- Gold is under pressure as the US dollar firms because of the Fed.

the price of gold has reacted little to what was a well-anticipated move by the Federal Reserve on Wednesday. The central bank has raised the reference interest rate by 75 basis points to leave the target range at 1.50% – 1.75%. This was in line with expectations and as a result there has been a choppy reaction in financial markets so far, following a lot of positioning and volatility ahead of the event.

The rise was the biggest since 1994 and the statement indicates that there will be more of the same in the near future.

Technical analysis

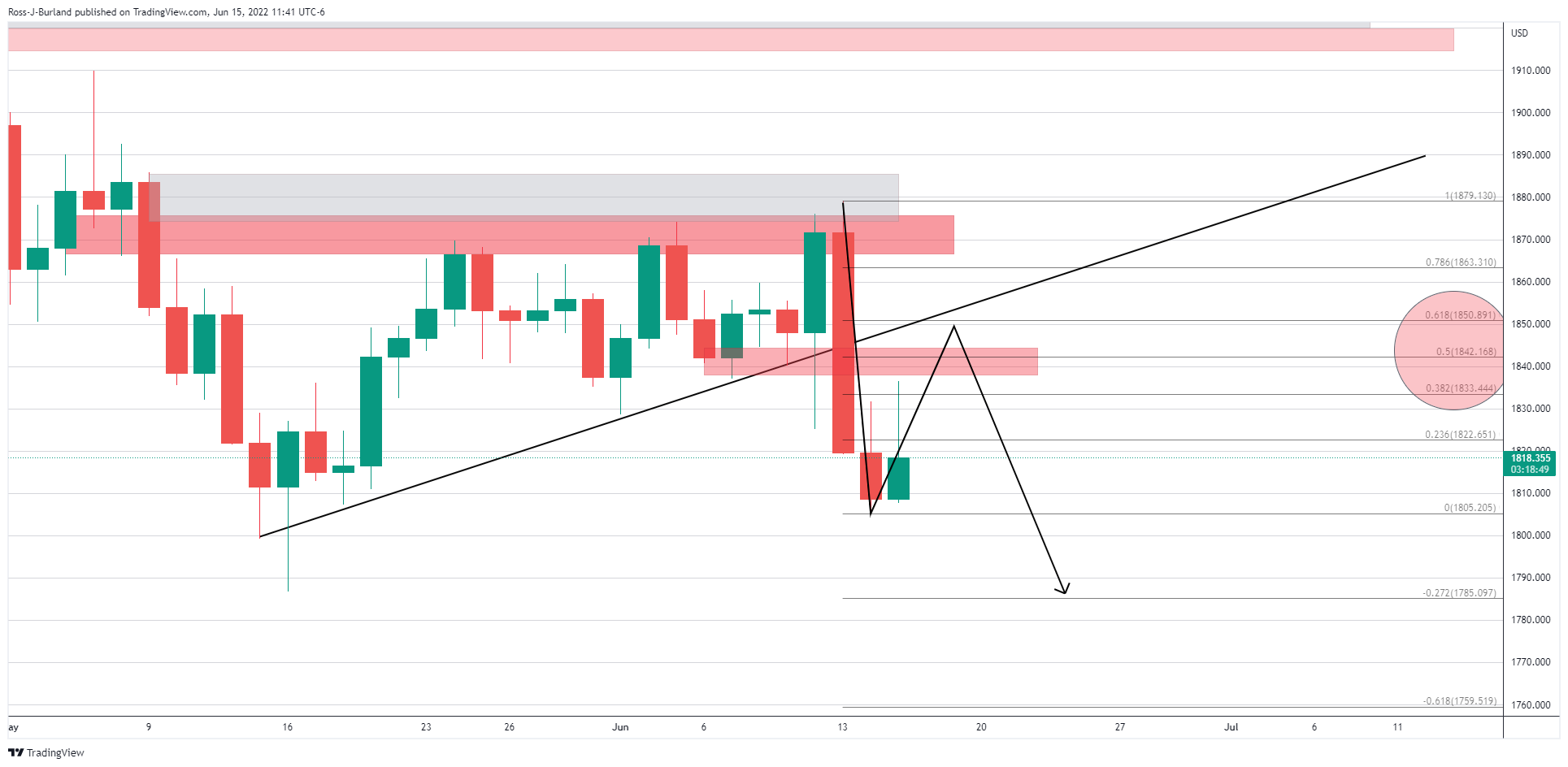

From a technical point of view, the daily chart is poised to continue lower as long as it is below the 61.8% confluence of the contrarian trend line.

On the hourly chart, breakout points are illustrated like this:

The formation of the W is a reversal pattern that would be expected to keep price tied to the neckline and an indicator of potential bears taking over.

Source: Fx Street

With 6 years of experience, I bring to the table captivating and informative writing in the world news category. My expertise covers a range of industries, including tourism, technology, forex and stocks. From brief social media posts to in-depth articles, I am dedicated to creating compelling content for various platforms.