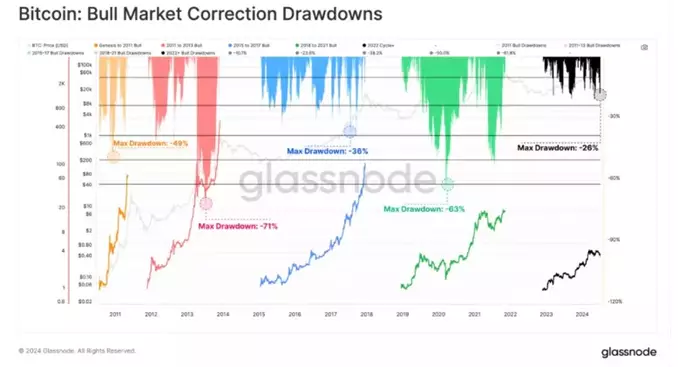

Glassnode emphasized that the 26% rollback in the value of Bitcoin from its historical maximum has transferred 2.9 million of the 3.2 million BTC to the status of “loss-making.” Analysts noted that the current Bitcoin cycle is one of the worst, despite the asset reaching its maximum price in March.

Experts explain that the local bottom of the rate often coincides with the moment when the “loss-making” amount of cryptocurrency at the disposal of speculators reaches the 2 million BTC mark.

According to calculations by Glassnode analysts, speculators have been holding more than 2 million “loss-making” bitcoins over the past month. However, as Glassnode believes, despite the significant correction in the rate of the first cryptocurrency, the structure of the crypto market is strengthening, and the volatility of virtual coins is decreasing as they are further accepted as a reliable asset class.

Earlier, Glassnode analysts urged market participants to be cautious, as on-chain indicators show that Bitcoin is going through a phase of significant consolidation and correction.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.