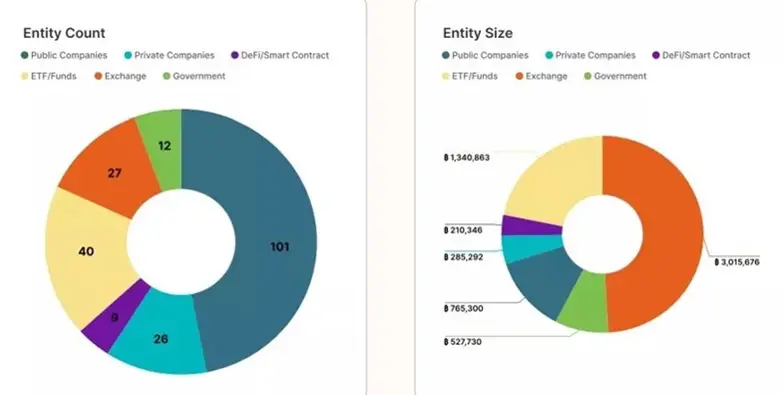

According to researchers, 6.14 million BTCs are concentrated in 216 holders. Among them are centralized crypto cars, crypto funds, public and private companies. The maximum number of coins from this share – 3.015 million BTC – lies on the balance of 27 centralized exchanges.

State treasures rarely carry out crypto activists in their accounts. Their cryptocurrencies infrequently move assets and are weakly correlated with bitcoin cycles – at the same time they hold enough to influence the market during sales or transactions, analysts of two companies noted.

“This trend is especially obvious to the state treasury of the United States, China, Germany and Great Britain. Here, most coins are acquired as a result of law enforcement, and not participation in market operations, ”the researchers said.

In their opinion, state reserves are a structurally separate class – sleeping, but capable of affecting markets during activation.

Bitcoin remains a high -risk asset, but its integration into the traditional financial system has made price fluctuations more balanced and less determined by speculators, experts say. According to them, the latest cycles position bitcoin as a macroactiv suitable for inclusion in investment portfolios – along with classic savings in savings.

Earlier, the general director of Bitwise Hunter Horsley said the approaching deficiency of the first cryptocurrency. According to Khorsley, he will provoke an increase in the Bitcoin course above $ 150,000.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.