- The British pound remained in Wednesday's opening range.

- The UK data caused some volatility, but with little movement.

- US retail sales and PPI figures on barrel for Wednesday.

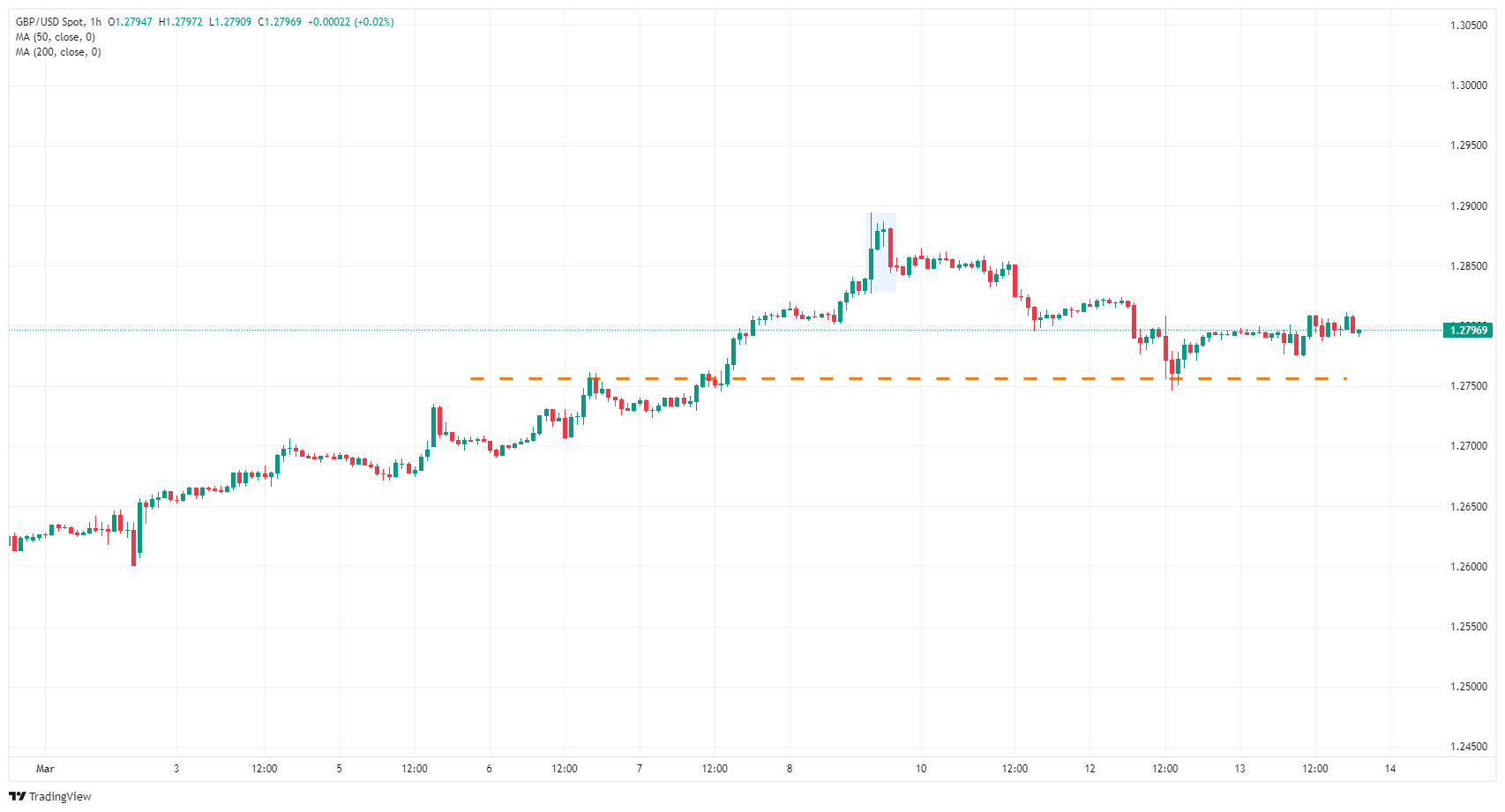

GBP/USD showed some volatility on Wednesday, but overall directional momentum remains limited, with the pair range-bound and anchored near the day's opening range, near 1.2790. Technical indicators fail to break above the 1.2800 level in the mid-week session, and investors are awaiting economic data.

UK industrial production fell -0.2% in January, after 0.6% in December, below the 0.0% forecast. UK monthly manufacturing output also fell, coming in at the expected 0.0% versus 0.8% previously. UK Gross Domestic Product (GDP) for January also met expectations and stood at 0.2%, up from -0.1% previously.

Weak US data on Wednesday leaves investors awaiting Thursday's retail sales and Producer Price Index (PPI) figures. US retail sales are expected to rebound in February, with the market average forecast at 0.8% following January's -0.8% decline. Meanwhile, February's core PPI is expected to decline slightly to 1.9% from 2.0% previously.

The week will conclude with the publication of the University of Michigan consumer sentiment index, which will remain at 76.9 points. Before that, UK consumers' average inflation expectations will be known early on Friday during the London market session. At a minimum, British consumers expect UK inflation to be around 3.3% for the next 12 months.

GBP/USD Technical Outlook

GBP/USD is entering a mid-week cycle, thrashing around in the mid-range as the pair grapples with an inflection point with price just above 1.2750. Hourly candles have dropped a potential breakout just below the 1.2900 area, and short-term action is set to consolidate until a stronger pattern emerges.

The daily candlesticks are returning to a strongly bid zone after a six-day bullish streak that ended quickly this week, with the pair failing to capture 1.2900. Consolidation plagues GBP/USD in the medium term, and a bullish bounce from the 200-day SMA at 1.2590 is seeing limited upside momentum.

GBP/USD hourly chart

GBP/USD daily chart

GBP/USD

| Overview | |

|---|---|

| Latest price today | 1.2796 |

| Today I change daily | 0.0003 |

| Today Daily change % | 0.02 |

| Today's daily opening | 1.2793 |

| Trends | |

|---|---|

| SMA20 daily | 1.2683 |

| 50 daily SMA | 1.2682 |

| SMA100 daily | 1.2595 |

| SMA200 daily | 1.2589 |

| Levels | |

|---|---|

| Previous daily high | 1.2824 |

| Previous daily low | 1.2746 |

| Previous weekly high | 1.2894 |

| Previous weekly low | 1.2652 |

| Previous Monthly High | 1.2773 |

| Previous monthly low | 1.2518 |

| Daily Fibonacci 38.2 | 1.2776 |

| Fibonacci 61.8% daily | 1.2794 |

| Daily Pivot Point S1 | 1.2751 |

| Daily Pivot Point S2 | 1,271 |

| Daily Pivot Point S3 | 1.2674 |

| Daily Pivot Point R1 | 1.2829 |

| Daily Pivot Point R2 | 1.2865 |

| Daily Pivot Point R3 | 1.2906 |

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.