- Gold price retreats from $1,770 on boost from US bond yields.

- The general strength of the US dollar and the risk impulse, headwinds for gold.

- Gold Price Forecast (XAUUSD): The failure of the sellers at $1,787 caused the pair to stumble towards the $1,750 area.

the price of gold down from $1,770 highs on high US Treasury yields spurred on by Fed policy makers reiterating they’re not done raising rates, despite ongoing slowdown in the US economy. However, money market futures are still pricing in a 50 basis point rate hike in September, while the odds of a 75 basis point increase stand at 80%. At the time of writing, XAU/USD is trading at $1,757.36.

XAU/USD lower on improving sentiment and Fed comments

Global equities remain firm one hour after the bell for the American session. US House Speaker Nancy Pelosi’s trip to Taiwan ended with no casualties yet. US non-manufacturing PMIs for July surprised economists, beating expectations, as the index rose to 56.7 from 55.3 in June, according to data on Wednesday. Services reports contradicted Monday’s manufacturing report, which showed production slowing, so demand for goods is falling as consumers shift to services.

The members of the Federal Reserve lean towards a rather dovish attitude

Since Tuesday, Fed officials have reiterated the Fed’s commitment to bring inflation to the 2% target, led by the San Francisco Fed’s Daly, saying “we remain determined and fully united” in bringing inflation down. Next, the Cleveland Fed’s Mester said he needs to see “compelling evidence” that prices are falling, while Chicago’s Evans commented that “50 basis points is reasonable” and added that 75 basis points may be needed. basics as data becomes available.

On Wednesday, St. Louis Fed President Bullard said the second-quarter slowdown was more worrisome than the first. By the end of the year, Bullard wants to raise the federal funds rate (FFR) to 3.75-4.00%.

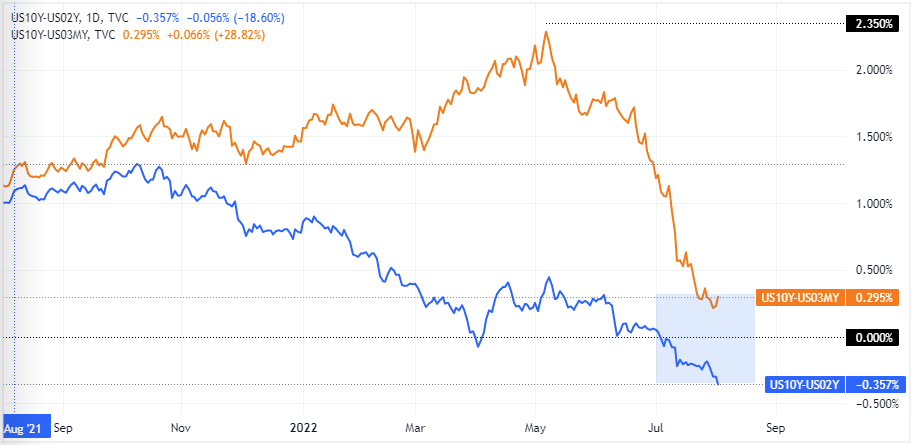

Meanwhile, US Treasury yields are rising sharply, led by 2-year yields, while the US 10-year Treasury yield is trading at 2,801%, up from 3,151. % of the first. Thus, the US 2yr-10yr yield curve inversion has deepened to -0.346% as investors positioned themselves for an impending US recession.

US 2yr-10yr Yield Curve Inversion

Supported by firm US bond yields, the USD is rising as the Dollar Index shows, gaining 0.34% to 106.711. The dollar has regained some strength in recent days, bolstered by safe-haven flows amid geopolitical jitters.

What must be considered

Initial jobless claims will be posted on the US calendar, along with other Federal Reserve officials making statements.

Gold Price Forecast (XAUUSD): Technical Outlook

XAUUSD continues to have a neutral bias to the downside. The failure of buyers to break the May 16 low turned resistance at $1,787.03 was a solid top level as sellers stepped in, dragging prices to their daily low of $1,750.00. However, the downtrend of the XAUUSD could be capped around the 20-day EMA at $1,731.65.

Therefore, the first support for XAUUSD would be the July 29 low of $1,752.27. Once broken above, gold will dip below the 20-day EMA. Otherwise, if gold buyers step in, its first resistance would be $1,772.77.

Source: Fx Street

With 6 years of experience, I bring to the table captivating and informative writing in the world news category. My expertise covers a range of industries, including tourism, technology, forex and stocks. From brief social media posts to in-depth articles, I am dedicated to creating compelling content for various platforms.