- Gold goes back after a rebound to $ 3,325; Sellers return as returns and the US dollar regain land.

- Fed records are expected for clarity; A moderate surprise could rekindle the stagnant recovery of gold.

- Goldman Sachs urges a greater assignment of gold in the midst of geopolitical risks and demand for central banks.

The price of gold extended its losses during the American session on Wednesday after reaching a daily maximum of 3,325 $ early in the day, since the feeling of the market became negative. However, sellers intervened, carrying yellow metal prices below $ 3,300, resulting in a solid fall of 0.18%.

The price action has remained calm while the operators expect the publication of the minutes of the last meeting of the Federal Reserve (FED) at 18:00 GMT. Although it could move the markets, Fed officials have expressed that they are in waiting mode, trying to evaluate the impact of tariffs imposed by the United States (USA).

The recovery of gold seems to have been stagnant during the week, since the yields of the US Treasury bonds recovered part of the fall of the previous week, which supports the US dollar. However, a moderate surprise turn in the minutes, the less likely scenario, could boost the prices of the XAU/Usd up.

On Tuesday, Fox Business News Gasparino, in an X publication, revealed that a framework between the US and India is close to being announced. It should be noted that the US has adopted a more flexible approach to commercial conversations.

Despite this, the golden potential of gold is maintained due to the growing geopolitical tensions between Russia and Ukraine, as well as the conflict in the Middle East that involves Israel and Hamas.

Goldman Sachs analysts recommended a higher assignment to the usual golden portfolios, Reuters revealed. Citing high risks for the institutional credibility of the US, pressure on the Fed and a sustained demand of the central banks.

In the week that progresses, the agenda will include the minutes of the Fed, the second estimate of the Gross Domestic Product (GDP) in the first quarter of 2025 and the Personal Consumer Expenses Price Index (PCE) preferred by the Fed.

Daily Gold Market Movements: Precious metal goes back to a strong US dollar and high yields in the US.

- The yields of the US Treasury bonds are increasing, since 10 -year bonus yield increases by four basic points (PBS) to 4,493%. Meanwhile, the real US yu. Four PBS also advance to 2,171%.

- The US dollar index (DXY), which tracks the value of the dollar against a basket of six coins, rises more than 0.33% to 99.89, driven by an improvement in consumer confidence data, which grew more in four years, revealed the Board Conference.

- New York Fed President John Williams said inflation expectations are well anchored and added that he wants to prevent inflation from becoming highly persistent, since that could become permanent.

- The data revealed that gold imports to Switzerland from the US reached their highest level from at least 2012 in April.

- In addition, Reuters revealed that “the net imports of gold from China through Hong Kong more than doubled in April compared to March, and were the highest since March 2024, according to the data.”

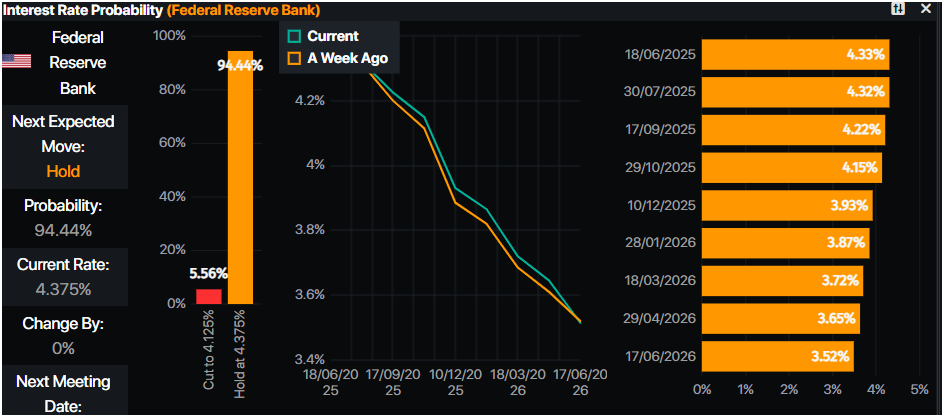

- The monetary markets suggest that the operators are discounting 44.5 basic points of relief towards the end of the year, according to Prime Market Terminal data.

Fountain: Prime Market Terminal

Xau/USD technical perspective: Gold price setback challenges $ 3,250

Gold prices have consolidated within the range of 3,280 $ -3,330 $ during the last four negotiation sessions, since the upward impulse seems to be fading for technical reasons. The impulse, measured by the relative force index (RSI), points towards its 50th neutral line, which if it breaks, could sponsor a downward movement in the prices of Xau/USD.

For a continuation of the upward trend, the bullies must exceed $ 3,300, $ 3,400 and the maximum of May 7, $ 338. If it is achieved, the following gold goal would be $ 3,500.

Downward, if gold falls below $ 3,250, it could expose a movement towards the simple mobile average (SMA) of 50 days at $ 3.211, followed by the minimum daily of May 20, $ 3,204.

FAQS GOLD

Gold has played a fundamental role in the history of mankind, since it has been widely used as a deposit of value and a half of exchange. At present, apart from its brightness and use for jewelry, precious metal is considered an active refuge, which means that it is considered a good investment in turbulent times. Gold is also considered a coverage against inflation and depreciation of currencies, since it does not depend on any specific issuer or government.

Central banks are the greatest gold holders. In their objective of supporting their currencies in turbulent times, central banks tend to diversify their reserves and buy gold to improve the perception of strength of the economy and currency. High gold reserves can be a source of trust for the solvency of a country. Central banks added 1,136 tons of gold worth 70,000 million to their reservations in 2022, according to data from the World Gold Council. It is the largest annual purchase since there are records. The central banks of emerging economies such as China, India and Türkiye are rapidly increasing their gold reserves.

Gold has a reverse correlation with the US dollar and US Treasury bonds, which are the main reserve and shelter assets. When the dollar depreciates, the price of gold tends to rise, which allows investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rebound in the stock market tends to weaken the price of gold, while mass sales in higher risk markets tend to favor precious metal.

The price of gold can move due to a wide range of factors. Geopolitical instability or fear of a deep recession can cause the price of gold to rise rapidly due to its condition of active refuge. As an asset without yield, the price of gold tends to rise when interest rates lower, while the money increases to the yellow metal. Even so, most movements depend on how the US dollar (USD) behaves, since the asset is quoted in dollars (Xau/USD). A strong dollar tends to keep the price of gold controlled, while a weakest dollar probably thrusts gold prices.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.