- Xau/USD falls more than 1.5% as the demand for safe refuge decreases due to the relaxation of global and geopolitical trade.

- Commercial Agreement between the US and China signed; More agreements are expected before July 9, improving feeling.

- Iran points out diplomacy; The Israel-Gaza war could end in two weeks, he says to Arabiya.

- The underlying PCE exceeded the forecasts; Fed Kashkari is still waiting for two feat cuts in 2025.

The price of gold collapsed more than 1.50% on Friday in the midst of an improvement in appetite for risk, driven by several factors. The de-escalation of the Israel-Iran conflict, the commercial agreement with China and the ongoing negotiations between the United States (USA) and their peers to reach trade agreements were well received by investors, who previously sought refuge in the demand for ingots as a safe refuge.

The XAU/USD quote $ 3,274 after reaching a daily maximum of $ 3,328. On Thursday, the White House announced that the US and China have formally signed a commercial agreement, effectively ending the ongoing “commercial war”. The US Secretary of Commerce, Howard Lutnick, said more agreements are coming as the July 9 deadline is approaching.

As for geopolitics, Iran has shown signs of flexibility, leaning towards diplomacy, since its UN representative said Tehran is open to forming a regional nuclear consortium in case of an agreement with Washington.

Adding to the optimistic environment is the possibility of the end of the Israel-Gaza war in two weeks, he revealed to Arabiya.

In the US, the preferred inflation indicator of the Federal Reserve (FED), the Personal Consumer Expenses Price (PCE) index, aligned with the estimates in May, but showed no progress towards disinflation.

Previously, Neel Kashkari of the Minneapolis Fed commented that he still sees two feats of fees in 2025.

What moves the market today: the price of gold is prepared for a correction in the middle of a stable US dollar and US yields.

- The price of gold is losing its brightness because market participants become increasingly optimistic about the global economy. The news of the commercial agreement with China, as well as those of other countries, including South Korea, Vietnam and the EU, were well received by investors.

- Howard Lutnick, US Secretary of Commerce, added that China “will give us rare earths”, and once they do, “we will reduce our countermeasures,” Lutnick told Bloomberg News in an interview.

- The underlying PCE in May increased a 2.7% year -on -year, one tenth above the estimates and data of April. General inflation for the same period increased by 2.3% year -on -year as expected.

- The University of Michigan (UOM) revealed that the feeling of the consumer in June improved moderately. The index rose from 60.5 to 60.7, while inflation expectations were reviewed down, with homes waiting for prices to rise from 5.1% to 5% during next year. For the next five years, inflation is projected to be around 4%, lowering 4.1%.

- The 10 -year Treasury bonus of the US is flat, with a yield of 4,242%. The US dollar index (DXY), which tracks the value of the dollar value against a basket of six peers, is practically unchanged in 97.28.

- The president of the Fed of Minneapolis, Neel Kashkari, said that an inflationary impulse is likely to occur, but real inflation indicates a renewed progress towards the objective of 2%. More time is needed to determine whether the effects of the commercial war are delayed or if they will be less than initially thought.

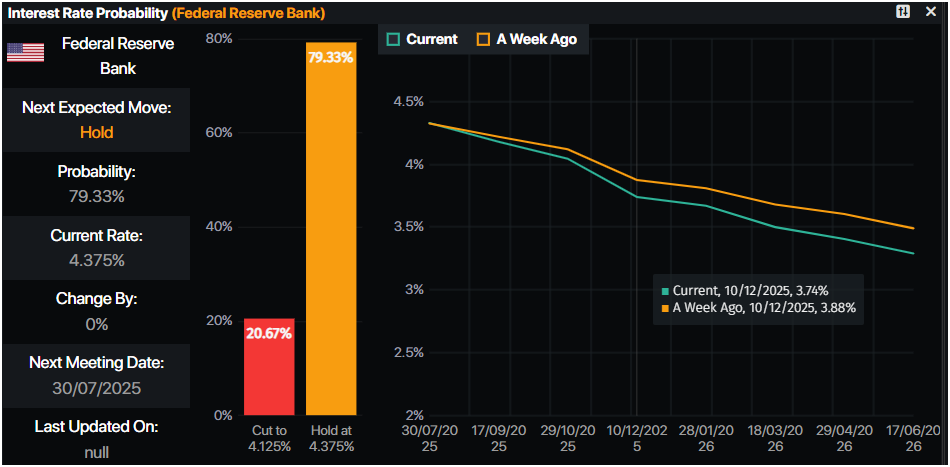

- The monetary markets suggest that the operators are discounting 63.5 basic points of relief towards the end of the year, according to Prime Market Terminal data.

Fountain: Prime Market Terminal

Xau/USD technical perspective: The price of gold is prepared for a setback at $ 3.200

The upward trend of the price of gold is maintained, but in the short term, it could fall more after breaking below the simple mobile average (SMA) of 50 days at $ 3,323. The relative force index (RSI) indicates that the moment has become bassist despite the fact that the price action has achieved higher and higher maximums.

For a bullish continuation, the Xau/USD must rise above $ 3,300. The next key resistance would be the 50 -day SMA at $ 3,323, followed by the Pico de Jun 26, $ 3,350. If it is exceeded, the following objective is $ 3,400. On the other hand, if the Xau/USD falls below $ 3,300, the minimum of May 29, $ 3,245 and $ 3,200 are at stake.

FAQS GOLD

Gold has played a fundamental role in the history of mankind, since it has been widely used as a deposit of value and a half of exchange. At present, apart from its brightness and use for jewelry, precious metal is considered an active refuge, which means that it is considered a good investment in turbulent times. Gold is also considered a coverage against inflation and depreciation of currencies, since it does not depend on any specific issuer or government.

Central banks are the greatest gold holders. In their objective of supporting their currencies in turbulent times, central banks tend to diversify their reserves and buy gold to improve the perception of strength of the economy and currency. High gold reserves can be a source of trust for the solvency of a country. Central banks added 1,136 tons of gold worth 70,000 million to their reservations in 2022, according to data from the World Gold Council. It is the largest annual purchase since there are records. The central banks of emerging economies such as China, India and Türkiye are rapidly increasing their gold reserves.

Gold has a reverse correlation with the US dollar and US Treasury bonds, which are the main reserve and shelter assets. When the dollar depreciates, the price of gold tends to rise, which allows investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rebound in the stock market tends to weaken the price of gold, while mass sales in higher risk markets tend to favor precious metal.

The price of gold can move due to a wide range of factors. Geopolitical instability or fear of a deep recession can cause the price of gold to rise rapidly due to its condition of active refuge. As an asset without yield, the price of gold tends to rise when interest rates lower, while the money increases to the yellow metal. Even so, most movements depend on how the US dollar (USD) behaves, since the asset is quoted in dollars (Xau/USD). A strong dollar tends to keep the price of gold controlled, while a weakest dollar probably thrusts gold prices.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.