- Gold cuts initial losses while unemployment requests and retail sales affect hopes of feat cuts.

- The US data exceeds estimates, reinforcing the stable Fed position before the July meeting.

- Fed officials point out patience, with inflation still above the target range.

The price of gold fell more than 0.26% during the American session on Thursday, cutting some of its previous losses of almost 1%. The publication of solid economic data from the United States, which supports the federal reserve position (FED) to keep the fees without changes in the next July meeting, contributed to this fall. At the time of writing, the XAU/USD is traded at $ 3.340.

The mood on the market remains positive throughout the negotiation day, which acts as an obstacle to gold prices, since investors digest the latest employment and consumption data. Initial unemployment applications last week continued to show improvements in the labor market. At the same time, retail sales data indicated that US households remain resilient, although the data suggests that the increase in sales is mainly attributed to higher prices.

After the data, some Fed officials crossed the lines. Governor Adriana Kugler commented that monetary policy needs to remain stable for a considerable time. The president of the Fed of San Francisco, Mary Daly, declared that there is still work to be done in inflation, since they have not achieved price stability.

Meanwhile, investors continued to discount less flexible by the Fed as more data was available, which reduces the demand for the metal that does not yield. The Future Future Fund Contract of December 2025 shows that merchants expect 42 basic points (PBS) of flexibility, the CBOT revealed.

On the commercial side, the Japanese negotiator Ryosei Akazawa held conversations with the US Secretary of Commerce, Howard Lutnick, in an effort to avoid or reduce 25% tariffs taxes on Japanese products.

Facing this week, merchants will be attentive to the speeches of the FED and the consumer’s feeling report of the University of Michigan.

Daily gold market movements: extends losses due to positive employment data in the US.

- Initial unemployment requests in the US for the week that ended on July 12 fell 228K in the prior to 221k print, below the 235K forecasts. The data supports the cautious posture of the Fed, since the labor market remains healthy, although it has not been cited as a cause of inflation.

- Retail sales in June exceeded the forecasts of 0.1% intermensual, increasing an intermennsual 0.6% and crushing the fall of May 0.9%, since part of the increase is a higher prices reflection due to tariffs. The consumer side inflation revealed at the beginning of the week that prices are increasing.

- The governor of the Fed, Adriana Kugler, added to her hard line comments that inflation remains above the objective, while the labor market remains stable and resilient. He added that IPC inflation is expanding to basic goods.

- The president of the Fed of San Francisco, Mary Daly, commented that the economy is in a good place and that, despite the restrictive rates, the June CPI began to show the effect of tariffs. Despite this, He added that tariffs could have a moderate impact on inflation and still favors two rate cuts.

- The US treasure yields remain stable on Thursday, with the 10 -year treasure performance of the US, which typically correlates negatively with gold, stable at 4,461%. However, the prices of the ingot are still pressured by the strength of the dollar. The US dollar index (DXY), which tracks the yield of the dollar against a basket of six currencies, rises 0.45% to 98.72.

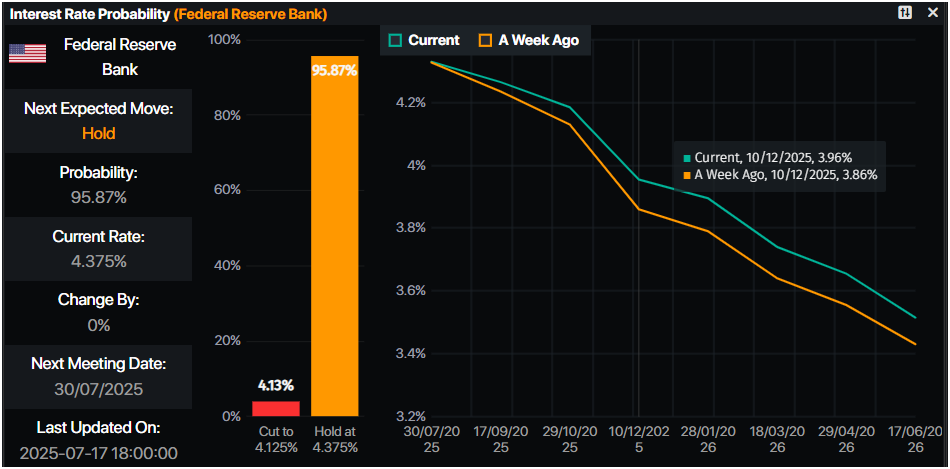

- The probability of interest rates indicates that the Federal Reserve will maintain its current rates, with 95% probabilities to maintain and 5% for a 25 basic points rate cut at the July 30 meeting.

Fountain: Prime Market Terminal

XAU/USD Technical Perspective: Gold remains without direction, trapped in the range of $ 3,300 -3,400

The consolidation is the key, as shown by the daily graphic of gold. The relative force index (RSI) is above its neutral line, but its slope remains flat, indicating more lateral action. However, from the point of view of the price action, the bulls are still in control, but they need to clear key levels of resistance.

For an upward continuation, the Xau/USD must exceed $ 3,400, which will expose the maximum of June 16, $ 3,452, before the historical maximum of $ 3,500. On the contrary, if the Xau/USD falls below $ 3,300, look for a fall towards the minimum of June 30, $ 3,246, followed by the simple mobile average (SMA) of 100 days at $ 3,209.

GOLD – FREQUENT QUESTIONS

Gold has played a fundamental role in the history of mankind, since it has been widely used as a deposit of value and a half of exchange. At present, apart from its brightness and use for jewelry, precious metal is considered an active refuge, which means that it is considered a good investment in turbulent times. Gold is also considered a coverage against inflation and depreciation of currencies, since it does not depend on any specific issuer or government.

Central banks are the greatest gold holders. In their objective of supporting their currencies in turbulent times, central banks tend to diversify their reserves and buy gold to improve the perception of strength of the economy and currency. High gold reserves can be a source of trust for the solvency of a country. Central banks added 1,136 tons of gold worth 70,000 million to their reservations in 2022, according to data from the World Gold Council. It is the largest annual purchase since there are records. The central banks of emerging economies such as China, India and Türkiye are rapidly increasing their gold reserves.

Gold has a reverse correlation with the US dollar and US Treasury bonds, which are the main reserve and shelter assets. When the dollar depreciates, the price of gold tends to rise, which allows investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rebound in the stock market tends to weaken the price of gold, while mass sales in higher risk markets tend to favor precious metal.

The price of gold can move due to a wide range of factors. Geopolitical instability or fear of a deep recession can cause the price of gold to rise rapidly due to its condition of active refuge. As an asset without yield, the price of gold tends to rise when interest rates lower, while the money increases to the yellow metal. Even so, most movements depend on how the US dollar (USD) behaves, since the asset is quoted in dollars (Xau/USD). A strong dollar tends to keep the price of gold controlled, while a weakest dollar probably thrusts gold prices.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.