By Allison Schrager

Like it or not, we live in a globalized economy. How one defines globalization or measures its progress can vary, but it generally tends to simply mean greater economic integration between countries, as well as more political cooperation, immigration, and trade in goods and services.

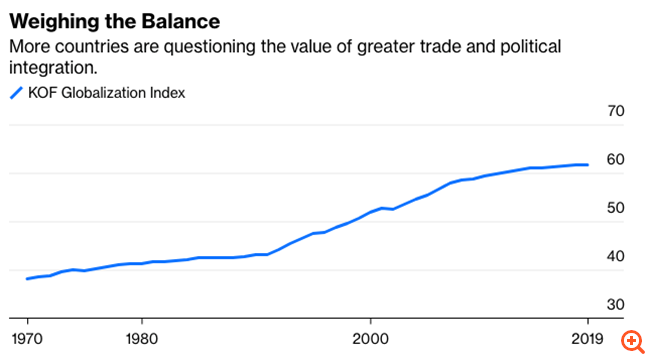

In all these areas, globalization has been on the rise until recently.

Some economists, experts and politicians argue that globalization has peaked and will now begin to reverse. Niall Ferguson sees this period of globalization, thanks to the pandemic, fading, if only by a small wave. Harvard economist Dani Rodrick announces “the end of neoliberalism”.

Dynamic

However, globalization is not a phase. It is a dynamic trend that cannot simply be stopped.

There has been a concerted push towards a more global type of integration throughout the post-World War II era. As the war ended, the world community created several major institutions (the World Bank, the International Monetary Fund, the United Nations, and the like) in order to pave the way for more cooperation and trade and to avoid the mistakes of the past. However, globalization really took off after the fall of the Berlin Wall.

The end of the Cold War, the improvement of technology which facilitated trade (especially of services and information) and an intellectual environment of the Washington Consensus kind, favored all things “global”.

Countries were eliminating more and more tariffs and more capital and goods than at any time in history were moving across borders. You can see this through the KOF index of globalization, which includes various sub-indices of economic and political integration.

But if you look closely at the index, you will see a slowdown in the pace of globalization over the last decade. The latter peaked in 2008 if measured as a percentage of trade to GDP.

Problems and questioning

Recent years have made us question the value of globalization. She kept many of her promises: more than a billion people no longer live in poverty, goods and services are much cheaper, and diversification has made the economy less risky.

But there were also problems. The entry of billions of low-wage workers into the world market very quickly displaced many people in richer countries from their jobs and exacerbated inequality within each country.

Dollarization meant that some developing countries would experience currency instability as foreign investors pulled their money at the first sign of trouble.

It is not surprising, then, that there has been a backlash against globalization, accompanied by policies to slow or even reverse it. The pandemic, which has led to shortages when trade has slowed, has only heightened frustration with global integrated supply chains. Both major political parties in the US are pushing for industrial policies that will subsidize more domestic production of certain goods.

There are more tariffs on some goods and capital restrictions. The IMF, once the greatest champion of globalization, now supports capital controls.

The outlook looks even bleaker. China’s once-robust economy—a major force in emerging globalization—isn’t looking so good. The world may no longer be able to count on China for cheap and abundant goods. Meanwhile, an ever-strengthening dollar and rising interest rates will put pressure on emerging economies, making them even more skeptical of global markets.

Common fate

Nothing lasts forever. Human progress stumbles and can sometimes bog down. However, globalization is not going to disappear. First, it is very difficult to let go of many of the relationships that have developed. We are all in the same boat, assets and commodities are still priced in dollars and foreigners still own a lot of US debt.

Manufacturing depends on intermediate goods made around the world that are not only cheaper, but also produced with skills that the US no longer possesses. America’s recent effort to bring semiconductor manufacturing back home shows why industrial policy is much more difficult than it looks and is not a good solution to structural job losses.

Second, the benefits of globalization are too great to give up. Many people no longer live in poverty and people are used to cheaper things. We see how disruptive and painful the return of inflation is proving to be, both economically and politically. Deglobalization would make inflation much worse and nobody wants that.

It also turns out that politicians are quite flexible in their views (see fossil fuel phase-out) if a shift can offer cheaper prices. Big talk about a retreat from globalization may be the next populist position to collapse.

The economic and political trends that threaten globalization need not be so ominous. Ken Moelis, founder and CEO of Moelis & Co., worries that there will be a setback to globalization because the war in Ukraine has revealed how vulnerable we are to third countries. However, this only shows how dangerous it is to depend on any single country, including your own.

Differentiation

In the future, countries need more diversification in where they source their goods and commodities, not less. We may not be able to rely on China, with its aging population and uncertain economic future, but more production can come from younger countries on the African continent, which can still benefit from more economic integration.

Globalization is far from perfect, but overall it makes our lives better. New tariffs and new industrial policies will take us a few steps back toward protectionism, but even more expanded trade can ease price pressures and maintain momentum toward more integration.

The tone of the globalization debate may have changed, but the genie is out of the lamp and will not accept being confined there again.

Source: Bloomberg

I’m Ava Paul, an experienced news website author with a special focus on the entertainment section. Over the past five years, I have worked in various positions of media and communication at World Stock Market. My experience has given me extensive knowledge in writing, editing, researching and reporting on stories related to the entertainment industry.