- Gold shoots at a maximum of five weeks in the midst of geopolitical tensions and a Fed dovish panorama

- Israel attacks Iran, feeding fears of a broader war and causing a refuge in gold.

- XAU/USD reaches $ 3,446 before giving in a profit taking; Look at the Fed decision next week and US data agenda.

The price of gold shot himself for the third consecutive day after the Israel-Iran conflict broke out on Friday, triggering a feeling of risk aversion in financial markets in fear that he could climb. At the time of writing, the XAU/USD quotes at $ 3,422, with an increase of more than 1%.

Several factors support gold. On Friday, Israel’s attack on Iran’s military facilities, nuclear facilities and senior officials increased tension in the area. After the attack, the Xau/USD reached a maximum of five weeks of $ 3,446 before going back to their current levels, since the operators took profits before the weekend.

The IPP and the USAs of the US strengthens strengthens the betting of Fed fees despite the improvement in the feeling of the consumer

Another factor was that inflation in the United States (USA) continued to decrease after the publication of consumer price index (CPI) and May Price Price Index (IPP). Recently, a consumer’s feeling survey at the University of Michigan (UOM) revealed that households are becoming more optimistic about the economy, although they are still concerned about the highest prices.

The president of the USA, Donald Trump, hinted that Iran caused the attack, since Washington warned Iran to restrict his nuclear program.

Next week, the operators will be attentive to the publication of the Monetary Policy Meeting of the Federal Reserve (FED), where officials will update their economic projections. In addition to this, retail sales, industrial production, housing and employment data could help dictate the direction of gold.

What moves the market today: the price of gold triggers by risk aversion

- Recently, US president Trump told Axios that Israel’s attack could help him reach an agreement with Iran. He urged to make a deal, adding: “There has already been a great death and destruction, but there is still time to end this massacre, with the next attacks already planned being even more brutal.”

- The consumer’s feeling report at the University of Michigan (UOM) in June showed that households are becoming more optimistic about the economy. The feeling index rose 52.2 to 60.5, while inflation expectations decreased for both periods of one year and five years, from 6.6% to 5.1% and 4.2% to 4.1%, respectively.

- Although the data is positive and clear the way for the Federal Reserve to loosen the policy, the escalation of the conflict in the Middle East pushed oil prices more than 6%. This suggests that gasoline prices could increase and that inflation reactivation is coming.

- The yields of the US Treasury bonds are recovering, with the 10 -year Treasury bonus yield of the US, uploading more than seven basic points (PBS) to 4,436%. The real US yet yields followed the same trend, increasing seven basic points to 2,186%, limiting the advance of gold.

- The dollar is strengthened after reaching minimum of three years, according to the US dollar index (DXY). The DXY, which tracks the value of the dollar against a pairs basket, rises 0.30% to 98.15 after reaching a minimum of several years of 97.60.

- Goldman Sachs reiterated that the price of gold will increase to $ 3,700 by the end of 2025 already $ 4,000 by mid -2026. Bank of America (Bofa) sees the gold at $ 4,000 in the next $ 12 months.

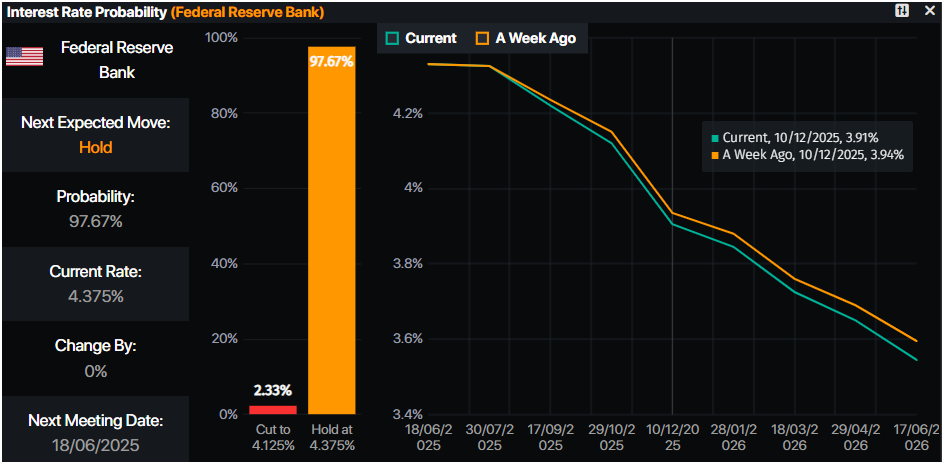

- Monetary markets suggest that operators are discounting 47 basic relief points towards the end of the year, according to Prime Market Terminal data.

Fountain: Prime Market Terminal

XAU/USD technical perspective: The price of gold is consolidated about 3,400 $

The price of gold is prepared to extend your profits beyond the figure of $ 3,450, clearing the way to challenge the historical maximum of $ 3,500 in the short term. The relative force index (RSI) shows that the impulse remains bullish, and with this in mind, the path of lower resistance is inclined to rise.

On the contrary, if the XAU/USD falls below $ 3,450, the first support would be the $ 3,400 mark. If it exceeds, the next stop would be the Simple Mobile (SMA) of 50 days at $ 3,281, before the maximum of April 3 turned into a support in $ 3,167.

FAQS GOLD

Gold has played a fundamental role in the history of mankind, since it has been widely used as a deposit of value and a half of exchange. At present, apart from its brightness and use for jewelry, precious metal is considered an active refuge, which means that it is considered a good investment in turbulent times. Gold is also considered a coverage against inflation and depreciation of currencies, since it does not depend on any specific issuer or government.

Central banks are the greatest gold holders. In their objective of supporting their currencies in turbulent times, central banks tend to diversify their reserves and buy gold to improve the perception of strength of the economy and currency. High gold reserves can be a source of trust for the solvency of a country. Central banks added 1,136 tons of gold worth 70,000 million to their reservations in 2022, according to data from the World Gold Council. It is the largest annual purchase since there are records. The central banks of emerging economies such as China, India and Türkiye are rapidly increasing their gold reserves.

Gold has a reverse correlation with the US dollar and US Treasury bonds, which are the main reserve and shelter assets. When the dollar depreciates, the price of gold tends to rise, which allows investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rebound in the stock market tends to weaken the price of gold, while mass sales in higher risk markets tend to favor precious metal.

The price of gold can move due to a wide range of factors. Geopolitical instability or fear of a deep recession can cause the price of gold to rise rapidly due to its condition of active refuge. As an asset without yield, the price of gold tends to rise when interest rates lower, while the money increases to the yellow metal. Even so, most movements depend on how the US dollar (USD) behaves, since the asset is quoted in dollars (Xau/USD). A strong dollar tends to keep the price of gold controlled, while a weakest dollar probably thrusts gold prices.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.