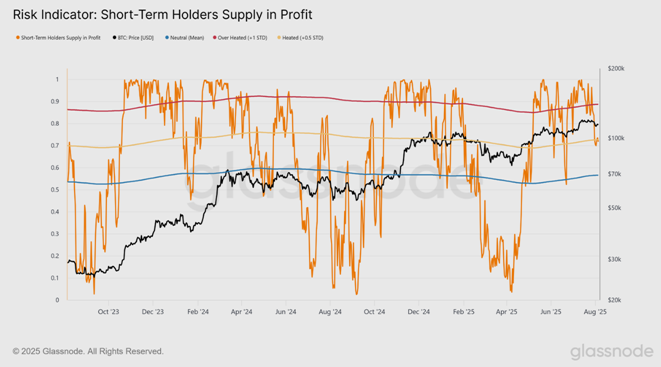

A sharp decrease in bitcoin price below $ 116,000 provoked a large -scale reduction in credit shoulder from investors and reduced the profitability of short -term holders, Glassnode experts studied market dynamics.

In July, Bitcoin established a new historical maximum at a mark of about $ 123,000. It was here that strong resistance was formed, restraining further growth. After the rollback, buyers who entered the market at a price above $ 116,000 were at a loss, which increased the pressure on the price of cryptocurrency.

According to the Glassnode forecast, the breakdown of the resistance level can be an important signal for returning control to bulls and the resumption of the ascending trend.

Despite the decrease in the quotations, interest in the asset has been preserved: purchases of about 120,000 BTC were recorded, which allowed the coin to recover above $ 114,000. However, the demand is clearly insufficient to overcome resistance, and the market remains in the consolidation phase, experts of Glassnode said.

According to their data, cooling is also outlined on the derivatives market, which signals a reduction in speculative pressure and a more cautious position of traders – they do not yet see the conditions for the resumption of the rally.

To resume growth, the key condition will be the return of the price above the zone of $ 116,000–23,000 with the support of growing demand, especially on the rations of the spotic bitcoin -tf, the Glassnode experts believe.

Earlier, the author of the book on personal finances “Rich Dad, Papa” and entrepreneur Robert Kiyosaki recommended investors to wait for the “August curse of Bitcoin”, from which it would be possible to benefit.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.