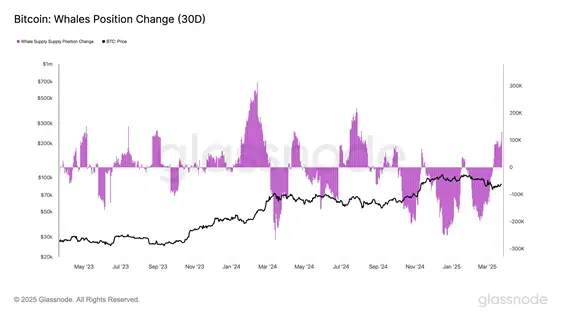

According to experts, the total purchase cost amounted to over $ 11.2 billion, at an average bitcoin price of $ 87,500. This is the fastest rate of accumulation from the end of August 2024.

Glassnode notes that the extension of the first cryptocurrency reserves demonstrates the confidence of large crypto participants in the further prospects of the asset, despite global uncertainty.

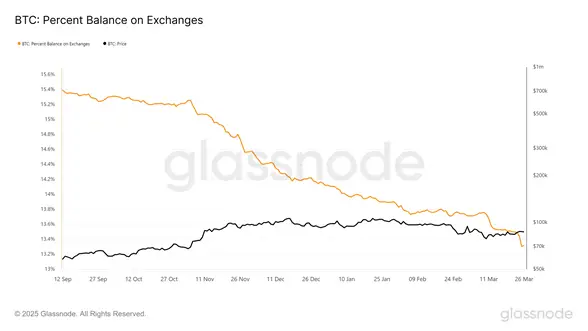

The trend towards the accumulation of bitcoins with large holders was outlined against the backdrop of a decrease in the share of cryptocurrency proposal on the bills. The activity of “whales” contrasts with the actions of small investors who rapidly reducing their positions in the market, analysts explained.

Since the beginning of March, Bitcoin was able to restore its position, overcoming the support level of $ 78,000. The market has supported the statement of the US Federal Reserve (Fed) on the likely mitigation of the policy, and the adaptation of companies to the administration of Donald Trump, experts say.

Earlier, Cryptoquant experts said that Bitcoin had a “key market point” for Bitcoin. In their forecast, they referred to the BCMI indicator, combining the main metrics and mood indicators of cryptorrhnik participants.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.