- GBP/USD surged more than 200 points, gaining 2%.

- UK 30-year bond yields fell 50 basis points to 4.38% as the bond sell-off is trimmed.

- UK Chancellor of the Exchequer Hunt calmed the markets, buying some time for UK Prime Minister Liz Truss as pressure mounts to impeach her.

The GBP/USD hits the 1.1400 level, as new UK Chancellor of the Exchequer Jeremy Hunt told the House of Commons that the government had changed course, while reiterating that Britain is a country that “pays its dues”. So far, the U.K. government’s U-turn is keeping investors in the mood, with global stocks trading in the green. At the time of writing, the GBP/USD pair is trading at 1.1384, above its opening price but far from two-week highs.

GBP/USD jumped as the new UK Chancellor of the Exchequer scrapped PM Liz Truss’s initial budget proposal

A missing US calendar left investors adrift on news of the UK economic turmoil. UK Chancellor of the Exchequer Jeremy Hunt cut taxes from the government’s new budget to calm markets. So far, the 30-year yield has fallen 45 basis points, from 4.85% to 4.35%, as tweaks by the new finance minister bought Prime Minister Liz Truss’ government time.

Sterling rose strongly against the dollar on Monday, up almost 2%, gaining more than 200 points, bouncing from lows around 1.1208 to daily highs of 1.1439.

Jeremy Hunt’s program raised the corporate tax rate while reversing tax changes on dividend income, alcohol tax and a VAT-free purchase scheme, with which he aimed to raise £5bn. In addition, Hunt commented that he would form an “economic advisory council” to provide independent advice to the government.

On the other hand, the latest inflation figures in the US, released last Thursday, have reinforced the arguments in favor of a new rise in interest rates by the Federal Reserve. Several officials expressed that inflation remains stubbornly high, that the labor market is tight, and stressed the need for the ratest to be restrictive.

On Saturday, St. Louis Fed President James Bullard said rising US interest rates have strengthened the dollar, which is weighing on other world currencies, an issue raised by some countries in the G20 meeting. However, Bullard added that once the Fed brings rates to a level that could push inflation down, the dollar could fall.

What to do

On Tuesday, the UK economic calendar will be very light with traders focusing on UK political turmoil and US dynamics. In the US, Industrial Production m Capacity Utilization and the NAHB Housing Market Index will update the state of the US economy.

GBP/USD Price Forecast

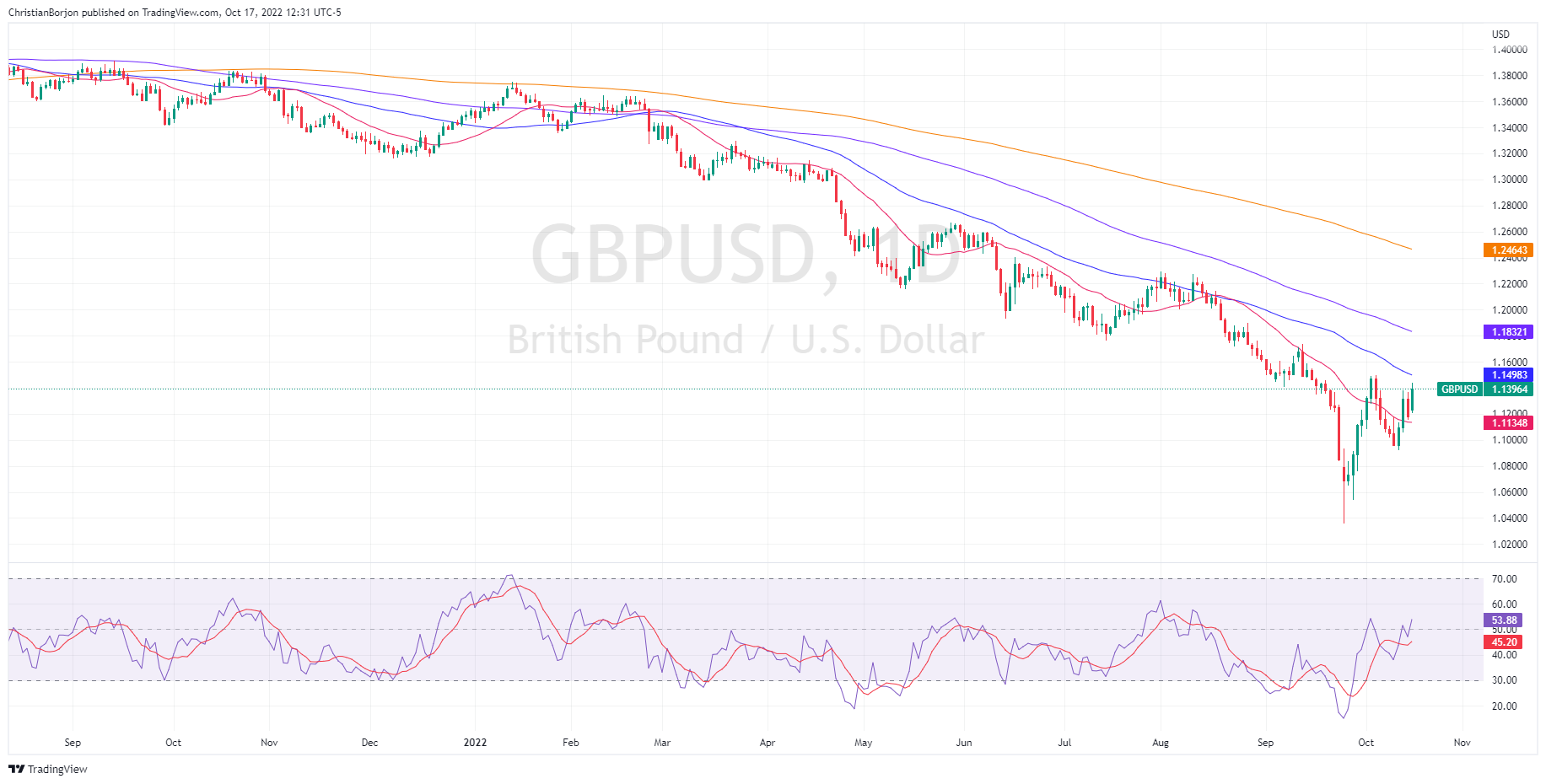

GBP/USD recovered some ground, pulling away from the 20-day EMA as the Relative Strength Index (RSI) broke above the 50 mid-line, a bullish sign. On its way north, the 50 day EMA is found at 1.1498, which once breached will expose 1.1500, followed by a test of the 100 day EMA at 1.1832.

Source: Fx Street

With 6 years of experience, I bring to the table captivating and informative writing in the world news category. My expertise covers a range of industries, including tourism, technology, forex and stocks. From brief social media posts to in-depth articles, I am dedicated to creating compelling content for various platforms.