The price of bitcoin (BTC) has been falling since mid-February. But this does not mean that the bull market should be forgotten – according to on-chain data, the asset is now in a transitional phase.

In a March 6 report by Glassnode analysts notedthat bitcoin has been thrown off a number of psychological levels. In their opinion, this was due to the actions of whales and old BTC holders. At the moment, the asset is trading in a narrow range with very little volume.

Bitcoin markets are still weak

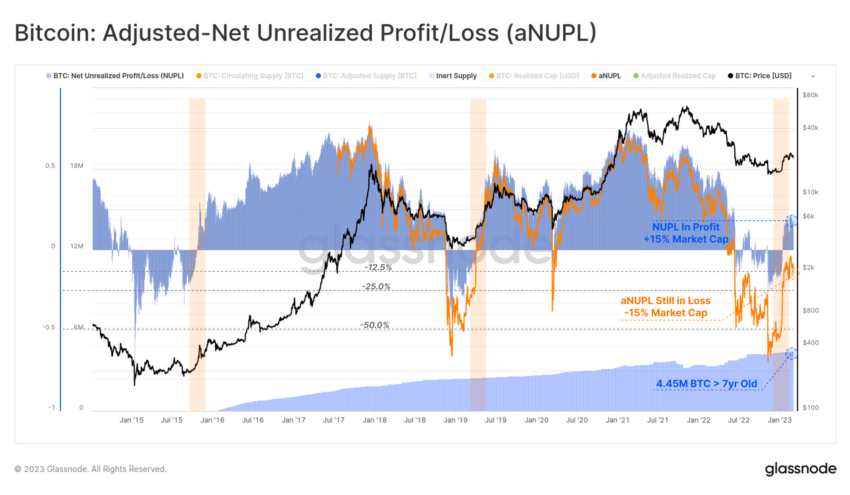

Glassnode notes that the $23,500 level serves as an important psychological barrier. A price break above this mark will return most investors to the profit zone. According to the Net Unrealized Profit and Loss (NUPL) indicator, BTC holders now have a net unrealized profit of about 15% of the market value.

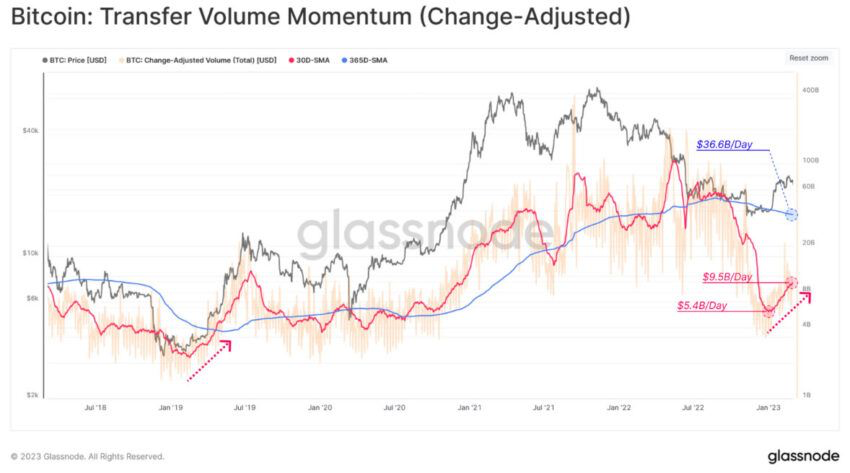

Analysts stressed that the current state of the market is definitely reminiscent of a phase that usually occurs in the late stages of a bear cycle and drew attention to the growing volume of transfers, which can be regarded as a sign of investors returning to the market.

Since the beginning of January, the monthly volume of transfers has increased by 79% to $9.5 billion per day. However, the figure is still below the annual average. A break above the 356-day moving average in 30 days would mean a massive influx of institutional capital.

What happens to the BTC price

The price of bitcoin has hardly changed since March 3, when it fell by more than 5% in an hour. The asset made a couple of breakouts above $22,500 in these few days, but they were unsuccessful.

At press time, Bitcoin is trading at $22,448. However, everything could change after today’s speech by Fed Chairman Jerome Powell before the US Senate Banking Committee, which will take place at 18:00 Moscow time.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.