist for around 6 months in light of risks to global growth, we see the possibility of further sharp declines in the value of the pound. We have revised down our cable target since 1.18 and we see the possibility of a drop to levels as low as 1.12 in a 1-3 month perspective.This means a more sustained break below 1.00 for EUR/USD.”

GBP/USD Price Analysis: Technical Outlook

GBP/USD continues to have a bearish bias, despite bouncing off weekly lows around 1.1860. The failure of GBP/USD buyers to break above the 20-day EMA at 1.2015 caused the pair to drop below 1.2000, extending towards the 1.1920 area. Even the Relative Strength Index (RSI), which was pointing higher at the beginning of the week, changed gears and is about to break below 40 as selling pressure mounts on the pair.

Therefore, the first GBP/USD support would be 1.1900. If it breaks below, the daily low of July 18 will be discovered at 1.1862, followed by 1.1800 and the yearly low at 1.1760.

Source: Fx Street

With 6 years of experience, I bring to the table captivating and informative writing in the world news category. My expertise covers a range of industries, including tourism, technology, forex and stocks. From brief social media posts to in-depth articles, I am dedicated to creating compelling content for various platforms.