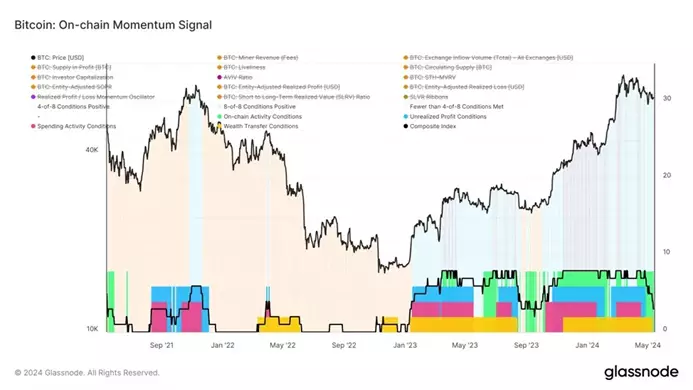

According to analyst estimates, at the end of April 2024, the income of Bitcoin miners remained above the historical norm. However, now there are negative dynamics in the market, profits are falling, and a number of mining companies are having financial problems.

In addition, the inflow of funds into exchanges peaked at the end of March 2024, and has since then entered a steady downward trend. Experts believe that the positive dynamics of revenues to centralized sites may approach zero in the near future.

According to experts, now fewer and fewer Bitcoin holders are in a profit position, which may have a negative impact on market sentiment. The profitability of operations is decreasing, which may lead to more cautious behavior by traders, Glassnode emphasized.

Earlier, Bernstein experts announced that the so-called Bitcoin price plateau that occurred after the halving satisfied miners. Large companies will be able to increase their market share by expanding infrastructure and introducing new capacities.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.