- Gold sees gains cut after the EU and China promise to counteract US tariffs.

- A cease cessation agreement mediated by the US on Ukraine is in consideration by Russia.

- The operators are waiting for the next US inflation data on Wednesday.

The price of gold (Xau/USD) is maintained by 2,915 $ at the time of writing on Wednesday, before the publication of the United States Consumption Price Index (IPC) (USA) for February. The market consensus is that there will be a slowdown in all inflation measures, both in monthly and annual indicators. However, many analysts and economists have commented that the current US tariff approach will be inflationary to the country, which could be reflected in the numbers.

Meanwhile, operators are still cautious about tariffs after China’s Foreign Minister Wang Yi commented that if the US wants to suppress China with their tariffs on steel and aluminum. Europe, on the other hand, promised to implement countermeasures for April 13. In the geopolitical field, a cease cessation agreement has been submitted in Ukraine mediated by the US for Russia to consider.

What moves the market today: the IPC will move the bets of the Fed

- Chinese consumption actions rise as the annual political meeting of the Nation concludes with support for domestic demand. Hong Kong’s jewelters lead the profits, driven by the demand for refuge for gold proxies, reports Bloomberg.

- Wall Street feels anxious as investors feel more and more restless for the policy of volatile tariffs, persistent inflation and the unknown rhythm of the flexibility of interest rates of the Federal Reserve (Fed). Market forecasts in banks, including JPMorgan Chase & Co. and RBC Capital Markets, have moderated their optimistic forecasts by 2025, since Trump’s tariffs feed the fears of slower economic growth, says Bloomberg.

- The CME Fedwatch tool sees 97.0% probability that there are no changes in interest rates at the next meeting of the Fed on March 19. The possibilities of a rate cut at the May 7 meeting are currently at 39.5%.

Technical analysis: moving rates

Implacable – That is the word that comes to mind when thinking about headlines about tariffs and gold movement this week. Monday’s fall was bought with enthusiasm, while the ingot is now aimed at testing the monthly limit around $ 2,930. Once that level is broken, a movement towards a new historical maximum is again at stake.

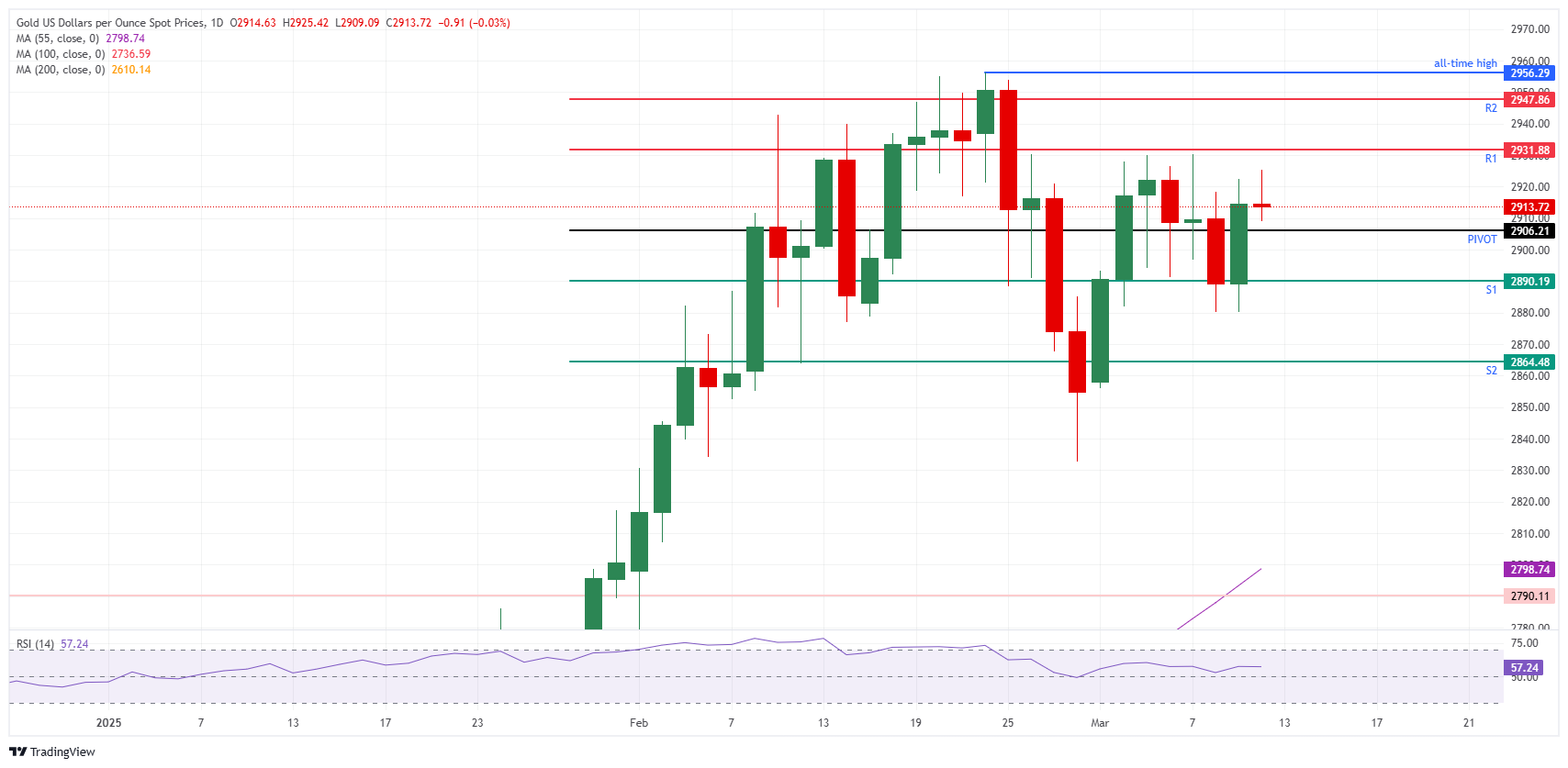

The gold is back above the round level of $ 2,900 and, from an intra -ethful technical perspective, it is above the daily pivot point in 2,906 $. The gold is directed towards the resistance R1 about $ 2,931, converging with the maximum of last week. Once surpassed, the intra -dial resistance R2 in 2,947 $ becomes the rise before the historical maximum of 2,956 $.

At the bottom, Wednesday’s pivot point is 2,906. In the event that this level is broken, the S1 support must be observed around 2,890 $. The S2 support in $ 2,864, coinciding with the minimum of February 12, should avoid any additional fall.

Xau/USD: Daily graphic

FAQS inflation

Inflation measures the rise in prices of a representative basket of goods and services. General inflation is often expressed as an intermennsual and interannual percentage variation. The underlying inflation excludes more volatile elements, such as food and fuel, which can fluctuate due to geopolitical and seasonal factors. The underlying inflation is the figure on which economists focus and is the objective level of central banks, which have the mandate of maintaining inflation at a manageable level, usually around 2%.

The consumer price index (CPI) measures the variation in the prices of a basket of goods and services over a period of time. It is usually expressed as an intermennsual and interannual variation. The underlying IPC is the objective of the central banks, since it excludes the volatility of food and fuels. When the underlying IPC exceeds 2%, interest rates usually rise, and vice versa when it falls below 2%. Since higher interest rates are positive for a currency, higher inflation usually translates into a stronger currency. The opposite occurs when inflation falls.

Although it may seem contrary to intuition, high inflation in a country highlights the value of its currency and vice versa in the case of lower inflation. This is because the Central Bank will normally raise interest rates to combat the greatest inflation, which attracts more world capital tickets of investors looking for a lucrative place to park their money.

Formerly, gold was the asset that investors resorted to high inflation because it preserved their value, and although investors often continue to buy gold due to their refuge properties in times of extreme agitation in the markets, this is not the case most of the time. This is because when inflation is high, central banks upload interest rates to combat it. Higher interest rates are negative for gold because they increase the opportunity cost to keep gold in front of an asset that earns interest or place money in a cash deposit account. On the contrary, lower inflation tends to be positive for gold, since it reduces interest rates, making bright metal a more viable investment alternative.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.