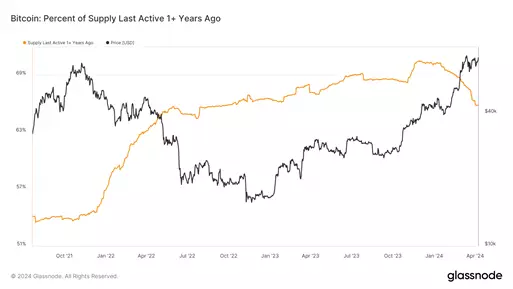

The share of the first cryptocurrency in hodlers’ accounts has been decreasing since January 2024. It was in January that the US Securities and Exchange Commission (SEC) approved the launch of spot Bitcoin ETFs.

At the end of November last year, the volume of bitcoins in hodler accounts was 70%, which was due to the dominance of the strategy of long-term cryptocurrency holding among investors and traders.

The change in the behavior model of hodlers is caused by a prolonged increase in the cost of digital gold, and the decrease in the share of the asset is associated with profit-taking by hodlers at the moment. The situation may change after the upcoming halving at the end of April and the subsequent change in the value of the first cryptocurrency.

Previously, Glassnode analysts reported that short-term holders are actively buying bitcoins, accumulating more than 1.2 million BTC since December 2023.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.